"ttyymmnn" (ttyymmnn)

"ttyymmnn" (ttyymmnn)

03/10/2020 at 10:43 • Filed to: None

0

0

57

57

"ttyymmnn" (ttyymmnn)

"ttyymmnn" (ttyymmnn)

03/10/2020 at 10:43 • Filed to: None |  0 0

|  57 57 |

I’ve been trying to figure out what’s been going on with the price war between the Saudis and the Ru ssians. It seems that they’ve had enough of our bid for energy independence, and want to regain control of the oil pricing screws.

U.S. Treasury Secretary Steven Mnuchin told Russia’s ambassador to the United States on Monday that energy markets needed to stay “orderly” amid rising concerns that extra supply from Saudi Arabia and Russia could trigger bankruptcies among higher-cost U.S. shale oil producers.

!!! UNKNOWN CONTENT TYPE !!!

jimz

> ttyymmnn

jimz

> ttyymmnn

03/10/2020 at 10:50 |

|

I had someone at TTAC literally yell “FAKE NEWS” at me when I said the stock market drop was due partly to this price war between the Saudis and Russia.

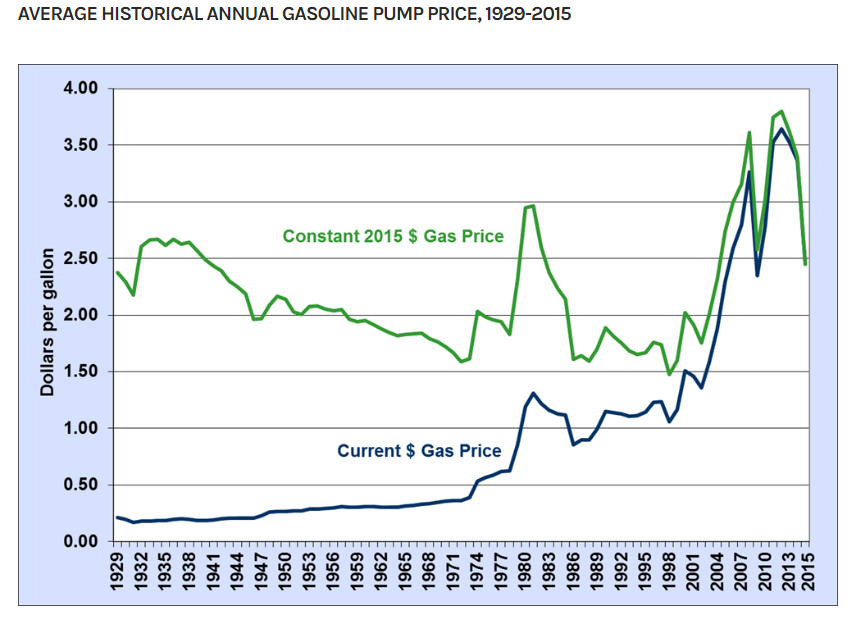

fun fact- normalized to 2020 dollars, gas in my area is as cheap as it was in 1970.

WilliamsSW

> ttyymmnn

WilliamsSW

> ttyymmnn

03/10/2020 at 10:53 |

|

Russia is probably doing this in an effort to kill the North American fracking industry and the Saudis are doing this in part to help us (and themselves).

facw

> ttyymmnn

facw

> ttyymmnn

03/10/2020 at 11:00 |

|

My read is that it really doesn’t have a ton to do with the US, though it’s certainly possible that US producers will feel some serious pain over this.

From what I’ve read, the issue is that demand is down due to COVID-19, and quite possibly will drop even further as things get worse, and with the possibility of a recession. Saudi Arabia and OPEC wanted to respond to this situation by slashing production to keep costs up. However, with expanded oil production outside of the Persian Gulf region, OPEC isn’t really strong enough to make that move on their own, people would just buy oil from other countries. This means they normally work in concert with Russia. However here, Russia wasn’t willing to cut back anywhere near as much as OPEC wanted (which would have caused hardship in Russia) . So the Saudis decided that if they weren’t going to keep prices high, they may as well slash prices, increase production, and make it up on volume, while putting pressure on Russia to change their stance. Saudi extraction costs are much lower than Russia’s so the price drops will render Russian oil economically unviable, and presumably bringing Russia back to the table for production cuts in the future.

The Saudis have tried something similar against US production, but while it did initially do great harm to the industry, US production was able to increase its efficiency so it shouldn’t be a death sentence now. It’s not clear that Russia can do that. It seems most likely they will agree to cut production (since they wouldn’t be able to sell their full production anyway), but there’s always a chance they could lash out in some way.

ttyymmnn

> jimz

ttyymmnn

> jimz

03/10/2020 at 11:01 |

|

I hadn’t thought of adjusting current price for inflation. My neighborhood market is selling at $1.87 this morning. I’ll be interested to see what it is at Costco. Unfortunately, I don’t need gas right now.

shop-teacher

> WilliamsSW

shop-teacher

> WilliamsSW

03/10/2020 at 11:02 |

|

They’re doing it to help themselves, don’t kid yourself.

ttyymmnn

> facw

ttyymmnn

> facw

03/10/2020 at 11:03 |

|

Ain’t the world grand? Thanks for your insight.

ranwhenparked

> ttyymmnn

ranwhenparked

> ttyymmnn

03/10/2020 at 11:04 |

|

Ive been expecting this for awhile now, the cartel does not like newcomers threatening their racket.

jminer

> ttyymmnn

jminer

> ttyymmnn

03/10/2020 at 11:06 |

|

Global policies and oil is one of those areas where there are so many competing interests and so much historical fuckery it’s hard to wrap your head around it.

I spent some time unwinding this all for my wife last night and the more I talked about the last 10-50 years and the track of all of this the more insane it sounded.

It is hilarious to me when this administration makes a call for cooler heads to prevail . Its ours usually doing stupid things to fuck with other nations. The same would go for almost all US administrations of the last 75 years when it comes to oil though. The fact that we’ve literally started several ground wars over it, installed pupped states, backed coups, assassinated leaders and countless other nonsense actions.

I know a few petroleum engineers though, and their industry had already been hurting by low prices. It’s interesting to see OPEC and Russia take the Amazon tactic here though ‘we have complete control over our end so let us see who can bleed longer and run you out of business’.

Particularly with Petroleum products I think all these companies/countries might be fighting for dominance of that is likely the last 25 years of Oil being big money. While there will always be industrial uses for it I fell like we are now with Oil where Coal was 15 years ago. On the brink of steep decline for multiple reasons, a major one being it’s slowly killing all of us.

Gone

> ttyymmnn

Gone

> ttyymmnn

03/10/2020 at 11:11 |

|

“...among the higher-cost U.S. shale oil producers” So like every ShaleCo. Have a bunch of thoughts/theories on this and had a nice convo yesterday on here w/davesaddiction is lateral Gs about it .

Think shale gets the fallout (and prob Russia)

, but they were already

seriously distressed. Hund

reds of billions in debt, never posting profits (no FCF so no debt replayment)

, unrealistic/impossible

IRRs, accele

ra

ting

decline rates, rising GORs, minimal Tier

1 acreage left, parent/child well

issues,

goofy failed expe

ri

ments (downspace

, cube, stack

)

etc. A lot of them weren’t going to make it through the year as it was. MLPs who didn’t go c-corp also got destroyed, but

that’s just

a side story

.

I also

think there’s more geopolitics to this than has been discussed (think proxy wars in Yemen/Syria) and the fraye

d

relations inside OPEC (and OPEC+) re: Iraq pumping more in April/May now too. Also, KSA upped to

12.3MMbbl/d this morning

, which really blows out what’s in their sto

ra

ge and related

chatter

about how

pushing much over 11MMbbl/day may permanently

damage their fields

. Some proxy going after KSA infrastructure would not surprise me tbh.

facw

> WilliamsSW

facw

> WilliamsSW

03/10/2020 at 11:11 |

|

Russia is doing this because they can’t afford to lose that oil revenue since they are pretending to be a world power with an economy the size of Italy’s.

It would make much more sense for them to have just agreed to the production cut, since they need high oil prices, but they are also desperate for cash.

For Sweden

> ttyymmnn

For Sweden

> ttyymmnn

03/10/2020 at 11:12 |

|

Give it time. Eventually Russia and Saudi Arabia will sign a non-aggression pact, then invade Iran.

ttyymmnn

> Gone

ttyymmnn

> Gone

03/10/2020 at 11:15 |

|

Think shale gets the fallout (and prob Russia), but they were already seriously distressed.

“They” being Russia or the frackers? I’m afraid I got a little lost in the lingo in your reply. But is the gist of it that the frackers are in trouble anyway?

ttyymmnn

> For Sweden

ttyymmnn

> For Sweden

03/10/2020 at 11:17 |

|

That would be funny if it weren’t plausible. I just read that Pooty-poot “would support legislation” to let him run for two more terms, possibly 16 more years in (official) power. Waiting for similar legislation in the US.

Gone

> facw

Gone

> facw

03/10/2020 at 11:19 |

|

!!! UNKNOWN CONTENT TYPE !!!

There is no real increase in efficiency, there was just greater access to cheap debt/VC money and a huge decrease in profit margin via service comp anies (which destroyed their value - SLB, HAL , BH, WFT, etc) . Drilling w/completions is still a $ 6-10MM endeavor per hole in most plays . This doesn’t include land or LOE. Don’t get me wrong, some wells make money, but many many more do not. URs look bad across the board.

WilliamsSW

> shop-teacher

WilliamsSW

> shop-teacher

03/10/2020 at 11:26 |

|

Oh of course they are, there’s no question about that. They want Russia to get in line. And they would prefer that fracking go away too, though that’s a bit more complicated.

Chuckles

> ttyymmnn

Chuckles

> ttyymmnn

03/10/2020 at 11:28 |

|

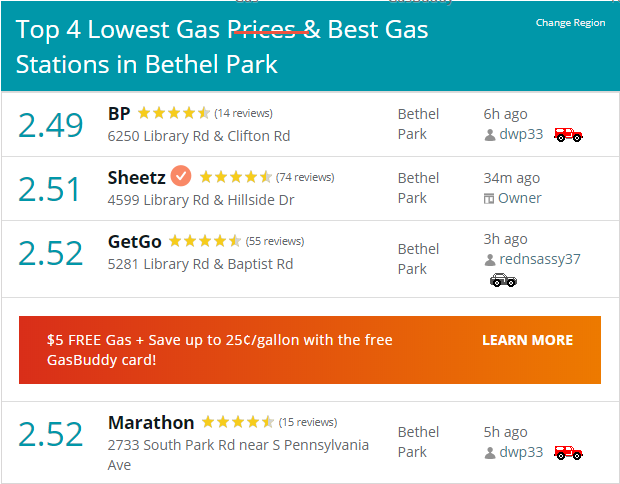

Gas is still over $2.50 for regular around me in PA. Still waiting on those cheap gas prices to show up...

Gone

> ttyymmnn

Gone

> ttyymmnn

03/10/2020 at 11:31 |

|

US shale was/is in deep financial distress. The Russia bit was meant to say they can’t

take the heat from KSA either. KSA > Russia > US Shale.

Sorry about the industry stuff. There was little access to credit for

most ShaleCos already, but this will

virtually elimi

nate it. Shale b

onds got smoked yesterday, revolvers will get shrunk, loan covenants were also likely broken. If so, banks can call those loans. DOE stepping in this morning with the whole “attempts by state actors to manipulate and shock oil markets” and “

U.S. ‘can and will’ withstand the volatility in oil markets”

makes a bigger mess of this. US gov may look to

bail all these ShaleCos out, not sure. It’s a

load of ShaleCo

debt (~$600B, ~$2-300B

due in next couple years) to deal with.

For Sweden

> ttyymmnn

For Sweden

> ttyymmnn

03/10/2020 at 11:35 |

|

Americans can't even pass a budget; they'll never ratify a constitutional amendment.

DipodomysDeserti

> ttyymmnn

DipodomysDeserti

> ttyymmnn

03/10/2020 at 11:43 |

|

Gas prices haven’t changed here. High $2 for regular. Driving to CA tomorrow so I hope that changes.

DipodomysDeserti

> jimz

DipodomysDeserti

> jimz

03/10/2020 at 11:45 |

|

So gas is now as cheap as it was in the middle of a gas crisis, but now we think that’s cheap. Sounds about right.

ttyymmnn

> Gone

ttyymmnn

> Gone

03/10/2020 at 11:53 |

|

Thanks.

ttyymmnn

> For Sweden

ttyymmnn

> For Sweden

03/10/2020 at 11:54 |

|

You’re assuming it will need an amendment. FDR didn’t.

davesaddiction @ opposite-lock.com

> ttyymmnn

davesaddiction @ opposite-lock.com

> ttyymmnn

03/10/2020 at 11:59 |

|

It’s less about us, and more about the Saudis being pissed at Russia for not playing along. The pain to U.S. producer

s is just gravy.

davesaddiction @ opposite-lock.com

> facw

davesaddiction @ opposite-lock.com

> facw

03/10/2020 at 12:01 |

|

No one in the U.S. can make money in the $30s. Even under $50 is a serious challenge. If it stays here long, lots of companies are in deep trouble.

davesaddiction @ opposite-lock.com

> Gone

davesaddiction @ opposite-lock.com

> Gone

03/10/2020 at 12:04 |

|

Can anyone in the States

make money at $35 & $2?

ranwhenparked

> Chuckles

ranwhenparked

> Chuckles

03/10/2020 at 12:05 |

|

Well, you have the highest per gallon taxes in the country, so it will fall, but you're not going to see the crazy cheap prices others do.

davesaddiction @ opposite-lock.com

> Gone

davesaddiction @ opposite-lock.com

> Gone

03/10/2020 at 12:05 |

|

So, I bought some OIH today. LOL - we’ll see how that plays out in a couple years!

For Sweden

> ttyymmnn

For Sweden

> ttyymmnn

03/10/2020 at 12:05 |

|

The 22nd Amendment was ratified in 1951; after FDR passed away.

jimz

> DipodomysDeserti

jimz

> DipodomysDeserti

03/10/2020 at 12:07 |

|

that didn’t hit until late ‘73, with a follow up in 1979-80.

jimz

> ttyymmnn

jimz

> ttyymmnn

03/10/2020 at 12:11 |

|

there were no term limits before FDR. The 22nd amendment establishing term limits was ratified in 1951; it would take another amendment to repeal it.

notgonnahappen.com.

Cash Rewards

> jimz

Cash Rewards

> jimz

03/10/2020 at 12:12 |

|

As much as TTAC commenters like to take shots at Jalopnic, they are not the best bun ch themselves, either

jimz

> Chuckles

jimz

> Chuckles

03/10/2020 at 12:14 |

|

That’s pretty damn cheap when you think of it in real dollars. Indexed to inflation you’re paying the same for a gallon of gas as you would have in 1969.

Gone

> davesaddiction @ opposite-lock.com

Gone

> davesaddiction @ opposite-lock.com

03/10/2020 at 12:15 |

|

Braver than I am - I haven’t jumped in, it’s wild out there lol.

I think there’s a lot of money to made with dead cat bounces for awhile - lots of sector volatility.

DipodomysDeserti

> jimz

DipodomysDeserti

> jimz

03/10/2020 at 12:15 |

|

I misread your post as “1970s”.

jimz

> Cash Rewards

jimz

> Cash Rewards

03/10/2020 at 12:15 |

|

there’s a handful of good ones. the rest are vapid trolls and aging right-wing curmudgeons.

Chuckles

> jimz

Chuckles

> jimz

03/10/2020 at 12:21 |

|

I get that. I've just been hearing a lot about gas prices plummeting, and here it's gone down about $0.10 in the last month.

user314

> ttyymmnn

user314

> ttyymmnn

03/10/2020 at 12:29 |

|

Vlad’s many things, but he’s not an idiot. Invading a M uslim country, especially a long-time client state? That does not end well for the USSR Russia. Much lower risk to keep playing all sides against each other (or really, to not do anything and just let everyone keep blaming “Russian bots”).

Gone

> davesaddiction @ opposite-lock.com

Gone

> davesaddiction @ opposite-lock.com

03/10/2020 at 12:36 |

|

L

egacy conventionals, a bit of offshore, and

strippers. Maybe a couple unconventionals - there are a few

monster horiz wells out there (8

00k

bbl+ URs)

. But seriously it’s no good at these prices.

If this keeps up I’d guess you’ll see a bunch of shut-ins.

Worst part of the whole horiz/long lat wells seems to be that a lot of them

become non-economic somewhere in the 10-20bbl/d range due to lifting costs. Vert wells do much better in that regard. Between the steep decline rate

s and economics once the well falls off, it’s hard to be economic.

Also, $2? Don’t overpay! Henry is under that. Also l

ook at Waha futures

lmfao

.

user314

> Chuckles

user314

> Chuckles

03/10/2020 at 12:37 |

|

BP down the road from me is at 2.49, Sheetz and the Get Go/Giant Eagle should follow shortly.

Wacko

> Cash Rewards

Wacko

> Cash Rewards

03/10/2020 at 12:46 |

|

Oppo is not jalopnic

Jalopnic comments sometimes are as bad as the ones on foxnews.

HoustonRunner

> ttyymmnn

HoustonRunner

> ttyymmnn

03/10/2020 at 12:49 |

|

I work in oil and gas, specifically with Trading groups. The general consensus was that Russia sees this as an opportunity to squeeze out (force to bankruptcy) some of the shale producers. This won’t slow down production, but it will likely slow down production growth in the major shale basins (and oil sands in Canada).

gmporschenut also a fan of hondas

> Chuckles

gmporschenut also a fan of hondas

> Chuckles

03/10/2020 at 12:53 |

|

The pump price is 6 months down the line, and even then a lot can happen to smooth out spikes/ drops

ranwhenparked

> jimz

ranwhenparked

> jimz

03/10/2020 at 12:53 |

|

And a lot less than in 1959, when gas was $2.76 a gallon in modern money. This often blows elderly people's minds, a lot of people over age 80 don't seem to understand "inflation" and just know that "stuff cost less in my day." And forget that they were probably making less than $2600 a year at the time.

Chuckles

> gmporschenut also a fan of hondas

Chuckles

> gmporschenut also a fan of hondas

03/10/2020 at 12:59 |

|

That's understandable. Reading some comments, I was under the impression that people were already seeing significant drops.

fintail

> jimz

fintail

> jimz

03/10/2020 at 13:00 |

|

So we get some of the same costs enjoyed by luckyboomers and the “great/silent” groups when they were younger. Now only if we could have their housing, medical, and education costs.

jimz

> ranwhenparked

jimz

> ranwhenparked

03/10/2020 at 13:04 |

|

Yep. “Back in my day, a loaf of bread was a nickel!”

“Back in your day, $1.00/hr was good pay.”

Gone

> davesaddiction @ opposite-lock.com

Gone

> davesaddiction @ opposite-lock.com

03/10/2020 at 13:10 |

|

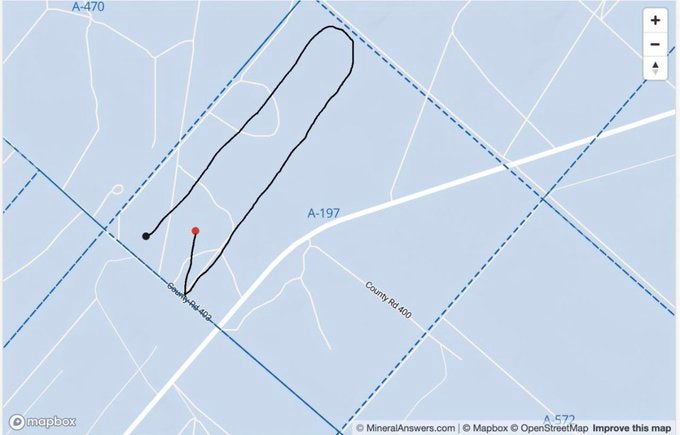

Also, this is like my favorite thing but I’d like to know the economics here. A nd I really just want to post it. Shell drilled this nonsense last year. JPT even did an article on it. I mean completely sweet engineering feat but all the money... Does this pay out? /rhetorical

Neelie 1-85 Lov

Loving County, TX

Shell

Production Dates

Jul 2016 - Nov 2019

Total Oil Production

83,216

BBLs

Total Gas Production

268,184

MCF

Recent Oil Production

139

BBLs in

Nov 2019

OOF

Recent Gas Production

234

MCF in

Nov 2019

Wells on Property

5

https://pubs.spe.org/en/jpt/jpt-article-detail/?art=6595&linkId=82144975

davesaddiction @ opposite-lock.com

> Gone

davesaddiction @ opposite-lock.com

> Gone

03/10/2020 at 14:10 |

|

We’ll see if I’m brave, or foolish.

davesaddiction @ opposite-lock.com

> Gone

davesaddiction @ opposite-lock.com

> Gone

03/10/2020 at 14:16 |

|

Haha - that’s hilarious. Shell has enough money, it was probably

worth it as a test of feasibility. But if they were drilling 5Ks instead of 10Ks in that area, my guess is that the economics don’t really

make sense. They’re lucky they were able to have a successful completion. Would be interesting to see if this viable in an area where they’re drilling 10Ks but you have a lone square-mile unit you want to develop.

davesaddiction @ opposite-lock.com

> Gone

davesaddiction @ opposite-lock.com

> Gone

03/10/2020 at 14:21 |

|

We’re looking at a recomplete program to try to increase cash flow some (some on poorly performing horizontals).

davesaddiction @ opposite-lock.com

> Gone

davesaddiction @ opposite-lock.com

> Gone

03/10/2020 at 14:37 |

|

So, domestic oil production really is a national security issue. I don’t think the government should bail out oil companies, but it’s not good to go back to a state where we’re dependent on the Middle East and Russia...

davesaddiction @ opposite-lock.com

> Gone

davesaddiction @ opposite-lock.com

> Gone

03/10/2020 at 14:41 |

|

So, you’ll like this: EnCap/Felix

lost something like one BILLION dollars in value yesterday on that WPX deal ($900k in cash, the rest was stock). Crazy.

Gone

> davesaddiction @ opposite-lock.com

Gone

> davesaddiction @ opposite-lock.com

03/10/2020 at 15:01 |

|

Agree, I don’t see how those short lats make money though s

uper long ones are also trouble. I’m ama

zed that it worked, just seems like a wild idea.

Interve

ntion is much cheaper than new holes! ROI on recompletes and well stims

can be really good.

Lots of shale (al

so

LPI and WPX)

up, so everybody’s good now I guess lol

.

OXY’s done a lot of dumb things but at least they dropp

ed

capex and div

y’s today. Would assume others will follow suit

.

Hamm came out of hiding to shake

the

money tree and I can only see that as a

bad sign. It took no time fo

r CLR to ask for

money...

Gone

> davesaddiction @ opposite-lock.com

Gone

> davesaddiction @ opposite-lock.com

03/10/2020 at 16:29 |

|

L OL! That’s amazing. Not such a bad deal for WPX then I guess.

davesaddiction @ opposite-lock.com

> Gone

davesaddiction @ opposite-lock.com

> Gone

03/10/2020 at 16:36 |

|

Who knows how it will play out... ?

“ Upon close, an entity controlled by EnCap Investments L.P. – the financial sponsor for Felix – received consideration of approximately 153 million shares of WPX stock and $900 million in cash.

The purchase price consists of $900 million cash, subject to closing adjustments, and $1.6 billion in WPX stock issued to the seller. WPX plans to fund the cash portion through issuance of $900 million of senior notes on an opportunistic basis. WPX also has obtained committed financing from Barclays in connection with the transaction and has full access to a $1.5 billion revolving credit facility.

The stock consideration comprises approximately 153 million WPX shares, which is based on the 10-day volume-weighted average price as of Dec. 13, 2019. The transaction is subject to customary closing conditions and approval by WPX shareholders.”

153 MM shares x $10.46 per share = $1.6 Billion

153 MM shares x $3.21 per share = $491 MM (yesterday)

(Now $4.34 = $664 MM)

Gone

> davesaddiction @ opposite-lock.com

Gone

> davesaddiction @ opposite-lock.com

03/10/2020 at 16:37 |

|

Yeah, bailouts are bad in this case. I thought the auto ones were reasonable however, so not sure my opinion counts for much

...

I think having the access to oil in a relatively quick timeline (shale) is great, and it’s a buffer (along with SPR)

that could be left mostly in the ground and used as needed. If everyone else wants to burn thems

el

ves out with production we’d have ours. Long term, oil usage will decline due to the energy transition (cheap oil shifts this timeline though). I think we should hang on to our resources as long as possible. If the ShaleCos pumped from an economic standpoint, not a financing treadmill standpoint, I think it’d help. Majors taking over, slowing development, reducing waste (flaring), and stabilizi

ng prices wouldn’t hurt IMO. I get it’s capitalism, but think we should be smarter about it -

national

security, price stabilization, etc

.

davesaddiction @ opposite-lock.com

> Gone

davesaddiction @ opposite-lock.com

> Gone

03/10/2020 at 16:46 |

|

Yeah, even if lots of wells are shut-in and plenty are left as DUCs, someone will end up owning them even if many companies go under, and if the need arises, the taps can be turned back on in fairly short order.

A decade ago, who thought

we’d be talking about peak oil

demand

?