"Textured Soy Protein" (texturedsoyprotein)

"Textured Soy Protein" (texturedsoyprotein)

04/11/2015 at 11:13 • Filed to: None

2

2

8

8

"Textured Soy Protein" (texturedsoyprotein)

"Textured Soy Protein" (texturedsoyprotein)

04/11/2015 at 11:13 • Filed to: None |  2 2

|  8 8 |

I've been thinking lately that my next fun car might be old enough that I won't be able to finance it through the usual channels. I've got a lot of local credit unions that will finance old(er) cars at low rates, but not really stuff in the "classic" category. But hark! There may be a solid option available.

The first result when I googled 'classic car financing' brought me to !!!error: Indecipherable SUB-paragraph formatting!!! . LightStream is SunTrust bank's online financing arm. They have some pretty compelling stuff, like:

No Restrictions: You can use your LightStream loan to finance any classic car, from any seller, regardless of make, model, year, mileage and loan-to-value.

My only personal experience with LightStream is back last December, I was in the middle of buying my Grand Cherokee from a dealer, and found myself with some free time. I went on LendingTree to get alternate loan offers and LightStream approved me for a silly good rate. I didn't go with them because they weren't going to be able to turn it around same day, and I was at a dealer over an hour away from home. So I can't comment on specifics of actually having a loan through LighStream, but they did approve me for an excellent rate.

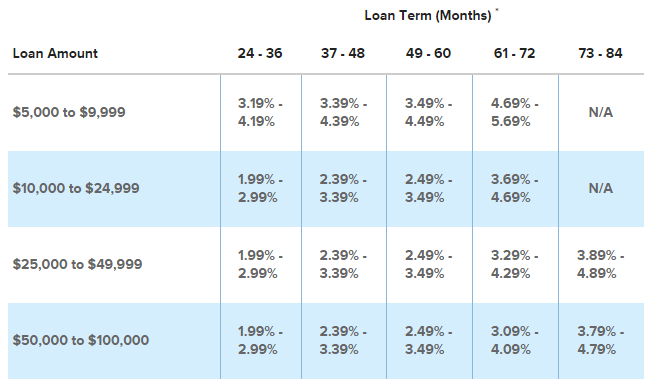

Anyway, I looked into the LightStream classic car financing to see what the deal is. They've got some pretty dang attractive rates.

There's a disclaimer to these terms:

The lowest rates are for LightStream's unsecured loan product and require excellent credit. If your application does not qualify, you may be eligible for our secured auto loan.

Unsecured? Hmmm...what does that mean?

The Unsecured LightStream Loan: No liens, no paperwork, no prepayment penalties or fees — just a fast and easy way to finance your classic car purchase, with the leverage of a cash buyer, because the funds are in your account and you're in control.

Our Secured Auto Loan Option: If you don't qualify for our unsecured loan, LightStream may be able to offer a secured auto loan. It will include a few additional steps for titling, and you can still buy any classic car, from any dealer or private seller. As with our unsecured loan, you'll have a simple, streamlined loan process and exceptional customer service.

Both of those sound like they could be good. Actually having no lien on the car sounds really good. But I wanted to see what they meant by 'excellent credit,' if it was just your credit score or something else. Their definition was pretty standard until I got to this part:

A proven ability to save evidenced by some or all of the following: liquid assets (stocks, bonds, bank deposits, etc.), cash down payments on real estate, retirement savings, and little, if any, revolving credit card debt.

Now, when I applied through LendingTree for the loan on the Grand Cherokee, they didn't ask me anything about savings. Maybe they would ask more about savings if on a classic car loan. I dunno. But I with my 750ish credit score got their best rate for a non-classic loan where there is a lien on the title.

So overall, this looks like it could be a pretty solid option for those of us who have excellent credit and some money in the bank, and want to buy an older car but can't necessarily just pay cash for the thing. Hopefully interest rates stay this low for if/when I decide to get some older car.

Sampsonite24-Earth's Least Likeliest Hero

> Textured Soy Protein

Sampsonite24-Earth's Least Likeliest Hero

> Textured Soy Protein

04/11/2015 at 11:31 |

|

Overall how did you like lending tree? I'm probably gonna use it when it comes time to find my next loan and I want a real opinion not just what that puppet on TV says lol

dogisbadob

> Textured Soy Protein

dogisbadob

> Textured Soy Protein

04/11/2015 at 11:35 |

|

An unsecured car loan is just a personal loan, right?

Car loans are by definition secured—they're secured by the car/title.

Textured Soy Protein

> Sampsonite24-Earth's Least Likeliest Hero

Textured Soy Protein

> Sampsonite24-Earth's Least Likeliest Hero

04/11/2015 at 11:41 |

|

It was fine. I didn't complete the process because I didn't start it soon enough. It was really more a spur-of-the-moment move on my part. I had gotten pre-approved by my credit union before going to the dealer. I had free time because the dealer took my pre-approval from my credit union and tried to beat it with another lender, and because I asked them to take their stupid stickers and tag frames off the Jeep and their detail guy was out to lunch.

I figured with the dealer already trying to beat my financing, I'd also check on LendingTree. Going through the site was simple enough, and they came back with approvals within 15 minutes. The only issue was since it wouldn't have been through the dealer finance department, and I was trying to do stuff same day, LightStream wasn't able to get funds available quickly enough for me to take the Jeep that day.

So if you do it a few days before you plan to actually make your purchase, and not just the initial LendingTree application but also following through the process with whatever lender they connect you with, it should work alright.

Textured Soy Protein

> dogisbadob

Textured Soy Protein

> dogisbadob

04/11/2015 at 11:44 |

|

Maybe? I don't really know much about personal loans because I try to avoid borrowing money except on giant purchases like cars. So I dunno if personal loan rates are similar to these.

lone_liberal

> Textured Soy Protein

lone_liberal

> Textured Soy Protein

04/11/2015 at 11:54 |

|

Financing a classic car probably makes more sense than financing a new car when you think about it. As long as you don't way overpay the car isn't going to depreciate like a new car would and might even appreciate a little.

Textured Soy Protein

> lone_liberal

Textured Soy Protein

> lone_liberal

04/11/2015 at 12:14 |

|

I had the same thought, actually.

Sampsonite24-Earth's Least Likeliest Hero

> Textured Soy Protein

Sampsonite24-Earth's Least Likeliest Hero

> Textured Soy Protein

04/11/2015 at 12:41 |

|

Cool thanks

glemon

> lone_liberal

glemon

> lone_liberal

04/11/2015 at 13:35 |

|

Right, they don't like to loan on used cars over a certain age because they are worried their collateral will be worth next to nothing shorty into the loan, and the older the car gets the wider the variance in condition/value depending on miles, accidents, maintenance, etc.

Then you get into the classic car market, big banks mostly don't want to mess with it because they don't know it and it is relatively small potatoes and more specialized, and there is a much wider range of valuation on a 30 year old car than a new or late model Toyota. But I think classic car collecting has become pretty common among us aging baby booomers, and values are going up, so maybe more financ