"ttyymmnn" (ttyymmnn)

"ttyymmnn" (ttyymmnn)

04/27/2020 at 11:35 • Filed to: wingspan, Planelopnik

0

0

38

38

"ttyymmnn" (ttyymmnn)

"ttyymmnn" (ttyymmnn)

04/27/2020 at 11:35 • Filed to: wingspan, Planelopnik |  0 0

|  38 38 |

(Flickr/Pittsburgh International Airport)

As a way to help struggling airlines (after the industry has already received $25B in bailout money), President Trump has suggested that the federal government could buy four to five years worth of airline tickets for government employees flying on official business—for at least a 50% discount.

!!! UNKNOWN CONTENT TYPE !!!

“One of the ways we can help the airlines is buying tickets at a very large discount, maybe 50% off or maybe more, and you buy into four or five years’ worth of tickets, and you infuse [the airlines] with some cash,” the president said.

I’m no economist, but on the face of it, this doesn’t seem like a terrible idea. Maybe it should have been the first move, before the handout. But it also seems like the government, which is a huge purchaser of airline tickets in normal times, might be looking to take advantage of a bad situation to score a good deal.

facw

> ttyymmnn

facw

> ttyymmnn

04/27/2020 at 11:40 |

|

That would be good, but I suspect if it’s a good deal for the government, the airlines won’t actually accept. Unlike other businesses, they have ample access to credit and significant durable assets that can be used as collateral, so getting access to cash shouldn’t be a critical issue for them. As bad as things are right now for the airlines, they shouldn’t be in a position where they need to accept a bad deal for them just to get short term cash (especially after a bailout).

ranwhenparked

> ttyymmnn

ranwhenparked

> ttyymmnn

04/27/2020 at 11:45 |

|

I mean, yeah, this one doesn’t seem that bad. Government employees are going to have to travel again at some point as part of their job, so the tickets are going to have to be purchased. Recognizing the expenses now will hurt this year’s budget, but its totally blown anyway, and will help future year’s numbers, plus, a discount would ultimately be a net savings.

For Sweden

> ttyymmnn

For Sweden

> ttyymmnn

04/27/2020 at 11:47 |

|

President Trump is about to learn all of the airline voucher redemption policies.

farscythe - makin da cawfee!

> ttyymmnn

farscythe - makin da cawfee!

> ttyymmnn

04/27/2020 at 11:48 |

|

eh... on the one hand...yeah..thats probably not a bad plan...

on the other....let the airlines die....fuckers keep fucking up fiscally...time to pay the piper.... sides...ive kinda gotten used to these empty skies...and airports suck anyway

(sorry to all the people i just made jobless.....shitty time to be unemployed this....good luck with that)

CarsofFortLangley - Oppo Forever

> farscythe - makin da cawfee!

CarsofFortLangley - Oppo Forever

> farscythe - makin da cawfee!

04/27/2020 at 11:52 |

|

It seems like a high percentage of Oppos would be made unemployed (even more than they are now) by that

duurtlang

> ttyymmnn

duurtlang

> ttyymmnn

04/27/2020 at 11:53 |

|

Euro Oppomeet 2021 : tickets financed by Trump!

Turbineguy: Nom de Zoom

> ttyymmnn

Turbineguy: Nom de Zoom

> ttyymmnn

04/27/2020 at 11:53 |

|

Surprisingly, this doesn’t sound like a bad idea. But after a $25B bailout? Those guys should’ve been smarter & held onto more cash and not used their tax savings for stock buybacks.

smobgirl

> ttyymmnn

smobgirl

> ttyymmnn

04/27/2020 at 11:53 |

|

I mean, hell, if I wasn’t currently unemployed I’d be happy to buy a ten pack of flight vouchers for my own future use.

Future next gen S2000 owner

> facw

Future next gen S2000 owner

> facw

04/27/2020 at 11:56 |

|

I think part of the issue is the leverage. Sure the y could get access to credit but profit margins aren’t great in the airline industry. I could see some benefit, from the airlines side, to pre-purchased ticket sales over a line of credit.

SBA Thanks You For All The Fish

> facw

SBA Thanks You For All The Fish

> facw

04/27/2020 at 11:58 |

|

You think the airlines have ample access to credit? You’re kidding right?

Buffett famously just sold his 13 million shares of Delta stock for a 70% loss-- nobody rating these companies now thinks they are credit-worthy. When The Oracle of Omaha fights his way out of a burning building, rather than put his “long-term” faith in the management to turn it around? The credit markets believe all these companies are going to burn to the ground.

SBA Thanks You For All The Fish

> For Sweden

SBA Thanks You For All The Fish

> For Sweden

04/27/2020 at 11:59 |

|

Heh. Good point.

Maybe if the airlines all stiff Uncle Sam over these “vouchers” we’ll finally get an airline passengers’ bill of rights.

Which SHOULD have been on the table in the bailout discussions.

facw

> SBA Thanks You For All The Fish

facw

> SBA Thanks You For All The Fish

04/27/2020 at 12:00 |

|

They might, but the airlines can still put their planes up for collateral. Prospects for investors are different than prospects for lenders, so Buffett’s decision really isn’t relevant at all.

SBA Thanks You For All The Fish

> CarsofFortLangley - Oppo Forever

SBA Thanks You For All The Fish

> CarsofFortLangley - Oppo Forever

04/27/2020 at 12:00 |

|

We’re going to be 35-40% unemployed by the time this is done. Worse in Everett and Renton. Much worse.

ranwhenparked

> facw

ranwhenparked

> facw

04/27/2020 at 12:02 |

|

Credit? Nope, not without someone like the government cosigning/backstopping any loans, banks and bond investors do not want anything to do with airlines right now.

Durable assets? Maybe Delta - they own most of their planes outright, the others lease a large percentage of their fleet. And the market value of airliners is tumbling at the moment, some lessors have already started scrapping fairly young planes just to avoid paying storage fees.

farscythe - makin da cawfee!

> CarsofFortLangley - Oppo Forever

farscythe - makin da cawfee!

> CarsofFortLangley - Oppo Forever

04/27/2020 at 12:02 |

|

well.. shit... guess i wont be getting re elected now..

i hope everyone on oppo makes it through this okay...(everyone else too)

buuut... im still not a fan of saving the airlines....it probably has to be done anyway... but damnit...if im to be paying for it (and i will be...one way or another) i’d like to at least know lessons were learnt....wich wont be the case... coz magic bailout is always there...and that ceos bonus aint gonna pay itself....

CarsofFortLangley - Oppo Forever

> SBA Thanks You For All The Fish

CarsofFortLangley - Oppo Forever

> SBA Thanks You For All The Fish

04/27/2020 at 12:03 |

|

Zoidberg’s property value: $2.99

honestly, this whole situation is astounding (understatement). Insurance was always supposed to be bulletproof yet its a bloodbath

ranwhenparked

> Turbineguy: Nom de Zoom

ranwhenparked

> Turbineguy: Nom de Zoom

04/27/2020 at 12:04 |

|

Well, to be fair, how foreseeable was a total worldwide economic shutdown that it would have been wise and prudent to hold on to billions of dollars in cash that could have been put to other uses? This has never been done before in history, it would be like expecting a company to have a contingency plan for the 2nd coming of Christ.

SBA Thanks You For All The Fish

> facw

SBA Thanks You For All The Fish

> facw

04/27/2020 at 12:05 |

|

Dunno. With 75% of their fleets sitting out here in the desert? The lendable “residual” value on these airframes are pretty low. The fleets have large components of “leased” planes, the leases they’ve already defaulted on with ILFC.

Delta was in the strongest position and I believe the best deal they could get on collateralized debt was only going to allow them to survive until late spring.

HoustonRunner

> ttyymmnn

HoustonRunner

> ttyymmnn

04/27/2020 at 12:06 |

|

I’ll start with the fact that I work in consulting, and about half of my career has been on the road. But right now United has several thousand dollars of mine that I do not intend to use (late June family trip to Europe that we are not taking). Fli ghts that far out are not cancelled, so I need to make a dec isi on by 30-Apr. Current policy is that if I cancel by 30-Apr I get no penalty but only get travel vouchers good for 24 months. If I wait to see if they cancel the flights, I may end up with worse terms or lose the money altogether.

Suffice to say I’m not in favor of giving them more money.

Turbineguy: Nom de Zoom

> ranwhenparked

Turbineguy: Nom de Zoom

> ranwhenparked

04/27/2020 at 12:06 |

|

Maybe this will be the turning point for a few enlightened CEOs.

El Relámpago(LZone) - Humanity First!

> ttyymmnn

El Relámpago(LZone) - Humanity First!

> ttyymmnn

04/27/2020 at 12:06 |

|

Lifetime passes for all Government employees!(no I’m not one).

SBA Thanks You For All The Fish

> farscythe - makin da cawfee!

SBA Thanks You For All The Fish

> farscythe - makin da cawfee!

04/27/2020 at 12:10 |

|

But, hey, at least those assholes bought back $100 billion in their own stock, financed by bag fees and $200_change_fees, before we bailed ‘em out.

It’s not like they could have realized they were in a cyclical, highly-capital-intensive industry with huge risk, eh?

Oh, wait a minute..

SBA Thanks You For All The Fish

> ttyymmnn

SBA Thanks You For All The Fish

> ttyymmnn

04/27/2020 at 12:12 |

|

I’d actually favor re-regulation. If they asked me...

And, yeah, this doesn’t seem like a “new problem”. These guys have been like this forever. https://freakonomics.com/2011/06/24/why-do-airlines-always-lose-money-hint-its-not-due-to-taxes-or-fuel-costs/

camarov6rs

> ranwhenparked

camarov6rs

> ranwhenparked

04/27/2020 at 12:22 |

|

Something of this magnitude would be hard to foresee for sure. Looking at GM and Ford though they have Billions in reserves and are accessing credit lines. I don’t know how much the airlines had in reserves but I don’t think it was to the same level of GM. To me that signals they were not looking expecting enough cloudy weather.

ranwhenparked

> Turbineguy: Nom de Zoom

ranwhenparked

> Turbineguy: Nom de Zoom

04/27/2020 at 12:23 |

|

So, basically, from now on, every company has to keep 2 years’ worth of expenses on hand

ttyymmnn

> SBA Thanks You For All The Fish

ttyymmnn

> SBA Thanks You For All The Fish

04/27/2020 at 12:23 |

|

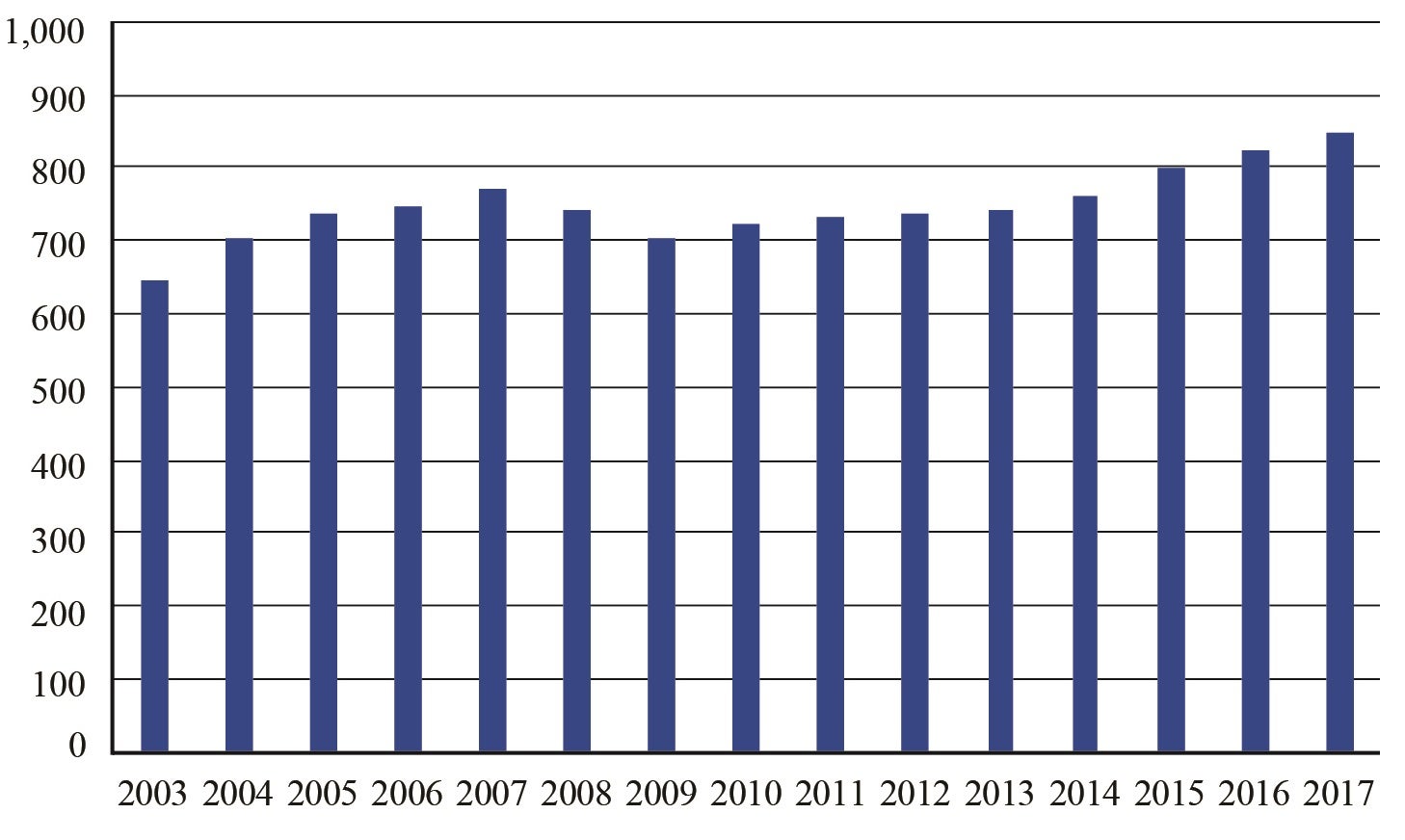

I’d be interested to see the passenger numbers in the ten years since this article.

WasGTIthenGTOthenNOVAnowbacktoGTI

> Turbineguy: Nom de Zoom

WasGTIthenGTOthenNOVAnowbacktoGTI

> Turbineguy: Nom de Zoom

04/27/2020 at 12:24 |

|

Mid Engine

> CarsofFortLangley - Oppo Forever

Mid Engine

> CarsofFortLangley - Oppo Forever

04/27/2020 at 12:32 |

|

Puget Sound doesn’t depend solely on Boeing like it used to. Tech is the thing here.. yeah Boeing layoffs will sting but the inflow of tech bros writing code will more than offset that. I expect the real est ate market to be down very slightly, those engine-n erds need somewhere to live. The other thing is the WFH will likely be a more permanent thing for many, and cramped ap artments get old in a hurry, so housing will still be in demand.

ranwhenparked

> camarov6rs

ranwhenparked

> camarov6rs

04/27/2020 at 13:15 |

|

American Airlines Group has $8.4 billion in available credit, which is still only equal to about 4 months’ worth of revenue, but, is over 7 years worth of net income for them. Which, certainly gives an idea of how high their operating costs are.

In a deep recession, revenue might fall by 10-20-30%, since the economy slows, but doesn’t stop completely. In this case, it fell off nearly 100% because everything was forced to almost a full stop.

Even during the Great Depression, the shipping companies (the airlines of the day, since air travel was still pretty rare) were able to find ways to utilize their fleet and make up some revenue shortfall by running cheap booze and gambling cruises into international waters when demand for actual travel fell off. That sort of creative thinking isn’t an option right now, since the planes just can’t fly with passengers at all, regardless of what special promotions or package deals airlines might think of to encourage business.

The only thing they’ve come up with is temporarily converting some passenger planes to cargo use, but they’re not as efficient as dedicated freighters, and there isn’t enough demand to come anywhere close to utilizing the bulk of the fleet.

SBA Thanks You For All The Fish

> ttyymmnn

SBA Thanks You For All The Fish

> ttyymmnn

04/27/2020 at 13:18 |

|

Here it is through ‘17.

This is US only and raw “passenger counts”, not passenger miles...

Turbineguy: Nom de Zoom

> ranwhenparked

Turbineguy: Nom de Zoom

> ranwhenparked

04/27/2020 at 13:47 |

|

I don’t think that’s practical, but you’re on the right track. Maybe 6 months? Otherwise it’s Uncle Sam to the rescue again.

camarov6rs

> ranwhenparked

camarov6rs

> ranwhenparked

04/27/2020 at 13:47 |

|

All very true they are in an artificially created crater. I was just comparing their relative “cash on hand” vs some automakers which are smaller companies by revenue (I could be wrong).

According to this article GM had access to $30 billion in liquidity with $17 billion cash. They seemed much more prepared to weather storms at the cost of their ultimate share price vs some in the airline industry.

ttyymmnn

> SBA Thanks You For All The Fish

ttyymmnn

> SBA Thanks You For All The Fish

04/27/2020 at 13:48 |

|

I’d be interested to know what caused the dip in 2009. I guess it was the 2008 recession or whatever it was? It’s just that we’ve heard so much about how pax numbers dropped off after 9/11, but little about how they’ve been steadily increasing (at least in the last 10 years).

fintail

> ttyymmnn

fintail

> ttyymmnn

04/27/2020 at 13:53 |

|

So like a groupon (sorry if this has been said, not reading it all). Maybe one of the least stupid ideas the orange menace has floated during these 69865876577 years of his first term.

fintail

> Mid Engine

fintail

> Mid Engine

04/27/2020 at 13:53 |

|

Some people are doomers who can’t back it up.

40% unemployment? I call bullshit.

SBA Thanks You For All The Fish

> ttyymmnn

SBA Thanks You For All The Fish

> ttyymmnn

04/27/2020 at 13:56 |

|

Yeah, 08-09-10 was all The Great Recession.

Oddly, Delta’s “permanent return to profits” was all driven by bag fees, change fees, seat selection fees.... NOT really that much increase in traffic.

The Mr. Grumpy Pants part of me will observe that the “last guy in the Oval Office” had a tendency to rubber-stamp all the airline mergers. Which had the net effect of destroying competitive forces and turning the airline biz into one dominated by only four carriers. The fee-gouging of the last 10 years is almost completely due to the airline consolidations.

Then the remaining four airlines all implemented big bag fees (swa being the exception), drove big profits and manipulated their stock price up with stock buybacks... .then ran to the government for bail0uts when it all went bad.

the Airlines are basically “big banks with wings”.

gmporschenut also a fan of hondas

> duurtlang

gmporschenut also a fan of hondas

> duurtlang

04/27/2020 at 14:23 |

|

Round trip tickets to Singapore GP in sept for 600$. How much of a gamble is it?

gmporschenut also a fan of hondas

> SBA Thanks You For All The Fish

gmporschenut also a fan of hondas

> SBA Thanks You For All The Fish

04/27/2020 at 21:44 |

|

what starts getting extra shady are the code share alliances with other national airlines . Oh BA/AA have a monopoly on the US to UK route (vs united, Delta etc)? United and Lufthansa to germany?