"rotundapig" (rotundapig)

"rotundapig" (rotundapig)

08/17/2013 at 11:56 • Filed to: car companies, money

0

0

11

11

"rotundapig" (rotundapig)

"rotundapig" (rotundapig)

08/17/2013 at 11:56 • Filed to: car companies, money |  0 0

|  11 11 |

I'm finally to the point where I have some money that I'd like to invest to try and get a bit more than the pittance they give me for keeping it in savings. It isn't much, so I'd like to manage it myself. Since I follow the automobile industry already, I figured I'd buy stocks of car companies I thought were on the right track, but it doesn't look to be that simple.

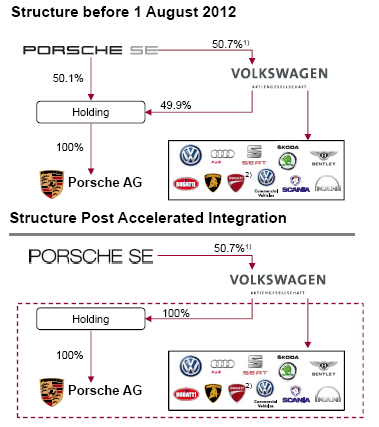

Take VW for example. I could buy VOW, VOW3 (4,5, whatever) or buy an ADR such as VLKAY. I know they are traded in different exchanges and probably under different rules, but does anyone have any idea what the practical differences are?

This image was lost some time after publication.

This image was lost some time after publication.

Redd, the RX-7 that could

> rotundapig

Redd, the RX-7 that could

> rotundapig

08/17/2013 at 12:17 |

|

TSLA!

rotundapig

> Redd, the RX-7 that could

rotundapig

> Redd, the RX-7 that could

08/17/2013 at 12:28 |

|

yeah, part of this interest is that I told a friend of mine to buy Tesla when it was about $40, but didn't take my own advice.

Joe_Limon

> rotundapig

Joe_Limon

> rotundapig

08/17/2013 at 12:42 |

|

Tesla is a very scary investment. The stocks are way over hyped. It is a bubble waiting to burst.

Unless you are very rich, the best investment you can make is in yourself. Or things you can manage, use the money as a down payment on some industrial/retail property. The stock market is a glorified casino.

bourgeoisie

> rotundapig

bourgeoisie

> rotundapig

08/17/2013 at 12:53 |

|

Stock markets are for when you have "fuck you" money. It doesn't sound like that's the case for you.

Enjoy the cars, don't buy the stock.

945T

> rotundapig

945T

> rotundapig

08/17/2013 at 13:08 |

|

My Ford stock has gone up significantly since I bought it during the carpocalypse. They're the only domestic auto maker that's actually y'know, building cars I would want or would recommend to others, so...

JuleZ3C

> rotundapig

JuleZ3C

> rotundapig

08/17/2013 at 14:15 |

|

Buy Plastic Omnium, check them out!

rotundapig

> bourgeoisie

rotundapig

> bourgeoisie

08/17/2013 at 15:10 |

|

The plan is to run a little personal finance experiment by investing a few thousand dollars in companies that I feel like are good medium-long term investments (5 years or so), taking a few thousand to use to flip cars, which I've made money at in the past, and seeing how each works out.

It's not exactly "fuck you" money, but it is money that I may otherwise spend on things definitely losing propositions financially (like pouring it in to parts for my rabbit).

rotundapig

> Joe_Limon

rotundapig

> Joe_Limon

08/17/2013 at 15:17 |

|

Well, I'm not talking about nearly enough money to invest in something like property, and I don't mind taking a bit of a gamble with this money. Basically, I know if I let money sit in savings, it'll either barely make enough to keep up with inflation or (more likely) I'll blow it on something more retarded than stocks.

it's kind of a little experiment to feel out how I want to handle my money when it comes time to start saving for retirement in earnest.

Joe_Limon

> rotundapig

Joe_Limon

> rotundapig

08/17/2013 at 15:38 |

|

Or, you could visit auto auctions and flip cars on the weekend. Don't buy cars that "could be worth a lot of money" but involve months of expensive restoration. Go for the easy flips that you can list instantly and sell in a week or two.

rotundapig

> Joe_Limon

rotundapig

> Joe_Limon

08/17/2013 at 17:48 |

|

oh hell yes. I tend to go for cars that I know I could part out/scrap and still make a profit. They tend to have the lowest risk/initial investment and the bigger margins if it all works out.

last time I bought an Audi Coupe Quattro for $1500. no way to lose there.

rotundapig

> JuleZ3C

rotundapig

> JuleZ3C

08/17/2013 at 17:54 |

|

I'm really only interested in investing in companies that I'm already familiar with and follow. I was just hoping someone knew the differences in the different symbols for what appears to be the same company.