"AestheticsInMotion" (aestheticsinmotion)

"AestheticsInMotion" (aestheticsinmotion)

01/05/2019 at 15:28 ē Filed to: None

1

1

21

21

"AestheticsInMotion" (aestheticsinmotion)

"AestheticsInMotion" (aestheticsinmotion)

01/05/2019 at 15:28 ē Filed to: None |  1 1

|  21 21 |

Inspired by Wobbles. I decided to try out a high-yield online savings account. 2.45% interest with zero fees and minimal hoops to jump through. A f ew other changes as well. Any pros want to double-check my thought process to make sure Iím doing things correctly?

Previously I had three accounts, all through my local credit union.

A) checking account with 4.00% interest up to $500 and then .05% interest past $500.

B) savings account with 6.00% interest up to $500 and then 0.10% interest past $500.

C) second savings account 0.10% interest.

The way I used them was to put all deposits into checking, all expenditure was put on whatever credit cards would earn me the best rewards for any given purchase, and Iíd use the checking account to pay off the credit cards in full before the end of the billing cycle. Saving accounts werenít used at all.

Now Iíve greatly enjoyed learning how to maximize credit card rewards this past year, and I figured it was about time to do the same with my liquid assets as well. Seems like Iíve been leaving a good amount of money on the table.

So... I opened an online-only high-yield saving account with CIT Bank, which is offering 2.45% interest if you either have >$25,000 in the account (lol, someday) or... If you deposit at least $100 a month. IfIyou donít meet either of those requirements, the interest rate drops down to 1.04% or something, but depositing $100+ a month shouldnít be a problem so I can effectively count on the higher rate.

So my current accounts are as follows:

1) Credit union checking account with 4.00% interest up to $500 and then 0.05% interest past that.

2) Credit union saving account with 6.00% interest up to $500 and then 0.10% interest past that.

3) CIT Savings Builder account with flat 2.45% interest assuming I deposit a minimum of $100 per month.

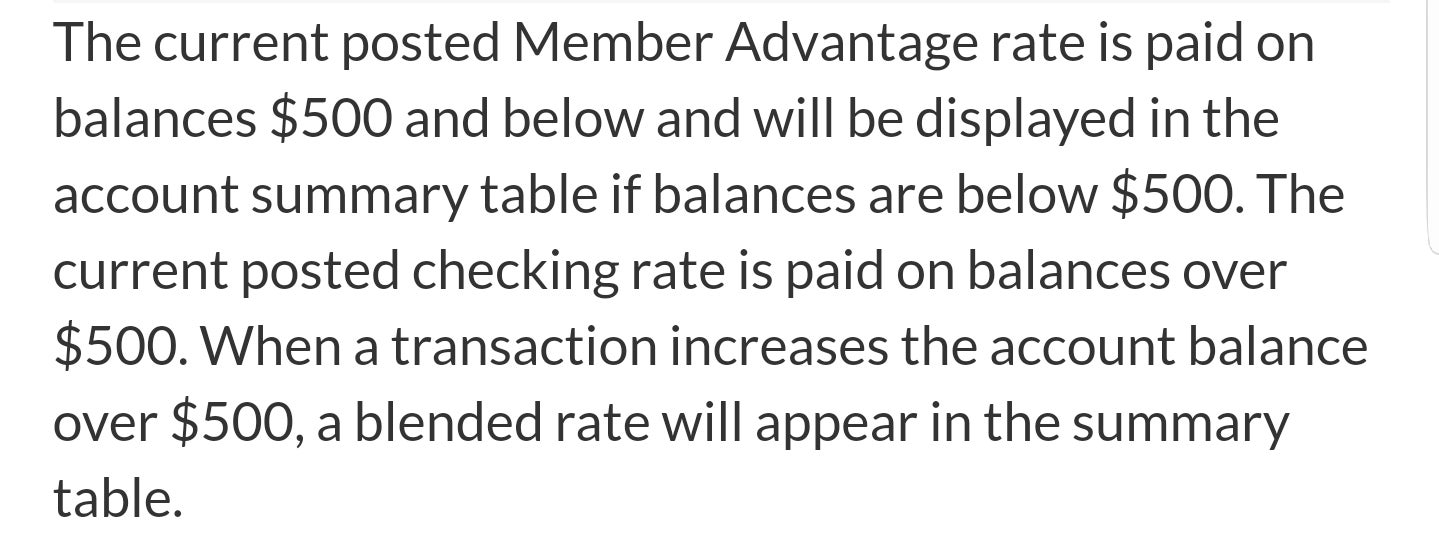

What Iím trying to figure out now is what the best way to divide my money is. One thing Iím not positive about is how the interest rate works when I pass the $500 threshold on the credit union accounts. Do I get the high rate on the first $500 and the low rate on anything past that, or is it that once Iím past $500 in the account I get the low rate for the entirety of the account? The snippet below makes me think I get the good rate on the first $500 every month, even if the total balance goes above that.

More importantly... Does it even matter?

Tell me if this makes sense. Iím thinking I keep $464.00 in the credit union saving account and $480.00 in the credit union checking account each month, and combined earn $56.00 in interest each month, bringing the total balance of each account to $500.00. As soon as I hit the $500 mark, I transfer the total interest earned into the CIT account as it has the highest interest rate for balances over $500. And I just repeat this every month. I can set up some automatic transfers so itís all automated.

Am I missing something, or does that seem like the way to go?

Honeybunchesofgoats

> AestheticsInMotion

Honeybunchesofgoats

> AestheticsInMotion

01/05/2019 at 15:34 |

|

Iíd personally feel uncomfortable only having immediate access too $1000 from the physical bank accounts. Iím not familiar with the online savings account youíre using, but from what little I know, there are usually limits on how often you can withdraw cash.

Bas for the first question, itís definitely the higher rate on the first $500 and the lower on anything extra.

Wrong Wheel Drive (41%)

> AestheticsInMotion

Wrong Wheel Drive (41%)

> AestheticsInMotion

01/05/2019 at 15:43 |

|

Iíve been using Barclayís for my savings for a few years now. Itís up to 2.2% with no minimums or requirements to earn that. Only restriction is that there is a $1000 per month maximum deposit, but itís not like I ever hit that haha. It has worked out pretty great except I need to stop spending it. Buying a Miata on Monday hopefully will be the last time I withdraw from that account for a while. Paying off the Subaru loan in November and then being done with student loans for good a year after that. Then I can start real life and actually build a savings account that only goes up!

Dr. Zoidberg - RIP Oppo

> AestheticsInMotion

Dr. Zoidberg - RIP Oppo

> AestheticsInMotion

01/05/2019 at 15:44 |

|

I have a money management account with BECU, which I think is 2.45% with no limit. I put all of my paychecks in there. I also have a check book for that account, which I use to pay my fatter bills with (yes, I still write checks). My wifeís paychecks go to our checking account, which we have use for our infrequent debit card purchases. I say k eep as much as you comfortably can in the high interest no limit account.

I find the transferring thing could be a little convoluted, because places like BECU allow for only a few account transfers per month. So imagine you have a rough month where you need to shuffle around money , but you canít because you used one transfer on a whole 56 bucks. But if donít have a transfer limit or penalty, go for it.

Maybe also consider †a credit account that offers 1-2% on purchases?

AestheticsInMotion

> Wrong Wheel Drive (41%)

AestheticsInMotion

> Wrong Wheel Drive (41%)

01/05/2019 at 15:44 |

|

Oh man, just reading that got me pumped! I feel like a traitor to the me of a few years ago by getting excited by the idea of saving up and managing money, but.... It is what it is!†

Soooooo did you pick a Miata??

Wrong Wheel Drive (41%)

> Honeybunchesofgoats

Wrong Wheel Drive (41%)

> Honeybunchesofgoats

01/05/2019 at 15:48 |

|

I donít even have a physical checking account anymore. Iím online only entirely. I have a credit union account with local- ish branches but I donít keep any money on hand in it since it doesnít accrue interest. I've just relied on what I can get from an ATM. I can call my bank (Schwab) and get a cash advance at any bank for free though. So if I really needed to get a few grand in cash, it's some hoops but it's not bad. I've only had to do that a couple times in the last 5 years though.†

AestheticsInMotion

> Dr. Zoidberg - RIP Oppo

AestheticsInMotion

> Dr. Zoidberg - RIP Oppo

01/05/2019 at 15:54 |

|

Hmm, whatís a money management account? Iím seeing BECU Money Market accounts but definitely nothing close to 2.45%.

Iíve got a credit account with BECU, but I think it may be the non-bonus one. Even if I did get the other one, I think I can do better than 1-2% with my current cards. And good god, o f all the places, BECU is the one Iím most scared to get an application t urned down and have an extra hard credit pull for no reason.†

Wrong Wheel Drive (41%)

> AestheticsInMotion

Wrong Wheel Drive (41%)

> AestheticsInMotion

01/05/2019 at 16:00 |

|

The Nebraska Miata is being inspected today with a super thorough inspection. If that comes back to suggest that itís a good purchase (will have a 40 page report after a 2 hour inspection) then Iím gonna buy it. I couldnít find anything wrong with it other than the branded title. Repairs seemed top notch to me. But Iíll hold my breath until I find out tonight. If all goes well, Iím renting a car one way to drive out there Monday morning to complete the purchase. And taking the rest of the day off to hopefully go for a drive.

Supreme Chancellor and Glorious Leader SaveTheIntegras

> AestheticsInMotion

Supreme Chancellor and Glorious Leader SaveTheIntegras

> AestheticsInMotion

01/05/2019 at 16:03 |

|

I have an Amex savings, think its exactly a 2.07% interest rate at the moment. Been pretty nice so far with no issues or problems.†

E92M3

> AestheticsInMotion

E92M3

> AestheticsInMotion

01/05/2019 at 16:12 |

|

Youíre not earning $50 in interest per month with the checking and savings (keeping just $500 a mo nt h in them each ) . Thatís $50 for a WHOLE year. Is it really worth a $1.66 per month to even keep †the savings account?

TheRealBicycleBuck

> AestheticsInMotion

TheRealBicycleBuck

> AestheticsInMotion

01/05/2019 at 16:14 |

|

You have a slight error in your thinking. Itís not 4% per month, itís 4% per year, a †rate of about 0.33% per month. You wonít be earning $56 per month. On $1,000, youíll be picking up around $3.33 per month.

Dr. Zoidberg - RIP Oppo

> AestheticsInMotion

Dr. Zoidberg - RIP Oppo

> AestheticsInMotion

01/05/2019 at 16:15 |

|

I'll do some more digging later and reply. I admit that my latest focus has been savings and my IRA, details are slipping my mind.

AestheticsInMotion

> E92M3

AestheticsInMotion

> E92M3

01/05/2019 at 16:20 |

|

Hmm. I knew posting here would be a good idea. The account doesn't cost me anything.... But you're right, probably not worth dealing with it. Sigh

AestheticsInMotion

> TheRealBicycleBuck

AestheticsInMotion

> TheRealBicycleBuck

01/05/2019 at 16:21 |

|

And this is why I Oppo. Rats.

So does the interest still pay out monthly?†

His Stigness

> Dr. Zoidberg - RIP Oppo

His Stigness

> Dr. Zoidberg - RIP Oppo

01/05/2019 at 16:34 |

|

I may be wrong, but I am almost positive the 6 transfer limit per month is a Federal rule. Both Wells Fargo and Amex savings account both say there is a limit of 6 a month.†

His Stigness

> Wrong Wheel Drive (41%)

His Stigness

> Wrong Wheel Drive (41%)

01/05/2019 at 16:38 |

|

American Express has 2.1% right now and they donít have any restrictions on balance or how much you can transfer each time.

Itís pretty easy to switch accounts and then you could feasibly transfer more if you want.

Dr. Zoidberg - RIP Oppo

> His Stigness

Dr. Zoidberg - RIP Oppo

> His Stigness

01/05/2019 at 16:44 |

|

Mine says 6 as well, so that must be it.

Dr. Zoidberg - RIP Oppo

> AestheticsInMotion

Dr. Zoidberg - RIP Oppo

> AestheticsInMotion

01/05/2019 at 16:45 |

|

Yes

TheRealBicycleBuck

> AestheticsInMotion

TheRealBicycleBuck

> AestheticsInMotion

01/05/2019 at 16:49 |

|

It does. And if you can automate the transfers and make the transfers without fees, itís still a good idea. It just wonít be as lucrative as you first assumed.

AestheticsInMotion

> His Stigness

AestheticsInMotion

> His Stigness

01/05/2019 at 18:04 |

|

You are correct, sir

AestheticsInMotion

> Supreme Chancellor and Glorious Leader SaveTheIntegras

AestheticsInMotion

> Supreme Chancellor and Glorious Leader SaveTheIntegras

01/05/2019 at 18:05 |

|

That is my backup option if this bank gives me issues, or if the user interface is unbearably bad

E92M3

> AestheticsInMotion

E92M3

> AestheticsInMotion

01/05/2019 at 21:16 |

|

You could earn 2.8% on I Bonds right now. You do lose 3 months of interest if you cash them out before 5 years though. But you can buy up to $10k each year. I wouldnít do that until youíve maxed out a Roth IRA first though.