"Wobbles the Mind" (wobblesthemind)

"Wobbles the Mind" (wobblesthemind)

07/05/2019 at 07:14 ē Filed to: Nio

1

1

19

19

"Wobbles the Mind" (wobblesthemind)

"Wobbles the Mind" (wobblesthemind)

07/05/2019 at 07:14 ē Filed to: Nio |  1 1

|  19 19 |

Just a quick heads up on Nio, there is no bad point of entry ó even while the stock is rallying over 15 % a day ó as long as you get out by the end of January (February if you donít mind risk) . I know what all the finance guys say but NONE of them know ANYTHING about the car market.

It takes around 2,500 deliveries per month for Nio to make money actually building the cars. You can glanc e at their Q4 earnings and adjust for the ES6 being an assumed lower margin but a higher volume vehicle. T hatís what Iím looking for, a minimum of 2,500 deliveries per month through the end of the year.

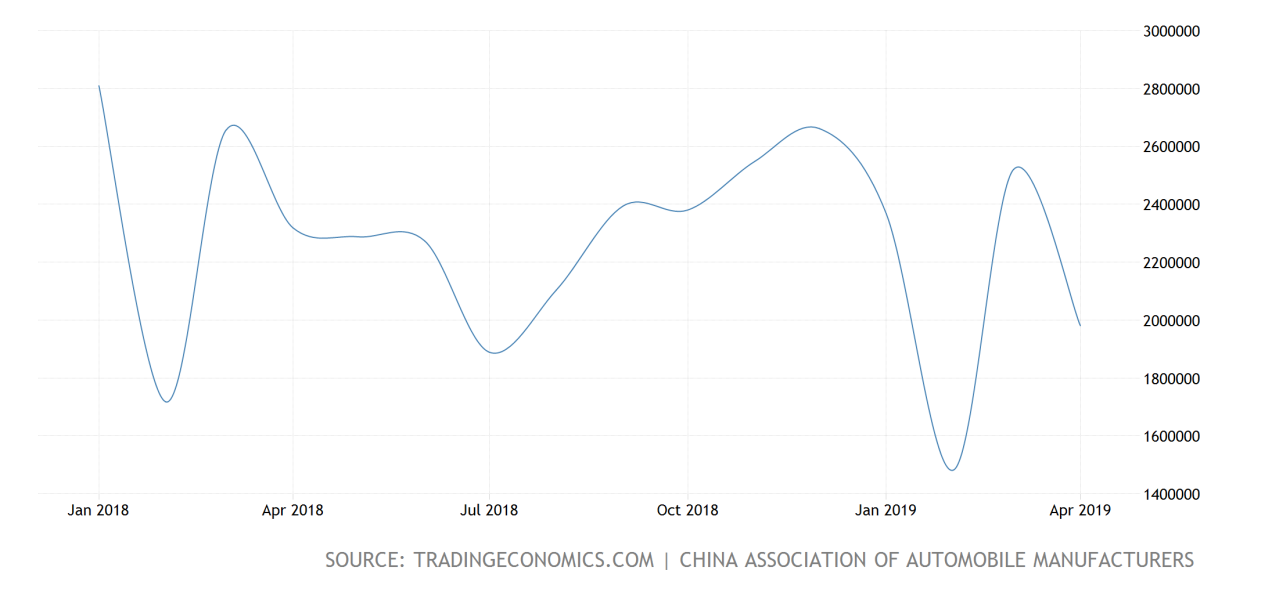

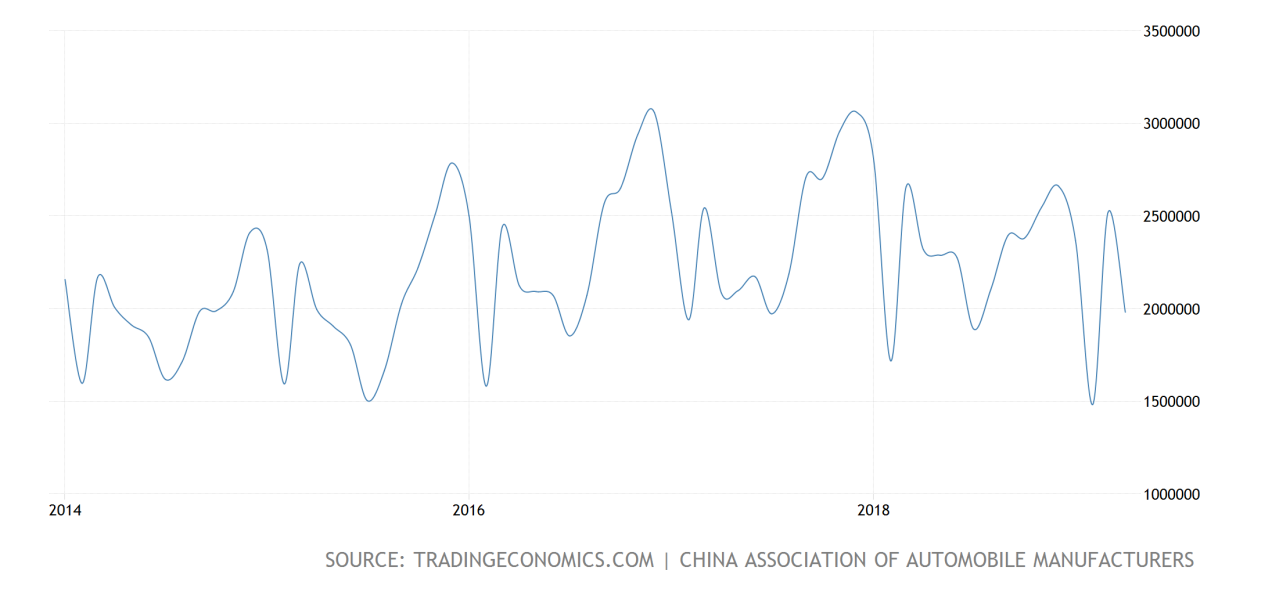

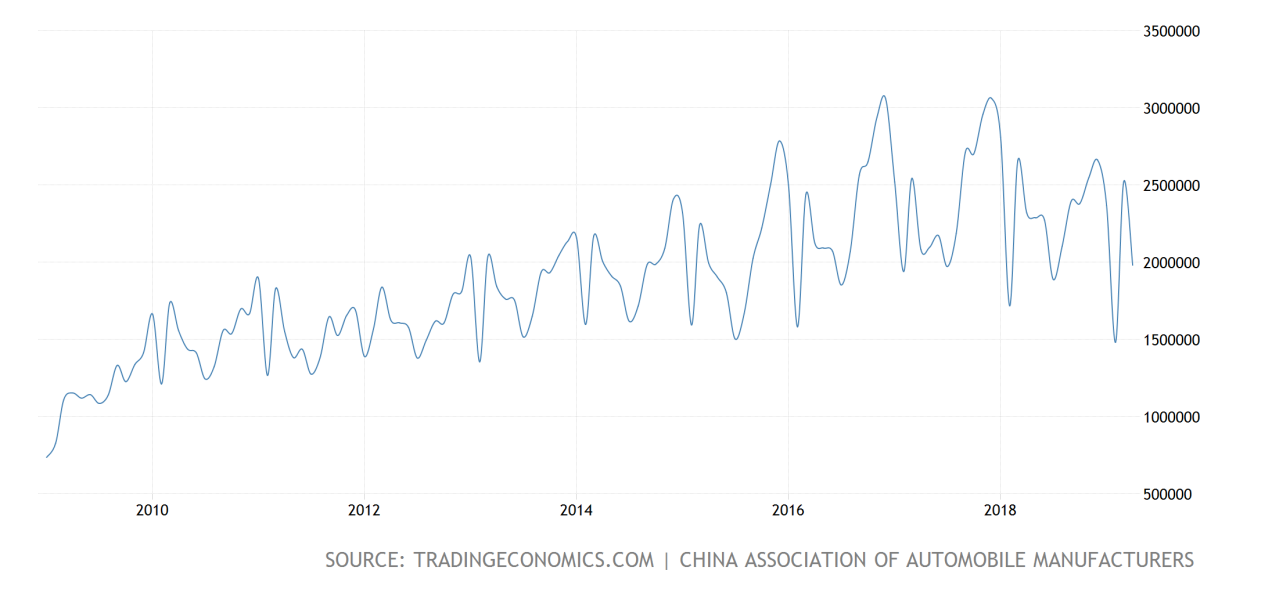

A very interesting thing about China is that it has one of the most consistent monthly car sales structures I have ever seen. The big thing to know is that September through January is the hype-maker, and that the February Freefall is traditional and always terrifying .

July and August are two of the worst months for car sales in China. However, with Nio delivering preorders beginning at the end of June, they have effectively secured strong sales for July and August which turns a weakness into a strength by pushing non-preorder buyers into the ES8 if they canít wait or over into September sales and on.*

* This is also a great way to find out what kind of moat is inside the brand name by how many people either jump into an ES8 or wait for September and on to get the ES6.

Notice that the yearly shape stays relatively the same. You can always spot February because itís a massive drop from January followed by a big rebound for March.

And this is to show how long this has been going on.

So, Nio already told us that they had around 12,000 preorders for the ES6 to deliver this year. From the end of June until September, Nio will be delivering 6,000 first edition cars. This means that w e can expect that July and August will have at least 2,000 ES6 deliveries plus the ES8 should be selling a minimum of 500 units (I think it will average over 1,000 units per month even with the ES6 on sale).

This means that Nio has essentially secured profitablity for the rest of the year as far as making sure that they make more selling the cars than they lose bu ilding them (t his is the mo st telling metric in the entire auto industry) . Of course, there are other expenses that need to be accounted for but those only come up quarterly.

Iím not going to jump into any other stuff since Iím not sure if you all are into automoti ve market and brand geekdom, especially with a Chinese startup car brand selling electric crossovers . All Iím saying is that this company is all growth from June 2019 through January 2020 . Nioís Q2 earnings wonít include the cost of the recall, and they s hould beat on earnings, beat on revenue, a nd give some extremely positive forward guidance for Q3 which should all be reported around mid-to-end of August.

One last note, remember that while dropping from $6 to $3 is a 50% loss, going from $3 to $4.50 is a 50% gain and leaves you room for an additional 50% gain if you believe that the stock will return to it s previous level. Thatís all I will say on that besides that Nio is intrinsically more valuable between September through the end of January than any other time during the year, especially this year versus last year.

There will still be †more big dips, but there isnít a price between now and September that wonít be demolished by the end of January.

RallyDarkstrike - Fan of 2-cyl FIATs, Eastern Bloc & Kei cars

> Wobbles the Mind

RallyDarkstrike - Fan of 2-cyl FIATs, Eastern Bloc & Kei cars

> Wobbles the Mind

07/05/2019 at 07:23 |

|

I wish I knew things about investing and earning money and stuff :/

Wobbles the Mind

> RallyDarkstrike - Fan of 2-cyl FIATs, Eastern Bloc & Kei cars

Wobbles the Mind

> RallyDarkstrike - Fan of 2-cyl FIATs, Eastern Bloc & Kei cars

07/05/2019 at 07:42 |

|

Itís honestly the easiest thing to get into. Now, there is a big difference between investing and trading, and itís the day trading stuff that scares people away, but you donít need that. Investing is all about how much money do you want to make and how soon do you want to make it? If you want to make a 100% profit in 2 minutes, you gamble. If you want to make a 100% profit and have 35 years to wait, you just place your money some where in which it grows at 2% interest annually on average.

Iíll post more on financial stuff and investing if it turns out Oppo is interested. My big thing is that investing makes the financial burdens of car ownership much easier to handle no matter what your regular inc ome is (assuming that you have a strong budget and actually save money towards a goal rather than saving money just to see a big number in your account).

vondon302

> Wobbles the Mind

vondon302

> Wobbles the Mind

07/05/2019 at 07:49 |

|

Well damn Iím tempted.

Good post!

BrianGriffin thinks ďreliableĒ is just a state of mind

> Wobbles the Mind

BrianGriffin thinks ďreliableĒ is just a state of mind

> Wobbles the Mind

07/05/2019 at 08:02 |

|

Thanks for this, I find it fascinating to hear anotherís perspective. Whatís your target for year end 2019 share price?

Wobbles the Mind

> BrianGriffin thinks ďreliableĒ is just a state of mind

Wobbles the Mind

> BrianGriffin thinks ďreliableĒ is just a state of mind

07/05/2019 at 08:17 |

|

Iím terrible with share prices since those are impacted by everyoneís emotions at the time and thatís why we end up oversold or overbought. I can say this though, it makes far more sense for the brand to be valued at over $6 and up today (as in this very minute) than last year.

Otto-the-Croatian-'Whoops my Volvo is a sedan'

> Wobbles the Mind

Otto-the-Croatian-'Whoops my Volvo is a sedan'

> Wobbles the Mind

07/05/2019 at 08:19 |

|

A very interesting thing about China is that it has one of the most consistent monthly car sales structures I have ever seen.

Hereís my p

retty poorly-educated guess here, but this might be due to the chinese government-mandated drivers licenses and car-registration papers. I know that they have different lotteries and other systems of handing out a specific number of registrations each x period of time. I assume this is to keep the traffic at bay and not overpopulate the streets with cars.

So maybe that is one of the reasons for easily predictable sales figures in China?

Wobbles the Mind

> Otto-the-Croatian-'Whoops my Volvo is a sedan'

Wobbles the Mind

> Otto-the-Croatian-'Whoops my Volvo is a sedan'

07/05/2019 at 08:31 |

|

I think so too, which makes things such as the license plate being free a huge advantage during the slower sales months (I know Beijing has times in which the license plate can cost more than the car just to keep people from buying vehicles).

RallyDarkstrike - Fan of 2-cyl FIATs, Eastern Bloc & Kei cars

> Wobbles the Mind

RallyDarkstrike - Fan of 2-cyl FIATs, Eastern Bloc & Kei cars

> Wobbles the Mind

07/05/2019 at 09:21 |

|

I have $8000 saved for importing a

FIAT from Poland when the time comes, otherwise I am saving up for a house!

BahamaTodd

> Wobbles the Mind

BahamaTodd

> Wobbles the Mind

07/05/2019 at 10:31 |

|

Wonder if this reclining front seat with foot rests would even be legal in the US?

Wobbles the Mind

> BahamaTodd

Wobbles the Mind

> BahamaTodd

07/05/2019 at 10:54 |

|

Im glad someone else loves that Queenís Seating. I would be all over a car with this, especially now that independent fan speeds are appearing in more cars.

Nio has a ton of extremely cool (but initally costly) services that they offer. The one that caught my eye the most is the battery swap stations. Not because of charge times since that wont be an asset in the future with battery swapping . No, battery swapping allows them to lease out their batteries. Thatís a business game changer that will always be unique to BEVs , especially with over-the-air software updates.

RallyWrench

> Wobbles the Mind

RallyWrench

> Wobbles the Mind

07/09/2019 at 11:38 |

|

Iíve been thinking about getting my feet wet with them, a buddy of mine is a fabricator for them in the Bay Area and the future sounds positive. Iíve never tried investing on my own, might be worth playing with. I thought the same at the time of Teslaís IPO but didnít act on it , wish Iíd gone with my gut there!

Wobbles the Mind

> RallyWrench

Wobbles the Mind

> RallyWrench

07/09/2019 at 11:56 |

|

I definitely recommend it! I nvesting really is a game changer and it is easier than brushing your teeth . But do it when youíre ready, there are ALWAYS opportunities to make great returns as long as you take your time.

RallyWrench

> Wobbles the Mind

RallyWrench

> Wobbles the Mind

07/09/2019 at 15:08 |

|

What platform(s) would you recommend to start with?†

Wobbles the Mind

> RallyWrench

Wobbles the Mind

> RallyWrench

07/09/2019 at 18:05 |

|

Robinhood is excellent for trading in individual companies. Keep it simple, pick one to three companies that you already know, think are great and are growing in your experience, and that you would enjoy learning more about and following daily or weekly.

daender

> Wobbles the Mind

daender

> Wobbles the Mind

08/06/2019 at 19:39 |

|

Do you think itís worth investing now after about a month since you posted this? Iím thinking about putting in $10,000 and letting it ride and bailing out sometime January or hoping it goes up further by next year.

Wobbles the Mind

> daender

Wobbles the Mind

> daender

08/06/2019 at 22:46 |

|

It depends on your goal. But I do strongly recommend this stock (and I do mean stock, not business) as long as you plan to invest starting tomorrow and not sell until the end of January. If youíre going to get out prior then there are less volatile stocks/trades out there that are far better for risk management. But again, if your plan is to invest $10,000 tomorrow, walk away, and sell around January 31, then youíll very likely see over a 90% return simply due to the business having ever increasing consistency and momentum after mid-September.

If you have a specific goal (let me know the rate of return youíre thinking and the amount of time you want to get to that return) then I can give you a better recommendation. But this is all just speculation on a business and market that Iím knowledgeable about and can be changed by a poorly timed tweet in this current market.

ZHP Sparky, the 5th

> Wobbles the Mind

ZHP Sparky, the 5th

> Wobbles the Mind

08/08/2019 at 15:31 |

|

I already had 2 shares, and after seeing this I looked a bit more and bought another one .

So you know, about to reach billionaire status any day now!

getFuckedHerb

> Wobbles the Mind

getFuckedHerb

> Wobbles the Mind

08/15/2019 at 16:33 |

|

https://finance.yahoo.com/news/nio-stock-seems-only-continued-111040524.html

Should I still buy or? sub $3

†entry seems like a pretty sweet deal if it pops to $7 again.

Wobbles the Mind

> getFuckedHerb

Wobbles the Mind

> getFuckedHerb

08/15/2019 at 17:56 |

|

As long as you will hold until the end of January, then I still strongly recommend Nio stock. The sooner you plan to get out, the less I recommend the stock . I will say that e very month from July through December is an increase in car sales in China regardless of what the market condition is, and Nio is run extremely honestly (to a fault for quick money, but great for long term business health) .

Remember that:

$2.75 to $3.71 is a 35% return,

$2.75 to $5.23 is a 90% return,

$2.75 to $6.88 is a 150% return. †

I donít think any of those are unreasonable by January, and I think that even the midpoint is conservative. But if something changes fundamentally that causes me to change my own position, Iíll write another post.