"Krieger (@FSKrieger22)" (Krieger22)

"Krieger (@FSKrieger22)" (Krieger22)

07/08/2015 at 11:13 ē Filed to: None

0

0

10

10

"Krieger (@FSKrieger22)" (Krieger22)

"Krieger (@FSKrieger22)" (Krieger22)

07/08/2015 at 11:13 ē Filed to: None |  0 0

|  10 10 |

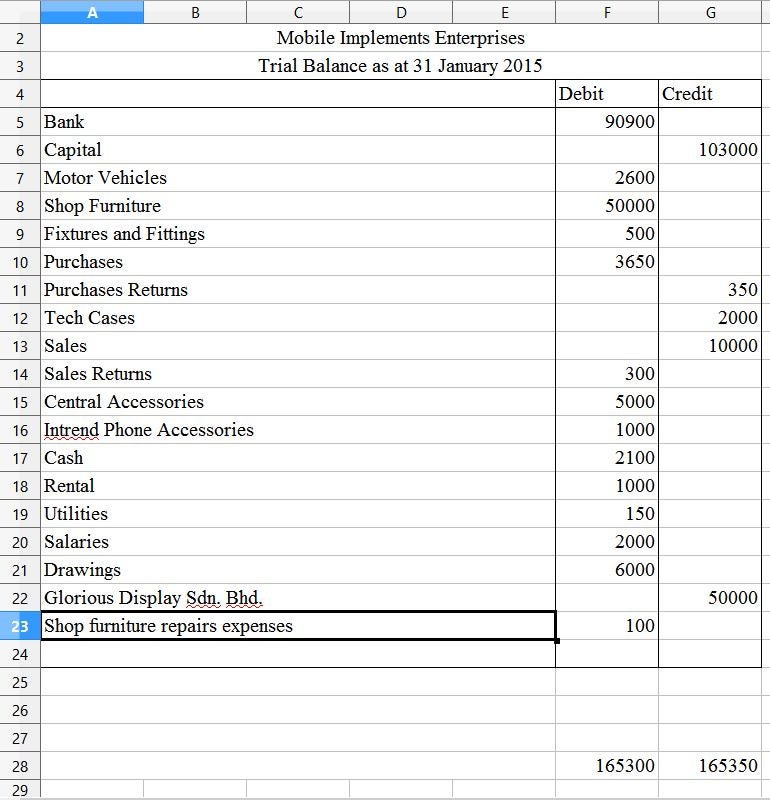

Of course, seeing that the gap is that small only makes things worse. Iíd like to thank RockThrillz89, CJ, Mr. Ontopís Monkeys Write Novels and The Dummy Gummy for suggesting things to try checking for.

!!!error: Indecipherable SUB-paragraph formatting!!!

is really making me consider more creative accounting...

Patrick Nichols

> Krieger (@FSKrieger22)

Patrick Nichols

> Krieger (@FSKrieger22)

07/08/2015 at 11:24 |

|

Looks like you added 650 to purchases when it was just a payment on the liability of the original purchase of 3000. With that said thereís probably at least one other thing off.

MonkeePuzzle

> Krieger (@FSKrieger22)

MonkeePuzzle

> Krieger (@FSKrieger22)

07/08/2015 at 11:29 |

|

I could help...

Krieger (@FSKrieger22)

> Patrick Nichols

Krieger (@FSKrieger22)

> Patrick Nichols

07/08/2015 at 12:11 |

|

The extra RM650 is due to there being another cash purchase of RM1000ís worth of stock and returns of RM350 of stock. Or thatís what I think I entered. Iíve included everything Iíve typed up in the blue link if you want to take a closer look.

Patrick Nichols

> Krieger (@FSKrieger22)

Patrick Nichols

> Krieger (@FSKrieger22)

07/08/2015 at 12:17 |

|

Just saw that but in that case it looks like you have credited it twice (once with the reduction of purchases and once with the purchase returns). What I see looks like youíve made 3650 in purchases and then returned 350 netting you 3300

RockThrillz89

> Krieger (@FSKrieger22)

RockThrillz89

> Krieger (@FSKrieger22)

07/08/2015 at 14:23 |

|

The debit of 350 should be to either cash if it was a cash return, or against the liability if was a return of purchases on credit. Purchase returns is a contra asset, and will be net against purchase, so all you did was zero out the return. 3650 is what you should have in purchases, so that is correct.

Iím looking at the T-charts I made yesterday to see if I can find you $50.

RockThrillz89

> Krieger (@FSKrieger22)

RockThrillz89

> Krieger (@FSKrieger22)

07/08/2015 at 14:54 |

|

Could you explain to me how you got RM400 of stock at the end of the year? I know the beginning inventory is zero, add purchases, subtract returns, subtract value of stock sold. But nowhere can I find the value of the stock sold. The transactions are apparently the sale value, not cost value. Or am I missing something here?

Edit: fuck it; when I get off work Iím going to do this damn thing myself. Iím having too much trouble following your work and I really canít sit here at work and do this start to finish. I want to help you out (the world could always use good accountants; plus everyone should know basic accounting in my opinion), because Iíve been there. Hell, I run into journal entires and trial balances that donít balance all the time. Itís what I do for a living.

Also, are you using cash or accrual method of account? By you FS layout, Iím guessing youíre using IFRS and not GAAP.

RockThrillz89

> Krieger (@FSKrieger22)

RockThrillz89

> Krieger (@FSKrieger22)

07/08/2015 at 18:58 |

|

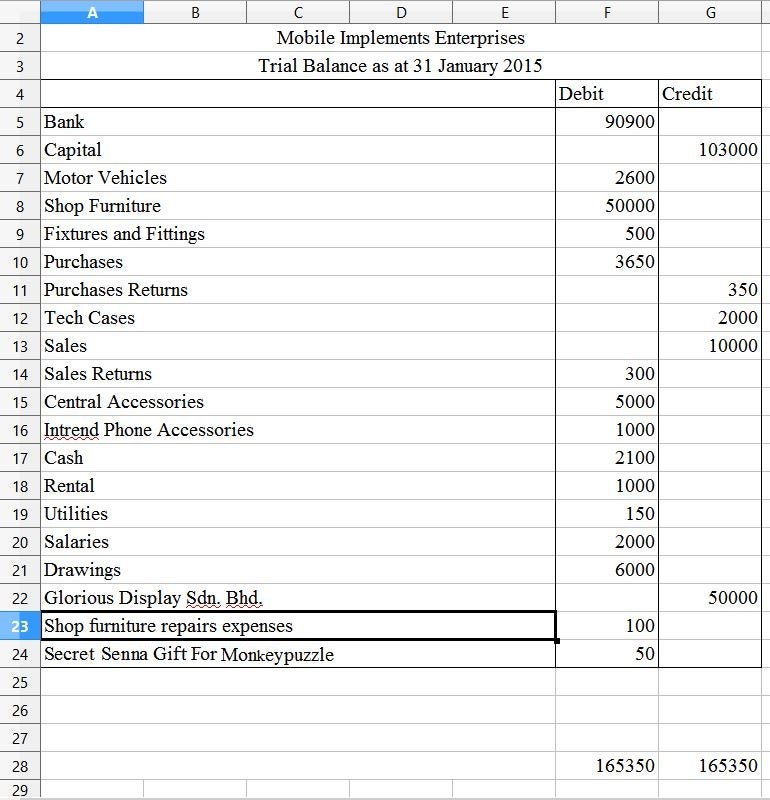

Here

is my TB and journal entries. It looks like you double booked the purchase returns and didnít book half of the sales returns. Go back through your JEís and check those two items. And Iím not giving you my work so you can copy. Youíre already 99% there; this is just comparing notes.

If you have any questions, let me know. If you need more detail on what I did or why I did something, let me know and we can talk about it through the google docs chat or some shit instead of making a huge thread on here.

Krieger (@FSKrieger22)

> RockThrillz89

Krieger (@FSKrieger22)

> RockThrillz89

07/08/2015 at 20:41 |

|

The RM400 value is according to the questions requirements that the final inventory be 10% of total purchases. And Iím using the accrual method, since you asked.

RockThrillz89

> Krieger (@FSKrieger22)

RockThrillz89

> Krieger (@FSKrieger22)

07/08/2015 at 20:47 |

|

Oh, donít think you included that part of the information or I missed it. I ended up just going with accrual anyway and assumed it was a periodic inventory. So it workout well then. I was thrown because you didnít have A/P and A/R on your trial balance, just customer/vendor names. I was having trouble figuring out what the cost basis of items sold. I wanted to do the COGS JE at the time of sale instead of at period end, which is more like cash method in my opinion.

Krieger (@FSKrieger22)

> RockThrillz89

Krieger (@FSKrieger22)

> RockThrillz89

07/08/2015 at 23:25 |

|

I went and compared the trial balances, and my mistake appears to be that I included sales and purchases returns in the trial balance despite using the net figures for sales and purchases (which already had them deducted). Using the gross figures for both or using net figures for both without returns (as you did) yielded a balanced balance sheet. Iím going to use the former since I am required to include contra accounts in the ledger and trial balance.

Once again, thank you very much, and I really appreciate the help. All I have to do now is digitise the edited trial balance.