"CarsofFortLangley - Oppo Forever" (carsoffortlangley)

"CarsofFortLangley - Oppo Forever" (carsoffortlangley)

11/13/2019 at 11:40 ē Filed to: None

0

0

45

45

"CarsofFortLangley - Oppo Forever" (carsoffortlangley)

"CarsofFortLangley - Oppo Forever" (carsoffortlangley)

11/13/2019 at 11:40 ē Filed to: None |  0 0

|  45 45 |

Hi Oppo! I am looking for some advise on leasing. It isnít something Iíve done, so I want to hear other peopleís experiences.

First off, all numbers are in Canadian Dollars. Currently $1USD=$.075CAD.

I am still looking at (tentatively) moving forward on the Impreza to replace the Forte. They offered me between $10,000 and $12,000 on the Forte subject to inspection. I still owe about $9,000.00 on the car. I also save the 12% tax on the trade in amount when purchasing/leasing a new car.

I financed the Forte because, as a work vehicle, I can write off the interest on the loan on my taxes, the depreciation of the vehicle and any maintenance costs (measured by mileage).

With a lease payment, I can write off the entire amount on my taxes.

Other key facts are: I get a car allowance of $600.00 (pre-tax) from my company and my gas is paid for in full, outside that car allowance. Normally, people would use that car allowance to pay for a nice truck or something, but I am trying to offset the costs of a work vehicle AND keeping the Fiesta ST insured with my allowance. (Basically using the allowance to pay for 2 cheap cars rather than 1 expensive one).

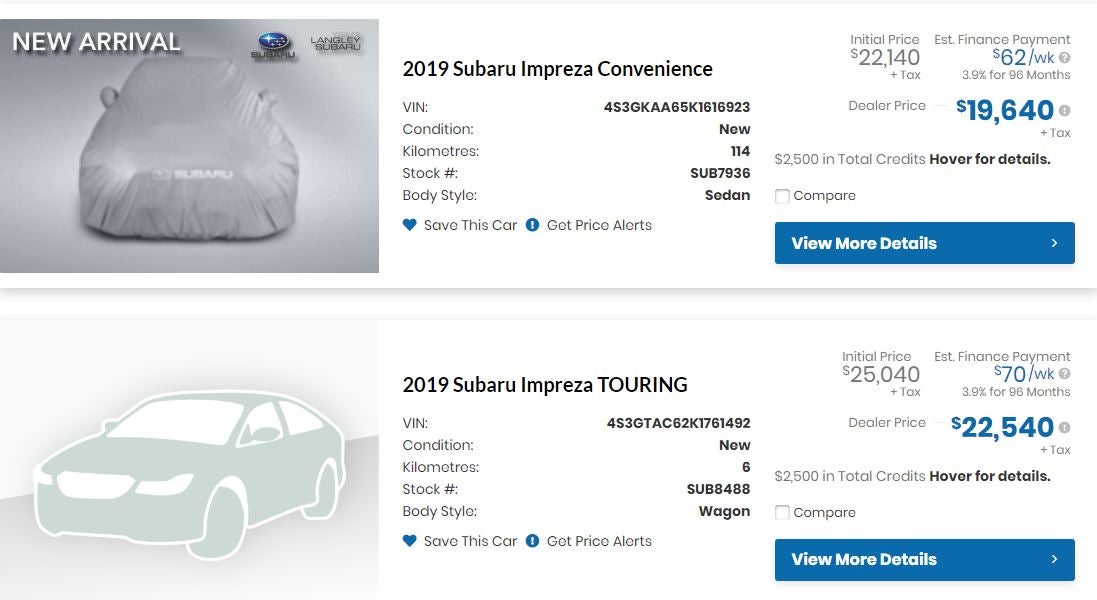

The two that I am looking at (pending financials working out) are:

Colours? Who knows. Donít really care. If the wagon comes in close $ wise, I may go for it, but again, cost is operative here.

The main goal here is monthly payments being low. As this is a business expense, we want them to be low.

What can Oppo tell me about leasing? Things to look for, past experiences, horror stories or what advantages buying would have.

Overall, the stress of buying another car is great as I feel my neighbou rs , in-laws , parents and co-workers judge me for the amount of cars I own/have owned.

However, I take solace in the fact that a) I only buy cheap cars and b) !!!error: Indecipherable SUB-paragraph formatting!!!

We bought the Fiesta 5 years ago for a good price and I donít seem to be losing any money on the Forte.† So, overall doing better than someone who buys a new Mercedes or something.

This is what we'll show whenever you publish anything on Kinja:

> CarsofFortLangley - Oppo Forever

This is what we'll show whenever you publish anything on Kinja:

> CarsofFortLangley - Oppo Forever

11/13/2019 at 11:47 |

|

A fiak l eases often have some fairly low mileage limits and going over can be quite punitive, so Iíd be cautious there unless you know you wonít exceed said limits.

Nothing

> CarsofFortLangley - Oppo Forever

Nothing

> CarsofFortLangley - Oppo Forever

11/13/2019 at 11:47 |

|

As a work vehicle, how many miles do you put on it? That would be my main concern with a lease, exceeding mileage limitations.

Iíve leased in the past, and it was basically no different from financing a car. I donít have any horror stories. When I shopped Challengers, I considered a lease as the terms were incredible . Interestingly enough, the lease was cheaper through GE Financial (or something like that) than it was through Chrysler Capital, so you may get a better rate through a third party if you let the dealer shop rates.

bob and john

> CarsofFortLangley - Oppo Forever

bob and john

> CarsofFortLangley - Oppo Forever

11/13/2019 at 11:50 |

|

leasing has some very low milage limits, so I would be VERY careful with that.†

CarsofFortLangley - Oppo Forever

> This is what we'll show whenever you publish anything on Kinja:

CarsofFortLangley - Oppo Forever

> This is what we'll show whenever you publish anything on Kinja:

11/13/2019 at 11:50 |

|

I would estimate that weíre looking at 20,000km a year average? I donít drive it outside of work which helps keep the mileage down, my office is in Surrey and †I work from home often when not on the road.

shop-teacher

> CarsofFortLangley - Oppo Forever

shop-teacher

> CarsofFortLangley - Oppo Forever

11/13/2019 at 11:51 |

|

I will also say, be careful of mileage.† I havenít ever leased, but I know a couple people who screwed themselves over by putting WAY more miles on than the lease allowed.† Both were, quite frankly, idiots who could screw up a wet dream.

This is what we'll show whenever you publish anything on Kinja:

> CarsofFortLangley - Oppo Forever

This is what we'll show whenever you publish anything on Kinja:

> CarsofFortLangley - Oppo Forever

11/13/2019 at 11:57 |

|

I believe you can negotiate the mileage up front up to something like 50,000k a year, so I believe that it †has the potential to work out for you assuming all of the numbers fall in line. If you hit the cap before the lease expires however youíll be in a bad spot, either paying to keep it parked or paying through the nose per km when you return it.

Dr. Zoidberg - RIP Oppo

> CarsofFortLangley - Oppo Forever

Dr. Zoidberg - RIP Oppo

> CarsofFortLangley - Oppo Forever

11/13/2019 at 12:01 |

|

Question: can you buy some car for cash and just pocket your monthly allowance (your post indicates that you can). Why not ride around in a old-but-good whatever vehicle and pocket $7,200 pre-tax?

BrianGriffin thinks ďreliableĒ is just a state of mind

> CarsofFortLangley - Oppo Forever

BrianGriffin thinks ďreliableĒ is just a state of mind

> CarsofFortLangley - Oppo Forever

11/13/2019 at 12:04 |

|

Mileage limits are def a concern, but you likely can write off the ďmileage overageĒ charge, assuming Canada is similar to the US.

The reason the lease is wholly write-offable is because there is no asset to depreciate. If you were to love the car and buy it out at the end, youíd then transition to the same type of accounting as you do now. Which is kinda a wash, but makes leasing a bit more advantageous.

Be aware that if you wreck the car, youíre likely still on the hook for the remaining lease payments as well as the difference between the payout and the DV, but Iím sure you know that.

If I was a business owner and didnít drive a huge amount of miles or abuse it , leasing definitely makes sense. Heck, most trucking companies I work with now exclusively lease trucks in lieu of buying them because it is so much simpler.†

CarsofFortLangley - Oppo Forever

> Dr. Zoidberg - RIP Oppo

CarsofFortLangley - Oppo Forever

> Dr. Zoidberg - RIP Oppo

11/13/2019 at 12:12 |

|

I could do, but... I dunno man.

Iíve thought about it, but am apprehensive of using a used car for work

Arrivederci

> CarsofFortLangley - Oppo Forever

Arrivederci

> CarsofFortLangley - Oppo Forever

11/13/2019 at 12:15 |

|

Since you use the car for work, leasing is your best bet, so I think your plan is solid.

On another note, your conversion rate:

First off, all numbers are in Canadian Dollars. Currently $1USD=$.075CAD.

Is wayyyyyyyyyyy off.† Current rates are $1USD = $1.32CAD.† I think you were trying for the inverse, which is $1CAD = $0.75USD.

Dr. Zoidberg - RIP Oppo

> CarsofFortLangley - Oppo Forever

Dr. Zoidberg - RIP Oppo

> CarsofFortLangley - Oppo Forever

11/13/2019 at 12:15 |

|

Using a used used car would be useful in utilizing useful vehicle allowances

ClassicDatsunDebate

> CarsofFortLangley - Oppo Forever

ClassicDatsunDebate

> CarsofFortLangley - Oppo Forever

11/13/2019 at 12:16 |

|

My only advice would be that 48 months is the sweetspot for Leasing. The dealer knows that they can move a 4YO used car with ~90K very easily. an 8year lease (assuming based on screenshots) is basically buying the car if you do the math so you might as well own it at the end and depreciate it via CRA rules.

Just a thought.

nermal

> CarsofFortLangley - Oppo Forever

nermal

> CarsofFortLangley - Oppo Forever

11/13/2019 at 12:17 |

|

All the same rules apply when leasing vs financing with a loan vs paying cash when purchasing a car. Start by Negotiatin on the trade in value and selling price separately.

Leasing is simply a method of financing a car. Instead of paying down the total purchase price in predetermined chunks, youíre paying down the depreciation for a set period of time in predetermined chunks.

Make sure you have enough mileage allowance. Check on shitty hidden fees at both the start and at the end. Check on potential end-of-lease costs for tire wear , dents & dings, extra mileage, etc. Check on the buyout amount if you choose to purchase at the end of the term. Make sure you tell them the dealer on the other side of town offered a lower payment for the exact same thing.

You can either save yourself money leasing, end up in about the same spot as buying , or totally bork yourself if you do it wrong. Good luck!

Mid Engine

> CarsofFortLangley - Oppo Forever

Mid Engine

> CarsofFortLangley - Oppo Forever

11/13/2019 at 12:19 |

|

I know this is shady as fuck, but there are people willing & able to roll back the mileage on a car when it comes time to turn a lease back in for a few hundred bucks . Iím certainly not advocating that, but it is a real thing.

When I lived in Canada I always leased as I worked on the road, and it was a huge tax be nefit to write off the lease vs. deprecating a car. Also, you get a shiny new car every three years! Put zero down and try to increase the buy back amount as muc h as possible, kee ps your monthly payments reasonable

Iím leasing my Tacoma and have a 12k/year mileage allow ance which is plenty for me, Iíve logged 12k miles in two years as itís my secondary vehicle . My buyout in February 2021 is $28k, the Tacomas hold their value like no ot her and I intend on buying it out right. So, I bought a CD that matures when the lease is up and will pay cash.

fintail

> CarsofFortLangley - Oppo Forever

fintail

> CarsofFortLangley - Oppo Forever

11/13/2019 at 12:24 |

|

Put as little money up front as possible, as if something happens to the car, youíre SOL.

In terms of maintenance, youíre an ideal leaser from the lessor standpoint, as you like a clean car, and I think some leasers are outright slobs.

Jordan and the Slowrunner, Boomer Intensifies

> CarsofFortLangley - Oppo Forever

Jordan and the Slowrunner, Boomer Intensifies

> CarsofFortLangley - Oppo Forever

11/13/2019 at 12:26 |

|

You could get an LS430 with every imaginable service record through Lexus, nothing could go wrong...

Mid Engine

> Dr. Zoidberg - RIP Oppo

Mid Engine

> Dr. Zoidberg - RIP Oppo

11/13/2019 at 12:28 |

|

Depends on the company, my car plan is explicit: has to be less than five years old and must be a four door. If you donít wanna play by their rules you can go rogue and get paid 52 cents a mile. In my case my lease is $366, allowance is $425 plus 20 cents a mile so I comply. Besides, I got a Taco and the company is paying for it!

Fuckkinja

> CarsofFortLangley - Oppo Forever

Fuckkinja

> CarsofFortLangley - Oppo Forever

11/13/2019 at 12:29 |

|

14 years of leasing f150s has been great. You change the oil 3 times and then you get a new truck. The lease payment is way cheaper than buying. We would trade in a bought truck before being paid off anyways. The mileage can be negotiated at the sign up. It effects the lease payment marginally.

CarsofFortLangley - Oppo Forever

> Dr. Zoidberg - RIP Oppo

CarsofFortLangley - Oppo Forever

> Dr. Zoidberg - RIP Oppo

11/13/2019 at 12:29 |

|

I guess, but:

a)I donít what I would buy

b) you typically need capital, ie the full price of the used car upfront

c) I would miss out on writing off the lease amounts or depreciation/interest on my taxes.

Not many used cars really interest me out there other than maybe a used toyota pickup/4runner.† But those typically are pretty expensive and Iíd be better of by all counts just buying a new base sedan

CarsofFortLangley - Oppo Forever

> Mid Engine

CarsofFortLangley - Oppo Forever

> Mid Engine

11/13/2019 at 12:30 |

|

Nah, I could buy a Vespa for all they care.† The car is my own choice, so whatever works for me

CarsofFortLangley - Oppo Forever

> nermal

CarsofFortLangley - Oppo Forever

> nermal

11/13/2019 at 12:32 |

|

You can either save yourself money leasing, end up in about the same spot as buying, or totally bork yourself if you do it wrong

mmmm so comforting!

Maxima Speed

> CarsofFortLangley - Oppo Forever

Maxima Speed

> CarsofFortLangley - Oppo Forever

11/13/2019 at 13:03 |

|

Donít..... next.

Lol just joking I donít know anything about it.

Chariotoflove

> CarsofFortLangley - Oppo Forever

Chariotoflove

> CarsofFortLangley - Oppo Forever

11/13/2019 at 13:26 |

|

Second on the mileage allowance. Make sure youíll come comfortably under that. In general a lease is better for a car you donít intend to keep long.

Another option, and one that I did, is to buy a car just off lease. †You get a still new-ish car (because mileage allowance and included maintenance) with a CPO warranty, but depreciation baked in for you.

CarsofFortLangley - Oppo Forever

> Arrivederci

CarsofFortLangley - Oppo Forever

> Arrivederci

11/13/2019 at 13:33 |

|

oops Iím a dumb.

412GTI

> CarsofFortLangley - Oppo Forever

412GTI

> CarsofFortLangley - Oppo Forever

11/13/2019 at 13:57 |

|

My family has moved to leasing over the last few years (father wrote it off as a business expense) and so far itís been smooth. I still finance, but if I could write it off I most likely would too. †

You definitely want to be sure of your miles, though. He went a little over on his first Accord lease but it was a wash trading it in early vs paying the mileage penalty.

Also, as others have mentioned, put as little down as you can. Youíre only pre-buying down the payment when you put money down, not the total amount financed. If you total the vehicle (or say stolen again) you donít get any of that equity back.

Snuze: Needs another Swede

> shop-teacher

Snuze: Needs another Swede

> shop-teacher

11/13/2019 at 14:00 |

|

My best friend did this. He took a lease on a WRX with like 10k miles/yr , then started dating a girl that lived like 50 miles away, and he was driving that several days a week, plus normal commuting and other driving duties. So at the end of the lease he was like 24k miles over his limit!

I donít know the full details but he was going to get hosed on mileage penalties, and the dealer offered him an out because they had some special incentives/financing at the time so he ďboughtĒ the WRX off lease and then turned around and traded it against the purchase of a new base model Legacy. (And I suspect he rolled some negative equity int o that).†

RallyDarkstrike - Fan of 2-cyl FIATs, Eastern Bloc & Kei cars

> CarsofFortLangley - Oppo Forever

RallyDarkstrike - Fan of 2-cyl FIATs, Eastern Bloc & Kei cars

> CarsofFortLangley - Oppo Forever

11/13/2019 at 14:01 |

|

Eh, I donít think Iíd ever consider leasing. I donít like the idea of being in possession of what is essentially somebody (or an entityís) elseís vehicle and beholden to a contract under which to operate it.

I always buy used, you can find some great cars in very good shape for decent prices that way.

Just my 2 cents!

CarsofFortLangley - Oppo Forever

> RallyDarkstrike - Fan of 2-cyl FIATs, Eastern Bloc & Kei cars

CarsofFortLangley - Oppo Forever

> RallyDarkstrike - Fan of 2-cyl FIATs, Eastern Bloc & Kei cars

11/13/2019 at 14:16 |

|

I get that. But, looking at used, I just canít see what I would want to be my Kia replacement.

shop-teacher

> Snuze: Needs another Swede

shop-teacher

> Snuze: Needs another Swede

11/13/2019 at 14:34 |

|

My drunk uncle put 171k miles on his leased Ď99(?) Impala. W hen I questioned him about that, he said, ďItís no big deal, Iím just going to buy it for ($10,250).

Yep.† His grand plan was to buy his Impala that was worth MAYBE two grand, for over ten grand.† GENIUS!!!

His Stigness

> CarsofFortLangley - Oppo Forever

His Stigness

> CarsofFortLangley - Oppo Forever

11/13/2019 at 14:57 |

|

Key things to consider when leasing:

Put as little money as down as possible. Assume the worst. If you lose the car either from a crash which totals the car, or itís stolen, you wonít see that money back. Granted the same thing can happen with a financed car, but generally depreciation isnít that horrible.

Mileage allowances are negotiable. Most lease ďdealsĒ are for lower mileage amounts. When you consider the lease payments is based off the deprecation, this makes sense. A low mileage vehicle will be worth more in the end, therefore your overall depreciation is less, thus, your lease payment is lower.

With those things in mind, look at the payoff amount. Will the residual most likely be lower or higher at lease end? Your goal should be to come out ahead at lease end and get a contractually good deal on the car should you choose to buy it.†

CarsofFortLangley - Oppo Forever

> His Stigness

CarsofFortLangley - Oppo Forever

> His Stigness

11/13/2019 at 15:11 |

|

Aim for a low resid. then?

NKato

> CarsofFortLangley - Oppo Forever

NKato

> CarsofFortLangley - Oppo Forever

11/13/2019 at 15:36 |

|

You once spoke about getting a panther. For $10,000 you could get one thatís in relatively good condition for $5-6k, and use the rest to pay for needed maintenance (fluid changes, brake job, Jmod for the transmission - this improves performance and longevity, and anything else you feel needs work).

Upside is, itís sturdy, very few people want to touch one, and ultimately, theyíre reliable. Mechanics love them because theyíre no-bullshit cars.

Also, easy to modify to your preference. If you get a MGM or LTC, you can look at getting the shocks replaced with police grade ones, and install heavier sway bars to give it that zip.

Edit: if you get a former police patrol car, I strongly recommend a rear axle teardown and inspection to make sure the bearings are not about to self destruct, and possibly use that as an opportunity to replace said bearings for peace of mind.†

CarsofFortLangley - Oppo Forever

> NKato

CarsofFortLangley - Oppo Forever

> NKato

11/13/2019 at 15:56 |

|

Actually, yeah, that is one that Iíd be down for. Harder to find in Vancouver than youíd think though.† The RCMP really abused theirs.

His Stigness

> CarsofFortLangley - Oppo Forever

His Stigness

> CarsofFortLangley - Oppo Forever

11/13/2019 at 16:06 |

|

Yeah. You can do that by having a higher monthly payment.†

NKato

> CarsofFortLangley - Oppo Forever

NKato

> CarsofFortLangley - Oppo Forever

11/13/2019 at 16:13 |

|

Look into importing one from California. Thereís a guy named Mario who flips Panthers, and they are always good value - a bit high priced, but you know you're getting a good solid car from him.

CarsofFortLangley - Oppo Forever

> NKato

CarsofFortLangley - Oppo Forever

> NKato

11/13/2019 at 16:14 |

|

hmm do you have a site for him?

CarsofFortLangley - Oppo Forever

> NKato

CarsofFortLangley - Oppo Forever

> NKato

11/13/2019 at 16:21 |

|

The issue is the exchange rate and duty/import fees.† No joke, it would likely cost MORE than the subaru

NKato

> CarsofFortLangley - Oppo Forever

NKato

> CarsofFortLangley - Oppo Forever

11/13/2019 at 16:37 |

|

I know what you mean. Hereís one of his most recent postings, a P7B with 40,000 miles, and 566 Idle Hours. (My car has 4,000+ idle hours on the odometer) (Edit: Z5 axle means itís an open diff 3.27. Not a problem -- itís relatively easy to upgrade to a trac-lok.)

This car is definitely worth at least $10,000.

(Youíll need to join the group to view it - I just sent a message to him asking if he has any public postings.)

Hereís the quote from the post:

2010 Ford Crown Victoria, P7B - EX Field Supervisor Vehicle with only 40,000K miles and 566 idle hours in like new running condition and shape folks.. The vehicle is original Brilliant White from factory (paint code is WT) the paint looks great and no peeling anywhere, it has some very light scratches that are hardly noticeable, from San Bernardino County, CA - no rust. The car looks and drives amazing, super sharp, shiny and very solid. Folks the whole entire car has been reconditioned inside out. Cold A/C, heater works, (2) new headlamp assembly, equipped with ballistic door panels inside front doors only, Police center console in place, blue silicone fail safe radiator hoses, (2) new working unity spotlights bulbs, new working aftermarket alarm with 2 remotes. At 40K. The car is in great/like new running condition. There are no noises coming from the engine or transmission. Services done from me are as follows: fresh engine oil 5W/20 - Full Synthetic oil and filter, new air filter, transmission has been serviced (Motorcraft Mercon LV fluid) and filter, throttle body was serviced and cleaned, all (8) Motorcraft spark plugs were checked individually and are all good and do not need replacement at this time, new ACDelco battery.. Vehicle is 110% ready. From the Department: Brakes are at 80% all around, drive belt looks good and so does the tensioner. Everything is in perfect working order. Folks everything on this vehicle is still in excellent mechanical and like new condition. Z5 rear axle. Super strong and smooth. This vehicle is a BULLET!! No leaks, no overheating, transmission shift smoothly and strong as it should, suspension is nice and tight.

Pictures:

NKato

> CarsofFortLangley - Oppo Forever

NKato

> CarsofFortLangley - Oppo Forever

11/13/2019 at 16:50 |

|

Thereís also this car:

2011 Ford Crown Victoria, P7B - Street Appearance Package former

Maricopa County Sheriff Office Vehicle with 98,000K miles in like new

running condition.. The vehicle is original Norsea Blue from factory

(paint code is KR) the paint looks amazing (2) door dings and it has

some very light scratches/chips that are hardly noticeable. Arizona

vehicle - no rust. The car looks and drives amazing, super sharp and

very shiny.

In Great Mechanical Condition/No Issues/110% Ready!

At 98K.

The car is in great/like new running condition. There are no noises

coming from the engine or transmission. Services done from me are as

follows: fresh engine oil 5W/20 - Synthetic blend oil and filter, new

fuel and air filter, transmission has been serviced (Motorcraft Mercon

LV fluid) and filter, throttle body was serviced and cleaned, (8) new

Motorcraft platinum spark plugs. From the Department: Brakes are at 85%

all around, new OEM electric fan shroud and module, drive belt looks

good and so does the tensioner, ACDelco battery appears to be in new

condition, new 200 AMP alternator, intake manifold also does appear to

be in new condition. Folks everything on this vehicle is still in

excellent mechanical and like new condition. X5 - track lock rear axle.

Super strong and smooth. This vehicle is a BULLET!! No leaks, no

overheating, transmission shift smoothly and strong as it should,

suspension is nice and tight.

$9,200 or best offer

Between the white P7B and this one, I would spring for this one, to be absolutely fucking honest with you. Looks more professional, and is in a much better condition, and has more features (cruise control). Just more miles on it than the white one.

NKato

> CarsofFortLangley - Oppo Forever

NKato

> CarsofFortLangley - Oppo Forever

11/13/2019 at 16:56 |

|

Just got a link for the 2010 P7B:

And this one for the NorSea P7B:

His phone number is in the description.

Dr. Zoidberg - RIP Oppo

> Jordan and the Slowrunner, Boomer Intensifies

Dr. Zoidberg - RIP Oppo

> Jordan and the Slowrunner, Boomer Intensifies

11/13/2019 at 21:03 |

|

Better go with a sure thing. Like a new GTI!

Dr. Zoidberg - RIP Oppo

> CarsofFortLangley - Oppo Forever

Dr. Zoidberg - RIP Oppo

> CarsofFortLangley - Oppo Forever

11/13/2019 at 21:06 |

|

a) I assume a ďknowĒ is missing here? Anyway: Subaru Justy.

b) Having never financed a car myself : probably!

c) But in exchange for sacrificing tax writeoffs, you get $7,200 annually just for yooooou

CarsofFortLangley - Oppo Forever

> Dr. Zoidberg - RIP Oppo

CarsofFortLangley - Oppo Forever

> Dr. Zoidberg - RIP Oppo

11/13/2019 at 21:30 |

|

Oops, yeah, left out a word. Good thing I have an editor at work.

$7,200 pre tax which so more like $4500 to $5000. Which isnít ďnothingĒ but....

I spend a lot of time in my car and really prioritize features, comfort and safety.

I feel like a Subaru Impreza (base) would be a good delta between cost, safety, comfort and practicality. Why not a used one? Canít find one honestly.

I like the idea of riding around in a $5,000 used corolla or something, but it doesnít make sense overall

Dr. Zoidberg - RIP Oppo

> CarsofFortLangley - Oppo Forever

Dr. Zoidberg - RIP Oppo

> CarsofFortLangley - Oppo Forever

11/13/2019 at 21:35 |

|

I get it. I do. Just offering my cheapskate perspective. Someone has to be that guy.

glemon

> CarsofFortLangley - Oppo Forever

glemon

> CarsofFortLangley - Oppo Forever

11/13/2019 at 22:12 |

|

I am not necessarily a fan or propon ent of leasing, but your situation, car used for work, work pays for car, I like your idea of using the allowance for two cars, true Jaloppo thinking there.

In my opinion people overthink the lease thing, I have considered buying a car after lease (my wife was leasing when we met, it took a couple cycles to get out of it), but have never done it, don't think I know anybody that has either.† Get the deal with the least money in (and out, you have to check that) and lowest monthly you can get with miles you can live with, simple as that.†