"Dr. Zoidberg - RIP Oppo" (thetomselleck)

"Dr. Zoidberg - RIP Oppo" (thetomselleck)

10/31/2019 at 10:00 ē Filed to: But it's my money and I want it now

0

0

41

41

"Dr. Zoidberg - RIP Oppo" (thetomselleck)

"Dr. Zoidberg - RIP Oppo" (thetomselleck)

10/31/2019 at 10:00 ē Filed to: But it's my money and I want it now |  0 0

|  41 41 |

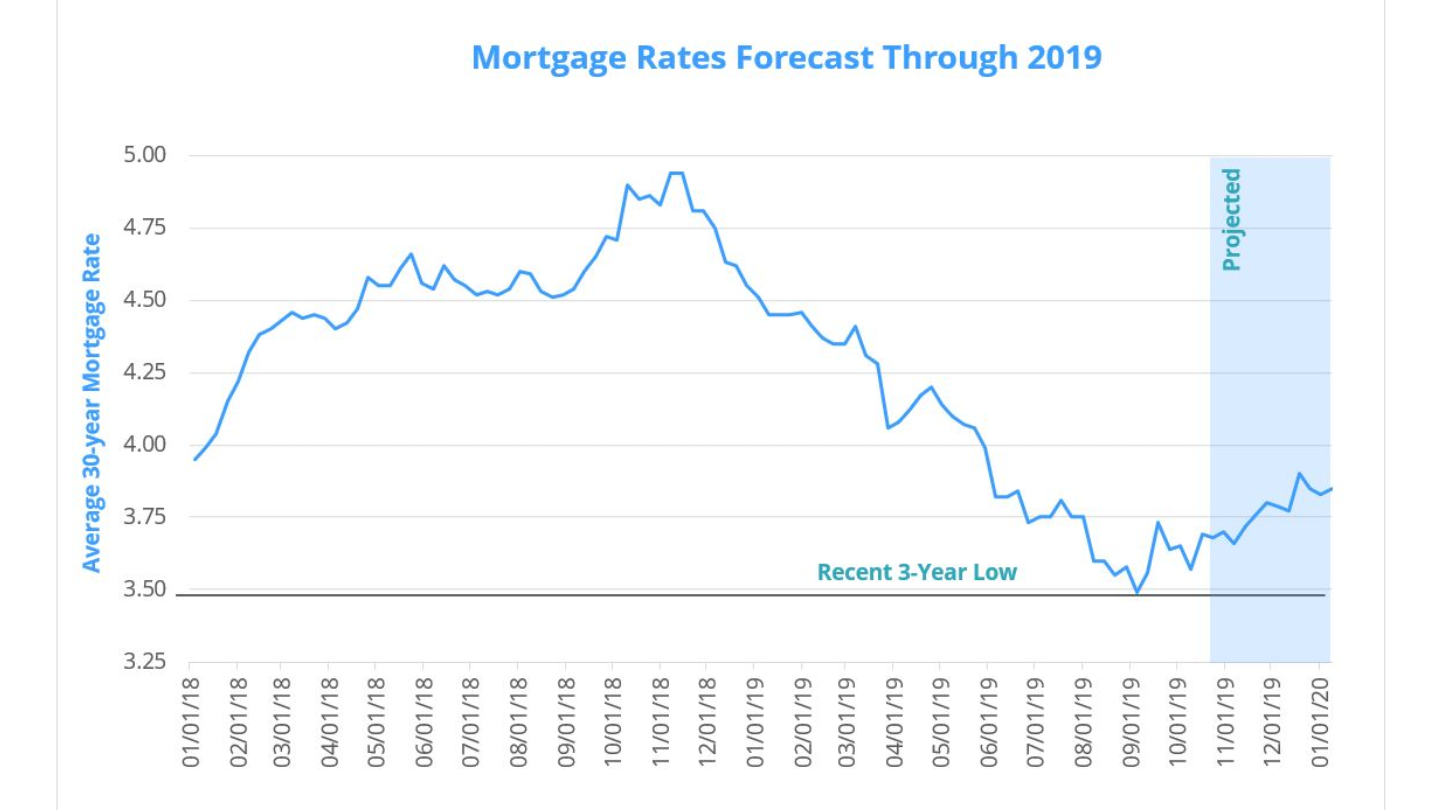

After reaching historic lows, they seem to be ď recovering. Ē Recovering is an interesting word used for this, because if youíre trying to buy a home right now, or refinance, or whatever else, it is not particularly welcome news on the individual level.

In September with murmurs of the DOOMED economy, there was talk that they would tank by the end of the year. Now 60 days later , some believe it will continue to rise through the end of the year!

Your economy , ladies and germs.

mazda616

> Dr. Zoidberg - RIP Oppo

mazda616

> Dr. Zoidberg - RIP Oppo

10/31/2019 at 10:01 |

|

My wife is a loan officer at a local bank, so she keeps up with this stuff. It all goes way, way over my head, though.

fintail

> Dr. Zoidberg - RIP Oppo

fintail

> Dr. Zoidberg - RIP Oppo

10/31/2019 at 10:03 |

|

Continued threats of increases are a good way to make people say OMGZ!!!! BU Y NOW!!!1!!!! Then the increases donít really materialize, but no body care s, keeps the housing-dependent economy alive and the brave FIRE sector warriors rolling in dough . I am sure it will end well.

This is what we'll show whenever you publish anything on Kinja:

> Dr. Zoidberg - RIP Oppo

This is what we'll show whenever you publish anything on Kinja:

> Dr. Zoidberg - RIP Oppo

10/31/2019 at 10:04 |

|

someassemblyrequired

> Dr. Zoidberg - RIP Oppo

someassemblyrequired

> Dr. Zoidberg - RIP Oppo

10/31/2019 at 10:05 |

|

youíll see 30 years touch the 2's, especially if the economy keeps stuttering. Fed did a quarter

-point cut yesterday.

BrianGriffin thinks ďreliableĒ is just a state of mind

> Dr. Zoidberg - RIP Oppo

BrianGriffin thinks ďreliableĒ is just a state of mind

> Dr. Zoidberg - RIP Oppo

10/31/2019 at 10:07 |

|

A lot of it has to do with the end of government regulation on Fannie Mae et al. †I was going to refinance (I bought at the end of 18 when they were at their peak) from 5%, but without at least a 1.3% decline from that rate, itís not worth the closing costs. Mortgage rates didnít dip enough to make me jump on it.†

Discerning

> Dr. Zoidberg - RIP Oppo

Discerning

> Dr. Zoidberg - RIP Oppo

10/31/2019 at 10:14 |

|

Glad I got mine at a low rate!

I learned two things f rom my recent experience. Find someone local who you can trust and who is on your side. My lender helped me to get a lower rate than what is a published and there was no by down fee. Second: donít bother with quicken or rocket. Their rates are junk and their sales people are aggressive and rude.

I also learned from them that a lot of people are refinancing right now and some lenders are actually increasing their refinancing rates strictly because they can as a result of the higher demand. They also said the wait period It is somewhat significant.

We put very little down because we wanted to have a large cushion and we want to invest more in the house. We have a PMI as a result but the effective rate is still very low and we are hoping we can reassess the house after our Renovations and have the PMI removed in a year.

CarsofFortLangley - Oppo Forever

> Dr. Zoidberg - RIP Oppo

CarsofFortLangley - Oppo Forever

> Dr. Zoidberg - RIP Oppo

10/31/2019 at 10:14 |

|

Good thing I renewed literally yesterday for 2.49%

Arrivederci

> BrianGriffin thinks ďreliableĒ is just a state of mind

Arrivederci

> BrianGriffin thinks ďreliableĒ is just a state of mind

10/31/2019 at 10:23 |

|

Yep - we bought at 4.125% in earlier 2018 - even at their lowest it wasnít enough of a carrot to refi.

Ash78, voting early and often

> Dr. Zoidberg - RIP Oppo

Ash78, voting early and often

> Dr. Zoidberg - RIP Oppo

10/31/2019 at 10:23 |

|

Still insanely low by historical standards. I remember getting our first mortgage in 2004 for just under 6%, and everyone was freaking out because mortgage rates hit 6%! Hurry and get your loans!

Hereís roughly 15 years:

Arrivederci

> someassemblyrequired

Arrivederci

> someassemblyrequired

10/31/2019 at 10:24 |

|

Mortgage rates generally donít follow the Fed funds overnight.

Arrivederci

> Ash78, voting early and often

Arrivederci

> Ash78, voting early and often

10/31/2019 at 10:28 |

|

Our parents all got loans for double-digits back in the 80s!

BKosher84

> Dr. Zoidberg - RIP Oppo

BKosher84

> Dr. Zoidberg - RIP Oppo

10/31/2019 at 10:28 |

|

But I was told by a fat orange man in Washington DC that the economy was doing great!

SBA Thanks You For All The Fish

> BKosher84

SBA Thanks You For All The Fish

> BKosher84

10/31/2019 at 10:33 |

|

Why do you think thereís a correlation>?

Unemployment is at historic low levels.† We just have too much capital parked in less than optimal return situations....† If the market tops, you see new floods of money into the debt markets, keeping interest rates low for many years to come.

davesaddiction @ opposite-lock.com

> Dr. Zoidberg - RIP Oppo

davesaddiction @ opposite-lock.com

> Dr. Zoidberg - RIP Oppo

10/31/2019 at 10:35 |

|

As they say, bull markets donít die of old age...

Really, really weird time right now. Internationally, everything seems to be pointing to recession, but indicators here in the States still seem pretty strong. Oil and natural gas and cheap and plentiful, and look like theyíll stay that way for the foreseeable

future.

davesaddiction @ opposite-lock.com

> Ash78, voting early and often

davesaddiction @ opposite-lock.com

> Ash78, voting early and often

10/31/2019 at 10:38 |

|

Yup. My mortgages/refis, starting in 2003,

have been 6.5, 4.75, 3.75, & 3.125.

Weíve been terribly fortunate!

fintail

> Arrivederci

fintail

> Arrivederci

10/31/2019 at 10:39 |

|

Closer to 20% in late 1981, although that didnít last long.

However, if counting local prices anyway, I would gladly pay 1980s interest rates if I could have 1980s housing costs, relative to incomes.

davesaddiction @ opposite-lock.com

> CarsofFortLangley - Oppo Forever

davesaddiction @ opposite-lock.com

> CarsofFortLangley - Oppo Forever

10/31/2019 at 10:39 |

|

WOW. Well done.

Highlander-Datsuns are Forever

> Discerning

Highlander-Datsuns are Forever

> Discerning

10/31/2019 at 10:49 |

|

It took me 5 years to get my pmi removed, itís a process but worth it.†

Arrivederci

> fintail

Arrivederci

> fintail

10/31/2019 at 10:51 |

|

Yep, that could never fly today with our housing costs and relative incomes, but man, 20% over 30 years is just painful.

lone_liberal

> Dr. Zoidberg - RIP Oppo

lone_liberal

> Dr. Zoidberg - RIP Oppo

10/31/2019 at 10:52 |

|

Weíre in the middle of a refinance that will take us to 3.5 from our previous 4.5. Itís kind of mind blowing since I remember my parents having double digit mortgage rates back in the 70s.

someassemblyrequired

> Arrivederci

someassemblyrequired

> Arrivederci

10/31/2019 at 10:53 |

|

This is true, but the RE market is cooling and refi activity is slowing (since pretty much everyone already has)

. Given the extremely low fed rates mo

ney looking for a home (pun intended) will keep downward

pressure on rates - especially if the stock market starts to drop and capital starts to pull back from equities

.

fintail

> Arrivederci

fintail

> Arrivederci

10/31/2019 at 10:56 |

|

I expect everyone refinanced asap when markets regained sanity.

Houses here that were 100K in 1981 can easily be 1.5MM+ now, nothing kept up with that.

Gone

> Dr. Zoidberg - RIP Oppo

Gone

> Dr. Zoidberg - RIP Oppo

10/31/2019 at 10:58 |

|

Closed on our refi recently (almost no down , moved from 30 to 15yr and noticeably dropped our rate ). The new t ax bill jacked our taxes (loss of deductions from mortgage interest and prop taxes gave us a hit ). With the closing costs rolled in weíll still be ahead in under 8 months. We have a 10% higher payment but the principal payment more than d oub led and the interest payment was lowered a fair amount .

CarsofFortLangley - Oppo Forever

> davesaddiction @ opposite-lock.com

CarsofFortLangley - Oppo Forever

> davesaddiction @ opposite-lock.com

10/31/2019 at 11:06 |

|

Ha! Thanks, really lucked out on it. We have a great lender. They gave me (reluctantly ) a mortgage 5 years ago when nobody else would.† Since then, things have gone super well and they renewed me without any questions this time.

Discerning

> Highlander-Datsuns are Forever

Discerning

> Highlander-Datsuns are Forever

10/31/2019 at 11:13 |

|

Ií m hopeful that, with the market increasing and the renovations we have planned, that we will be able to get a new assessment in 1 to 2 years that allows us to remove it.

Ií ve run the numbers and itís possible. Only time will tell though.

Even if the PMI goes through itís full course, our rate is really good. So Iím not too worried about it.

Regardless, our cushion is in a high yield index fund that should outweigh the effect (vs. If we had put it into the down payment).

Highlander-Datsuns are Forever

> Discerning

Highlander-Datsuns are Forever

> Discerning

10/31/2019 at 11:14 |

|

I had to pay for an appraisal so it did cost me $500, the rest was painless.

GoodIdeaAtTheTime

> Arrivederci

GoodIdeaAtTheTime

> Arrivederci

10/31/2019 at 11:16 |

|

I got mine down to 3.9%, with no money down . Even the mortgage lender was surprised at that. The regular going rate around here has hovering near 5% with 15% down.†

Discerning

> Highlander-Datsuns are Forever

Discerning

> Highlander-Datsuns are Forever

10/31/2019 at 11:37 |

|

Yeah, I probably will have to also

Mid Engine

> Dr. Zoidberg - RIP Oppo

Mid Engine

> Dr. Zoidberg - RIP Oppo

10/31/2019 at 11:39 |

|

My mortgage on my Bothell house is hard to give up: when I bought 4.5 years ago I put 20% down and took out a 15 year mortgage @ 3.125% fixed. Since then 2/3 of my payments have gone towards principal, the only real downside throughout this short time was the insane increase in property taxes.

I sold the house and itís due to close on December 6th, going forward on my new 7 acre property

weíre kinda stuck with a 4.5% variable (7 years) on a $220k mortgage

(and yes, I considered re-fi but the costs outweigh the benefits).

†

Since I made bank on the Bothell house I could retire my mortgage on the property in Gold Bar , but weíve opted not to pay off the mortg age on my new property. Iím using the proceeds to build a shop and house, Iíll use my ďnormalĒ monthly payment to eventually retire my mortgage. Also, once the house is built Iíll convert my cottage to an Air BnB. Doing it this way means within 5 years Iíll have no monthly payments and the Air BnB will pay for tax es and utilities. Within a reasonably short time Iíll be debt free and making enough passive cash to pay for my living expenses.

As for the market, who the fuck knows what to expect. I have a degree in economics but no one has ever had to factor in the likelihood of someone like Trump. Heís absolutely fucked the market over, one tweet at a time.

Mid Engine

> CarsofFortLangley - Oppo Forever

Mid Engine

> CarsofFortLangley - Oppo Forever

10/31/2019 at 11:43 |

|

My daughter got a similar rate (Montreal) , hers is locked in for four years. How long until youíre back at the table with the bank?

For the American audience you canít lock in a 30 year rate in Canada, the duration is 7 years max, the sweet spot for rat es is in the 3-4 year window. So, youíre back to renewing and itís a crap shoot what rates will be when the time comes. Glad to see you did well COFL!

CarsofFortLangley - Oppo Forever

> Mid Engine

CarsofFortLangley - Oppo Forever

> Mid Engine

10/31/2019 at 11:45 |

|

Five year closed term!

Mid Engine

> BKosher84

Mid Engine

> BKosher84

10/31/2019 at 12:11 |

|

The stable genius pushed us into a recession. The yield curv e on bonds have inverted, meaning you make more money on a short term bond/CD than on a longer note. No one is buying houses, cars, or iPhones.. it doesnít take long for the rest of the economy to follow suit. If youíre long on Amazon sell now, it ainít gonna be pretty when the consumers stop propping up the economy.

Arrivederci

> someassemblyrequired

Arrivederci

> someassemblyrequired

10/31/2019 at 12:57 |

|

Maybe.† Honestly, it might be a pretty sick time to refi to an ARM if you are willing to bet rates stay low.

someassemblyrequired

> Arrivederci

someassemblyrequired

> Arrivederci

10/31/2019 at 13:09 |

|

Possibly, if you have a short term left on the mortgage

. But 30yrs at 3.75% is cheeeeeeep money for not much more than an ARM and you avoid all the interest rate risk.

Arrivederci

> someassemblyrequired

Arrivederci

> someassemblyrequired

10/31/2019 at 13:28 |

|

Or if you just know youíll eventually move. My FIL did that with their place in Boston, got a crazy low rate for a jumbo on a 5/1 (IIRC) ARM, then they decided they wanted to stay in Boston longer, so he refiíd that into a 7/1 ARM on an even lower rate.

If you have no designs on relocating, cheap money over 30 years is definitely the move.

WiscoProud

> Ash78, voting early and often

WiscoProud

> Ash78, voting early and often

10/31/2019 at 14:36 |

|

Thats the problem with showing super short timelines on charts like that, its hard to see what it actually means.†

BaconSandwich is tasty.

> davesaddiction @ opposite-lock.com

BaconSandwich is tasty.

> davesaddiction @ opposite-lock.com

10/31/2019 at 14:58 |

|

Think oil and gas prices would jump if there was a production cut in the middle East, for whatever reason?

davesaddiction @ opposite-lock.com

> BaconSandwich is tasty.

davesaddiction @ opposite-lock.com

> BaconSandwich is tasty.

10/31/2019 at 15:12 |

|

Seems u

nlikely. OPECís power over the market is nothing like it used to be.

After the Iranian drone strikes on the Saudis, there was a quick spike, and then it got right back in line. Domestic r

ig count is down, pretty

hard to make money in current price environment, but if supply start decreasing and

price goes up 10 bucks, operators will come back in and weíll quickly

be back in an oversupply situation.

This is Brent crude

, not WTI, showing the drone strike

:

BigBlock440

> Mid Engine

BigBlock440

> Mid Engine

10/31/2019 at 15:44 |

|

No one is buying houses, c ars, or iPhones.

Thatís a lot of people named ďNo oneĒ I guess, 23 million no ones.

RPM esq.

> Dr. Zoidberg - RIP Oppo

RPM esq.

> Dr. Zoidberg - RIP Oppo

10/31/2019 at 15:47 |

|

I refinanced in September...had to pay some closing costs and didnít lower the rate a ton but the math still works in the longer term. If this comes true Iíll be glad I did.

Mid Engine

> BigBlock440

Mid Engine

> BigBlock440

10/31/2019 at 16:25 |

|

The stats donít lie, business is down considerably across the board. My company is the #1 supplier of semiconductors to the auto industry and also very strong in mobile phones. I know whatís going on, to put it mildly. Houses arenít selling either, itís widely documented. The fact that the inverted curve happened months ago is not an arguable point either.† †