"CB" (jrcb)

"CB" (jrcb)

08/25/2019 at 19:13 ē Filed to: Never take advice from boomers

0

0

22

22

"CB" (jrcb)

"CB" (jrcb)

08/25/2019 at 19:13 ē Filed to: Never take advice from boomers |  0 0

|  22 22 |

Thanks for the vote of confidence that I wonít live to 65, mum!

In actuality, Iím going the bank to figure out savings and retirement again. Being 24, better to start now than later. I have a tax free savings account, so my plan is probably to go half and half on that and a registered retirement savings plan. But, maybe the financial advisor will tell me Iím dumb.

CarsofFortLangley - Oppo Forever

> CB

CarsofFortLangley - Oppo Forever

> CB

08/25/2019 at 19:29 |

|

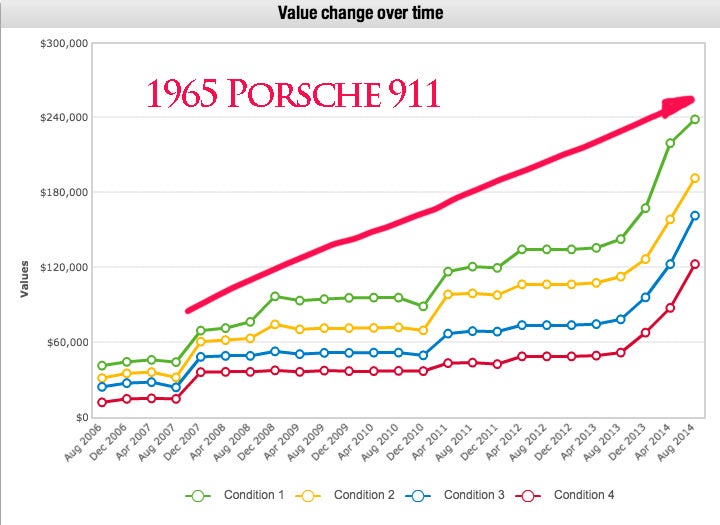

Buy cars man!

CB

> CarsofFortLangley - Oppo Forever

CB

> CarsofFortLangley - Oppo Forever

08/25/2019 at 19:33 |

|

Investing in a depreciating asset? Thereís no way this can fail!

KingT- 60% of the time, it works every time

> CB

KingT- 60% of the time, it works every time

> CB

08/25/2019 at 19:42 |

|

I max out my 401K for the yearly limit, well over the match from my company- do the match level at the very least . Never say no to free money! Plus, compound interest is your friend!

At 24, youíre way ahead of most people. I had other commitments and didnít start investing in a retirement plan until I was 29.

CB

> KingT- 60% of the time, it works every time

CB

> KingT- 60% of the time, it works every time

08/25/2019 at 19:44 |

|

Iíve got a pension as well, but I figure it makes sense to plan for the future thatís not optimal.

someassemblyrequired

> CB

someassemblyrequired

> CB

08/25/2019 at 19:51 |

|

Max out TFSA, RRSP you have to pay tax on withdrawals (basically tax deduction now, taxes when you withdraw ) . TFSA you donít get the deduction (after tax money) but you donít pay any taxes when you withdraw the money. Plus you can access the money at any time without penalty, unlike an RRSP.

Bottom line is unless you are making bank and in a really high tax bracket , the TFSA is the way to go.

CB

> someassemblyrequired

CB

> someassemblyrequired

08/25/2019 at 19:52 |

|

I figure, and Iíll definitely be bumping up my TFSA contributions , but Iím also wondering if even contributing a little bit a month to an RRSP isnít a bad idea.

Poor_Sh

> CB

Poor_Sh

> CB

08/25/2019 at 19:57 |

|

I donít max, but I save 10% and have a 5% match, I also will have a pension if things donít go to hell (as they will). So I think Iím on track for what I should need.. HOWEVER I just donít feel like trying harder. Iím pretty sure Iíll take it out with penalties when I turn 34 and find out I have a year to live. A year with super sweet travel and adventure!!!

CarsofFortLangley - Oppo Forever

> CB

CarsofFortLangley - Oppo Forever

> CB

08/25/2019 at 20:14 |

|

Wait... I'm losing money?

someassemblyrequired

> CB

someassemblyrequired

> CB

08/25/2019 at 20:17 |

|

Unless you need the tax deduction or you have a corporate match policy, the RRSP doesnít confer nearly as much tax benefits as the TFSA plus you pay penalties for withdrawals . In your 20s unless youíre a high-flying Bay Street lawyer or your company will match RRSP† contributions † the TFSA is a way better deal and far more flexible.

KnowsAboutCars

> CB

KnowsAboutCars

> CB

08/25/2019 at 20:47 |

|

What depreciation?

CB

> someassemblyrequired

CB

> someassemblyrequired

08/25/2019 at 20:57 |

|

My employer won't match, but I figure it can't hurt to put a little bit in until my TFSA gets maxed out.

someassemblyrequired

> CB

someassemblyrequired

> CB

08/25/2019 at 21:06 |

|

yep max out tfsa before you even think about RRSP under those conditions

subexpression

> CB

subexpression

> CB

08/25/2019 at 21:48 |

|

Some of the people I could picture advising against retirement plans today are people who have/had plans that were heavily invested in the stock market and watched half their nest egg evaporate a few years back. You also will occasionally meet people who went overboard funding a retirement plan and ended up short on cash . But you can minimize both risks with planning.

Longtime Lurker

> CarsofFortLangley - Oppo Forever

Longtime Lurker

> CarsofFortLangley - Oppo Forever

08/25/2019 at 22:13 |

|

How did your investment in Mazda pay off.

wafflesnfalafel

> CB

wafflesnfalafel

> CB

08/25/2019 at 22:26 |

|

your future you thanks you

CarsofFortLangley - Oppo Forever

> Longtime Lurker

CarsofFortLangley - Oppo Forever

> Longtime Lurker

08/25/2019 at 22:32 |

|

If it gets written off? I'll make a post about the $ breakdown

punkgoose17

> CB

punkgoose17

> CB

08/25/2019 at 22:38 |

|

Are pensions in Canada as bad as the US where you have to plan for it to not be there?

CB

> punkgoose17

CB

> punkgoose17

08/25/2019 at 22:51 |

|

Mine should be good because I'm a government employee, but you never know.

Grindintosecond

> CB

Grindintosecond

> CB

08/26/2019 at 02:44 |

|

Save for everything. Meaning lots save for school, or for kids college, or for mortgage, but not many play the smart game and save for everything at once. Putting one off for another now guarantees never getting back to any one thing.†

arl

> CB

arl

> CB

08/26/2019 at 07:45 |

|

Max it out and keep it maxed out. I didnít start until I was 35. Youíve got 10 years on me and can save a LOT of dough by retirement time. Just do it, do it, do it!!†

Future next gen S2000 owner

> CB

Future next gen S2000 owner

> CB

08/26/2019 at 17:11 |

|

Go post tax. Pay taxes on the money now while you are , presumably, in a low bracket. That way you wonít pay taxes when you pull it out and are in a, presumably, higher bracket.

Time is your friend 5 bucks today is worth more than 10 bucks in three years...........okay maybe not but compound interest is good!

davesaddiction @ opposite-lock.com

> CB

davesaddiction @ opposite-lock.com

> CB

08/27/2019 at 12:05 |

|

Yes! Save and invest early and often. Compound interest is your friend.