"MasterMario - Keeper of the V8s" (mastermario)

"MasterMario - Keeper of the V8s" (mastermario)

11/13/2019 at 09:51 • Filed to: stock market

0

0

41

41

"MasterMario - Keeper of the V8s" (mastermario)

"MasterMario - Keeper of the V8s" (mastermario)

11/13/2019 at 09:51 • Filed to: stock market |  0 0

|  41 41 |

For most of this year all the articles about stocks and the market were, “Will the market crash/correct this year or next” and now lately it’s all been “Market good, will continue for forseeable future” with many articles with titles like

!!! UNSUPPORTED LINE BREAK IN HEADER !!!

(I know this is a Yahoo Finance article, but the general theme seems to have permeated the whole financial news industry)

So I can only assume that means it will be crashing/correcting soon since people seem to have short term memories and forgot that before the 2008 crash most people were positive the economy would keep humming along.

Have a Magnum Hellcat for your time (why o why

did you axe the wagon Dodge?)

Mid Engine

> MasterMario - Keeper of the V8s

Mid Engine

> MasterMario - Keeper of the V8s

11/13/2019 at 10:07 |

|

This is where my economics degree comes in handy, I’m stumped as to why people don’t understand we’re already in a “recession”. When the bond curve inverts, people stop buying cars, houses, iPhones, etc.. Anything non-essential is already hurting and that will spread. Good time to short Amazon & Apple stock IMHO. Throw in the upcoming election and the current trade tensions and it’s a perfect storm.

Snuze: Needs another Swede

> Mid Engine

Snuze: Needs another Swede

> Mid Engine

11/13/2019 at 10:13 |

|

I’m not an economist, but I agree, I think we’re already screwed and just haven’t realized it yet. A lot of this nonsense is just market cheer-leading .

ttyymmnn

> Mid Engine

ttyymmnn

> Mid Engine

11/13/2019 at 10:14 |

|

Interesting. I don’t follow it all that closely, but I do tend to read newspapers like the WaPo and NYT. They’ve been predicting Great Depression 2.0 for a long time, but I recently saw a headline that the economy won’t tank, but that’s not necessarily good news. They say that because the headlines have to be negative in the Trump era. That said, I just don’t know now much longer we can go with the president meddling in the economy, with continued tax cuts that are swelling the deficit to Brobdingnagian proportions. It seems to me like the current government is playing a very short game of “let’s just get past 2020.”

MasterMario - Keeper of the V8s

> Mid Engine

MasterMario - Keeper of the V8s

> Mid Engine

11/13/2019 at 10:16 |

|

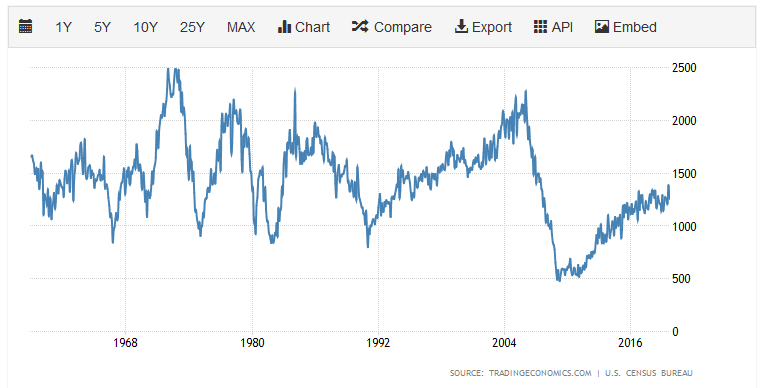

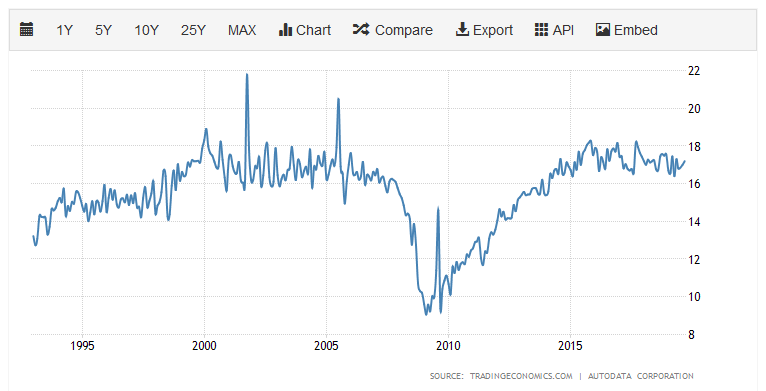

I started selling any economy driven stocks I own already and am only holding on to the stocks that are more resistant to recessions. I don’t think we’ve seen a slow down in the housing market yet, but the new car market does loo k to be slowing down already .

Tekamul

> MasterMario - Keeper of the V8s

Tekamul

> MasterMario - Keeper of the V8s

11/13/2019 at 10:16 |

|

The stock market has become a poor indicator of economic health. Most of the volume is automated, and most of the gains go to a small portion of the participants.

Thomas Donohue

> MasterMario - Keeper of the V8s

Thomas Donohue

> MasterMario - Keeper of the V8s

11/13/2019 at 10:17 |

|

Buy low, sell high.

In the event the market crashes, buy everything you can.

davesaddiction @ opposite-lock.com

> MasterMario - Keeper of the V8s

davesaddiction @ opposite-lock.com

> MasterMario - Keeper of the V8s

11/13/2019 at 10:18 |

|

Bull markets don’t die of old age, but yeah...

MasterMario - Keeper of the V8s

> Tekamul

MasterMario - Keeper of the V8s

> Tekamul

11/13/2019 at 10:18 |

|

I try explaining this to people constantly, but talking markets to the average person causes their eyes to glass over generally.

TorqueToYield

> Mid Engine

TorqueToYield

> Mid Engine

11/13/2019 at 10:19 |

|

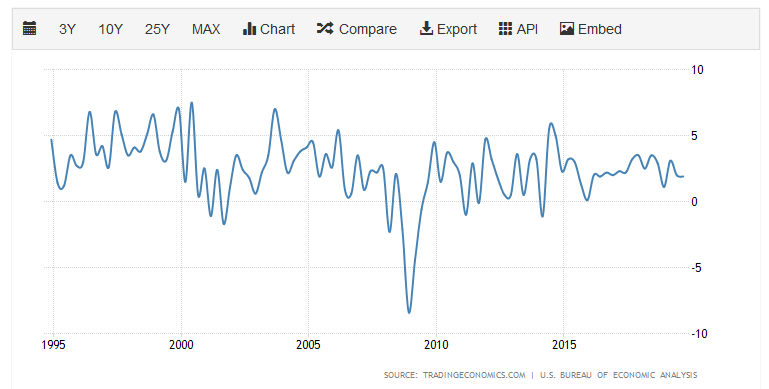

You have an economics degree and don’t think a recession is two consecutive quarters of GDP decline?

https://www.investopedia.com/terms/r/recession.asp

“A recession is a

macroeconomic

term that refers to a significant decline in general economic activity in a designated region. It is typically recognized after two consecutive

quarters

of economic decline, as reflected by

GDP

in conjunction with monthly indicators like employment. Recessions are officially declared in the U.S. by a committee of experts at the National Bureau of Economic Research (NBER), who determines the peak and subsequent trough of the

business cycle

which demonstrates the recession.”

We’re still technically in the longest economic expansion in US history, June 2009 until now.

MasterMario - Keeper of the V8s

> TorqueToYield

MasterMario - Keeper of the V8s

> TorqueToYield

11/13/2019 at 10:21 |

|

I think he means that he believes forces that drive a recession are already in motion and that the impact just hasn’t been felt yet.

MrSnrub

> MasterMario - Keeper of the V8s

MrSnrub

> MasterMario - Keeper of the V8s

11/13/2019 at 10:21 |

|

Stocks appear to have reached a permanently high plateau

davesaddiction @ opposite-lock.com

> Mid Engine

davesaddiction @ opposite-lock.com

> Mid Engine

11/13/2019 at 10:27 |

|

There’s talk that the yield curve isn’t the sign it used to be.

Housing starts may be

flattening, but no real decline yet (been a slow recovery since the Great Recession).

Unemployment looks good. Oil/natural gas/gasoline is cheap.

Globally, it does seem like things are slowing, but the US economy doesn’t really appear to be sharing the pain just yet. We’ll see.

davesaddiction @ opposite-lock.com

> ttyymmnn

davesaddiction @ opposite-lock.com

> ttyymmnn

11/13/2019 at 10:30 |

|

Can you imagine how different the response to the election will be from investors/big businesses

for a Trump reelection (shutters at the thought) or a Bernie/

Warren presidency? What a huge delta of possibly outc

omes.

davesaddiction @ opposite-lock.com

> MasterMario - Keeper of the V8s

davesaddiction @ opposite-lock.com

> MasterMario - Keeper of the V8s

11/13/2019 at 10:32 |

|

New car sales are flattening, but not exactly slowing (same with housing starts).

Future next gen S2000 owner

> MasterMario - Keeper of the V8s

Future next gen S2000 owner

> MasterMario - Keeper of the V8s

11/13/2019 at 10:33 |

|

Past results not indicative of future performance. Everyone seems to forget the regular decade recessions when their 401K goes up. Parties always stop.

Future next gen S2000 owner

> Mid Engine

Future next gen S2000 owner

> Mid Engine

11/13/2019 at 10:35 |

|

I need to learn more about the bond curve inverting. My understanding was that it is no longer inverted. Do average people even know about bond rates or whether they are inverted?

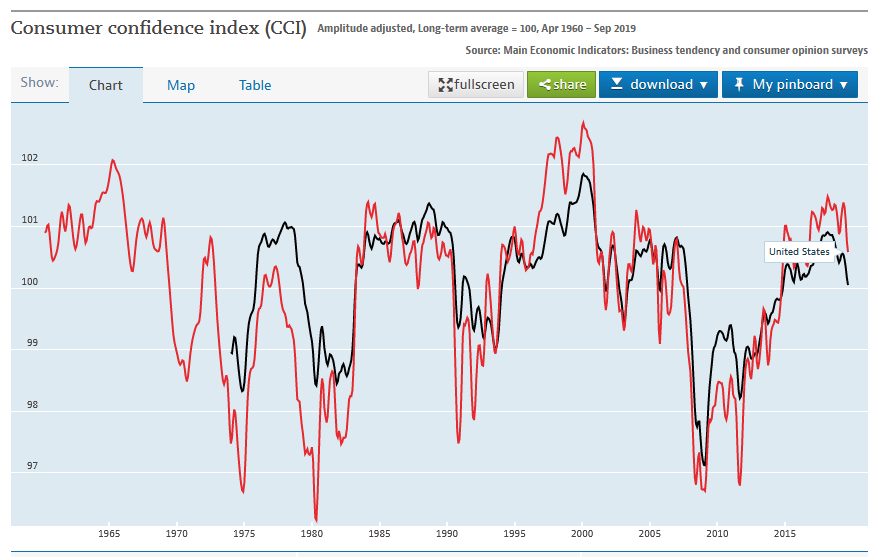

The whole thing seems to be driven by herd mentality rather than data. Everything is great, someone gets spooked, the market shifts, media panics, and it feeds to the average person from there.

davesaddiction @ opposite-lock.com

> Tekamul

davesaddiction @ opposite-lock.com

> Tekamul

11/13/2019 at 10:38 |

|

Unemployment is low, gas is cheap, wage growth is climbing (still too slowly)...

Consumer confidence is still high, but starting to dip.

jimz

> MasterMario - Keeper of the V8s

jimz

> MasterMario - Keeper of the V8s

11/13/2019 at 10:39 |

|

just waiting until the “sharing bubble” pops like the “dot-com bubble” did 20 years ago. Sooner or later the markets are going to realize companies like Uber and Lyft are never going to make money and that party will be over.

M.T. Blake

> MasterMario - Keeper of the V8s

M.T. Blake

> MasterMario - Keeper of the V8s

11/13/2019 at 10:43 |

|

I’m considering putting money into gold.

Granted you can’t swim though two electronically owned ounces of gold. I’ll never be Scrooge McDuck at that rate...

M.T. Blake

> Mid Engine

M.T. Blake

> Mid Engine

11/13/2019 at 10:44 |

|

Wise words sir.

Ash78, voting early and often

> MasterMario - Keeper of the V8s

Ash78, voting early and often

> MasterMario - Keeper of the V8s

11/13/2019 at 10:49 |

|

I’ve trimmed back from 10% cash to 30% cash over the past few years in preparation. I’m still hanging onto my perennial leaders, NFLX and AMZN, but 80% of my investments are in index funds or mutual funds. I also like TJX stores as a recession fighter...the tougher things get, the more people flock to discounts.

I know I’ve missed out on a lot of gains by being conservative, but I have a lot more at stake than in 2008-09 when I did this before :)

The most confusing thing is the business and finance world are freaking out, but consumers are humming along and propping it all up. Mixed signals.

Tekamul

> davesaddiction @ opposite-lock.com

Tekamul

> davesaddiction @ opposite-lock.com

11/13/2019 at 10:51 |

|

Y eah, but personal debt is climbing and the deficit is unbelievably high. As soon as we decide someone should pay a bill or two, instead of continually kicking the can down the road, negative growth will be strong and prolonged.

Mid Engine

> TorqueToYield

Mid Engine

> TorqueToYield

11/13/2019 at 10:59 |

|

Please.. I’m very aware of what constitutes a recession. Consumer spending and associated record high levels of debt have propped up the economy for some time now. Millenials can’t save the day as they’re dealing with st udent debt and stagnant wages, and as the boomers age out there’s not much left to shore up the consumer frenzy. I used “recession” as a pointer to the obvious fact that large ticket purchases are already in decline and the rest of the economy is sure to follow.

E92M3

> MasterMario - Keeper of the V8s

E92M3

> MasterMario - Keeper of the V8s

11/13/2019 at 10:59 |

|

The Fed can’t lower inerest rates anymore to delay the inevitable. However, until unemployment goes up, so much money will continue to be f unneled into the stock market automatically each pay period via 401k’s. Volume (de mand) has to go down for stock prices to fall. It’s probably going to take sizeable layoffs or an unforeseen event to trigger a massive selloff. Save your money, and be ready to double down on the dip.

Mid Engine

> Future next gen S2000 owner

Mid Engine

> Future next gen S2000 owner

11/13/2019 at 11:01 |

|

And that’s what’s been driving the stock market for quite some time, it’s not reason or logic. To a large degree it’s a fear of missing out, sounds like the last b ull market before the housing crisis destroyed wealth and people got crushed.

davesaddiction @ opposite-lock.com

> Tekamul

davesaddiction @ opposite-lock.com

> Tekamul

11/13/2019 at 11:02 |

|

Personal debt climbing

- folks just can’t learn their damn lesson, and lenders make it too easy... The D proposal to incentivize people with old cars to buy a new $40k electric car really pissed me off.

Are you all really that stupid?!

The deficit and national debt make me sick. Trump’s clearly no conservative...

Mid Engine

> davesaddiction @ opposite-lock.com

Mid Engine

> davesaddiction @ opposite-lock.com

11/13/2019 at 11:02 |

|

Agree with you sir, the housing problem is largely due to zoning restrictions and builders who favor McMansions because profit. The housing market needs starter homes, and lots of ‘em.

davesaddiction @ opposite-lock.com

> Mid Engine

davesaddiction @ opposite-lock.com

> Mid Engine

11/13/2019 at 11:08 |

|

At least in some places.

Just before the bottom dropped out in 2008, a developer had started a big neighborhood just north of ours (we’ve moved since)

. Homes were to start in the $350s (very nice for our area). Everything was done, ready, and they were ready to take deposits and get started. Then it all went south. It sat like it was for a couple years, then they sold it to another developer, who proceeded to build housed starting at half the cost. Who knows how much of a bath the original investor took.

nermal

> E92M3

nermal

> E92M3

11/13/2019 at 11:09 |

|

The Fed rate still has 2% that it can drop - ‘member it was @ 0% for the 8 years pre-Trump.

Agree with your other points though. Buy the dips!

Mid Engine

> davesaddiction @ opposite-lock.com

Mid Engine

> davesaddiction @ opposite-lock.com

11/13/2019 at 11:10 |

|

My company is the number one supplier of semiconductors to the automotive market, our sales are down 8% year on year. This really shouldn’t occur as the overall spend on electronics for automotive is exploding, there’s more content than ever. But here we are.

davesaddiction @ opposite-lock.com

> Mid Engine

davesaddiction @ opposite-lock.com

> Mid Engine

11/13/2019 at 11:12 |

|

That’s

interesting. What were sales 2017 vs 2018?

nermal

> MasterMario - Keeper of the V8s

nermal

> MasterMario - Keeper of the V8s

11/13/2019 at 11:15 |

|

I think that there will be politically driven instability next year. The market will drop sharply if Bernie or Warren gets the D nomination. It will also drop on new polls coming out showing Trump behind in the election. Post election, it will crash hard if the D wins (especially if it’s Bernie or Warren) , and surge if Trump wins while behind in polls (just like last time).

That said, people have jobs and access to credit. They will continue buying stuff. Also, the market is currently suppressed due to the trade war with China. If an agreement is reached there, it will surge forward.

Buy the dips!

Mid Engine

> davesaddiction @ opposite-lock.com

Mid Engine

> davesaddiction @ opposite-lock.com

11/13/2019 at 11:24 |

|

Up roughly 6% year on year

Azrek

> M.T. Blake

Azrek

> M.T. Blake

11/13/2019 at 11:41 |

|

As the Oppo resident coin collector. I recommend Chinese panda Silver coins. For some reason they go up in value more than other coins.

Or if you want check out the South African Rands or British Soverigns. These are smaller style gold coins with a mix of other materials. Essentially with a gold coin, they are worth the amount. So for example $1400. If you want a cup of coffee and you only have a gold coin you are gonna have ALOT of crappy change. Rands/Soverigns are fractical and can be spent easier.

Cheers!

gmporschenut also a fan of hondas

> MasterMario - Keeper of the V8s

gmporschenut also a fan of hondas

> MasterMario - Keeper of the V8s

11/13/2019 at 11:51 |

|

Part of the reason is worldwide gdp growth has Been declining for the last few years. A few European nations are on the edge of a recession. Concern of what the UK does with Brexit doesn’t help, with everyone agreeing that a no deal would have sent them into a recession. And unease/threats over trumps trade tariffs haven’t helped ease fears. There is also a disproportionate amount of the gain buy a few dozen stocks.(see Boeing) The stock market has been buoyed by tax cuts and low interest rates. With deficits increasing and low interest rates there are fewer options for governments to tur n to the event of a downturn.

So things are ok for the time being but there are warnings that shouldn’t be ignoree

davesaddiction @ opposite-lock.com

> TorqueToYield

davesaddiction @ opposite-lock.com

> TorqueToYield

11/13/2019 at 11:53 |

|

Yeah, slow growth is still growth. We’ll see what the 4th quarter numbers show.

davesaddiction @ opposite-lock.com

> E92M3

davesaddiction @ opposite-lock.com

> E92M3

11/13/2019 at 11:57 |

|

Maybe keep investing and hold back a quarter or half to be ready to buy low?

Would

a Warren presidency be

an “unfore

seen event”? Yet to be seen...

Everyone says trying to time the market is a fool’s errand.

davesaddiction @ opposite-lock.com

> nermal

davesaddiction @ opposite-lock.com

> nermal

11/13/2019 at 11:58 |

|

Watch out for that first dip, though...

M.T. Blake

> Azrek

M.T. Blake

> Azrek

11/13/2019 at 12:09 |

|

Thanks for the advice!

Azrek

> TorqueToYield

Azrek

> TorqueToYield

11/13/2019 at 12:21 |

|

In my office we have a Lawyer. In meetings he will come in last. He is a big dude and sit down with a giant coffee cup that says, “Don’t mistake your Google search for my Law Degree.” Just to set the tone.

I very much feel the same way with many other things when it comes to education vs Google Search ‘experts.’

Not to be negative, but I tend to follow folks who are in the ‘

Arena’

with experience vs a Googe Search!

Cheers!

My bird IS the word

> MasterMario - Keeper of the V8s

My bird IS the word

> MasterMario - Keeper of the V8s

11/13/2019 at 12:53 |

|

Something something buiseness cycle.

Stock market booms should scare you.