"LJ909" (lj909)

"LJ909" (lj909)

08/29/2017 at 13:10 ē Filed to: None

1

1

32

32

"LJ909" (lj909)

"LJ909" (lj909)

08/29/2017 at 13:10 ē Filed to: None |  1 1

|  32 32 |

Iíve encountered people that dont actually know either how being upside down works, or why you get upside down. Take my sister for instance. She doesnt get how you can be upside down on a loan. Her line of thinking is this: the bank is loaning you the money to buy the car. So why does the bank/lenders tie the depreciation of the car into the loan? It makes no sense to her and Iíve given up trying to explain it to her. But anyway back to my point..

When I say subjective I mean as far as the dealer is concerned when giving you a trade in value for the vehicle. Say for instance, you have a car with a Blue Book value of about 3 gran, and you still owe about 6200 on your loan. We all know dealers will rarely come close to market value on most cars. So if that cars Blue Book value is 3 grand, a dealer is going to offer you 1500. Maybe 2 thousand. So one dealer offers you 1500 and tells you you are upside down 4700. You go to another dealer and they offer you 2500 and tells you you are only underwater 3700. It varies dealer to dealer from what Iíve seen, with some making it seem worse than it is for whatever reason.

So do you guys think being underwater is subjective when it comes to dealers placing a value on your vehicle?

WilliamsSW

> LJ909

WilliamsSW

> LJ909

08/29/2017 at 13:22 |

|

Yeah, it is - you could also argue that a private party sale might eliminate the under water problem for some people, too.

And itís mostly†irrelevant if youíre not trying to get rid of the car - but itís still problematic even then, because you could be in an accident, sudden financial trouble, etc.

I think the only times Iíve ever been underwater is shortly after buying a car that had a great interest rate offer- so low I financed as much as possible. But there was cash in the bank to cover the gap if it became a real problem.

Manwich - now Keto-Friendly

> LJ909

Manwich - now Keto-Friendly

> LJ909

08/29/2017 at 13:24 |

|

I consider being upside down to be a completely separate issue from dealer valuations.

Whether the car is paid off or not, there will always some dealers who will give you more, and some who give shitty low-ball offers.

ďSo why does the bank/lenders tie the depreciation of the car into the loan?Ē

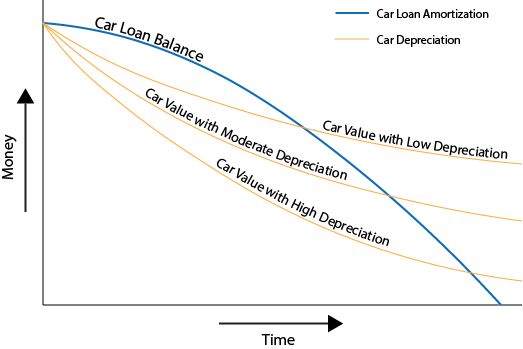

It might be better to explain it to her with an overlapping chart... and point out to her that the rate depreciation happens is NOT the same as the rate at which a loan gets paid off (amortization).

shop-teacher

> LJ909

shop-teacher

> LJ909

08/29/2017 at 13:25 |

|

To the extent that market value is subjective, yes. Iíve been in a situation a couple times, where I was trying to trade in a car that I was somewhat underwater on. Both times it was because those particular cars had proven to be unreliable. The first time, most dealers offered me around $3k less than I owed, but I found a couple dealers who were willing to offer me within a few hundred of my payoff price. I ate the money and moved on with my life. I ainít got no time for dat jibba-jabba (unreliable vehicles that is). The second time the numbers were a little closer together. Most dealers offered me around $2k less than I owed, but I was able to find a dealer that was more like $1k less. Again, I decided to eat the loss and move on with my life. Iím glad that I did.

LJ909

> WilliamsSW

LJ909

> WilliamsSW

08/29/2017 at 13:34 |

|

you could also argue that a private party sale might eliminate the under water problem for some people, too.

How so?

And yea gap would help, but most people either dont understand it enough to get it or dont wanna pay extra for it. I think Im currently upside down on my Sonic a few thousand. Maybe 3? But that stems from the major depreciation most subcompact and compact cars have.

WilliamsSW

> LJ909

WilliamsSW

> LJ909

08/29/2017 at 13:38 |

|

I just meant that itís part of the debate on valuation - Iíd expect a private party sale to yield more $ than a trade, so for some people, the higher sale price might reduce (or even eliminate) the amount underwater.

By Ďgapí, I literally just meant the gap between value and amount owed - I wasnít referring to gap insurance. Gap insurance can certainly have some value, but youíre right, people generally donít understand it, and I think that, as a result, it might not be priced correctly, either.

themanwithsauce - has as many vehicles as job titles

> LJ909

themanwithsauce - has as many vehicles as job titles

> LJ909

08/29/2017 at 13:41 |

|

Well, building off of other explanations, letís consider two big reasons why so many people end up ďunder waterĒ

1) No down payment = no initial decrease of the loan value. If you take out a 15k loan for a 20k car, then it gets very difficult to owe more than the car is worth. But if you owe 20k for a 20k car, then you actually have a 20k loan for an 18k car after depreciation begins. ANd after taxes and fees, youíre often taking out an extra grand or two. The *car* is worth 20k, but the *money* needed to buy it is more like 22k. So youíre really taking out a 22k loan for an 18k car after it leaves the lot. This ties into...

2) People making too small of payments over too many months with too high of an interest rate. An 84 month loan makes your payments smaller, but more of that payment goes towards the interest rate AND you are paying that loan off slower so you can end up ďunder waterĒ real fast. Going back to the 22k example. After your first year of payments, youíre looking at a balance of 19k. But the car is worth 17k or less depending on how much you drove. The year after that, your balance is 16k but the car is worth less - 14k. This continues until year 4 or 5 or so. So right when warranties run out, people could still be under water on their vehicle.

Trade-in value can often be manipulated with additional incentives or maybe some additional trade value or something to ďbalance the numbersĒ if you really need it. But when youíve got a decent sized gulf, thereís not much anyone can do.

nerd_racing

> LJ909

nerd_racing

> LJ909

08/29/2017 at 13:42 |

|

My underwater experience with my Mazda 2 was courtesy of a drunken/high idiot whom I worked with. He biffed parking his ratty ass crown vic and took out my back bumper cover, rear rock chip guard, and the wheel well splash shields.

Stupid me never called the police, he would have been toast then. I reported it since I had only had the car less than a year at that point. They fixed it for less than a grand and it was only plastic parts. I moved on with life, the kid got fired for continually coming to work drunk and high.

Two years later I was shopping around for a 1 series bmw and I find out my carís book value is down about $3k because of the accident history. I found a dealer that was willing to knock that to $1.5k since I had the documentation on what was repaired.

I chalked it up to a lesson learned. The next time someone bumped into my back bumper and only caused cosmetic scratches I didnít report it, they were gracious for me not going after them, and I didnít lose thousands of book value on my car, over hundreds in paint repair.

LJ909

> Manwich - now Keto-Friendly

LJ909

> Manwich - now Keto-Friendly

08/29/2017 at 13:44 |

|

But market valuation directly impacts whether or not you are upside down. Dealers dont usually go with the market though when they are giving you a value. Thats where you can look severely upside down at one dealer and not so much at another.

Its not so much that a graph would help, she just donít understand how they can tie the value of the vehicle into the loan. I told her depreciation affects pretty much everything with value. Then she proceeded to give me this example of why she doesnít agree with it:

ďSay youíre wanting to buy an Apple watch, but you dont exactly have the money for it. So I give you $300 bucks or whatever to be able to buy the watch. A year down the line youíve been making payments with interest to me to pay back what you owe me for letting me let you borrow the money A new model comes out, and you want that new version. So you ask can you loan me some more money to buy the new model. I come telling you that instead of the $150 that you had left that you owe me, because of the first model you bought is worth about 100 bucks now you owe me more than what the watch is worth. Does that sound right to you?Ē I told her shes weird for using that example but I kind of got her point.

LJ909

> shop-teacher

LJ909

> shop-teacher

08/29/2017 at 13:46 |

|

From my experience with selling I think credit of course plays a factor. Ive seen deals where a customer is only underwater 2 grand, but has a score less than 600 and the dealer wont do anything for him. But another customer will walk in underwater 12 grand but their score is 680 and they will work with him. Doesnt make sense.

LJ909

> themanwithsauce - has as many vehicles as job titles

LJ909

> themanwithsauce - has as many vehicles as job titles

08/29/2017 at 13:53 |

|

Im going to have to show this to my sister this was great thanks. More often than not though its people taking on much more than they can chew. Financial illiteracy is a big problem in our society, especially with my generation (Millennials).

Ive seen some people that are seriously underwater close to the example you provided. And then theres me. The example I used in the article is close to what Im kind of in with my Sonic. KBB with the mileage I have on it has it worth about 2500 maybe 3 grand. But I still owe 6 grand or so. But some dealers have made it seem like Im under 15 thousand when it really isnt that bad. From my experience, anything over 5 grand underwater is a big problem.

LJ909

> nerd_racing

LJ909

> nerd_racing

08/29/2017 at 13:56 |

|

Damn you really got lucky with have the right documents when the dealer asked for them. It sucks though now because of how Carfax and other vehicle history services are set up, anything little thing, ever something as simple as what happened to you, can make it seem like the car was in a major accident. So a ďfender benderĒ wont always actually be as bad as it makes it seem.

shop-teacher

> LJ909

shop-teacher

> LJ909

08/29/2017 at 13:57 |

|

That seems odd. I have good credit, so that always helps.

Nothing

> LJ909

Nothing

> LJ909

08/29/2017 at 14:00 |

|

Underwater isnít subjective to dealers or lenders. Itís dependent on how the purchaser acquired the vehicle and if they made themselves more susceptible to being underwater. No money down? Strike one. Interest rate over, say 3% (4-5% if going up to about 7 years old). Another strike.

Depreciation isnít tied into a purchase loan in any capacity. Youíve entered an agreement on what that item is worth to you NOW. What happens with valuation after that moment is irrelevant to the lender.

E92M3

> LJ909

E92M3

> LJ909

08/29/2017 at 14:06 |

|

A lot of people put themselves in the situation. They refuse to put a decent down payment (even though they have the cash), because if the car gets totalled in 2 months, the insurance company might just pay off the balance with no cash back to the buyer.

On the flip side, if you put down too little the insurance company can say: ďsorry, the bluebook says itís worth $7k less than the same ďnewĒ car, now that itís considered ďusedĒĒ. But you still owe thousands more than itís quoted book value. You are expected to pay that difference if you donít have GAP insurance.

nerd_racing

> LJ909

nerd_racing

> LJ909

08/29/2017 at 14:09 |

|

Iíve seen cars get a black mark for windshield replacements and being keyed... it is all about how it gets reported.

Chariotoflove

> LJ909

Chariotoflove

> LJ909

08/29/2017 at 14:11 |

|

How much you are underwater depends directly on how much your car is worth. So, yes, dealer valuation matters, but only when you go to trade in. Itís like when your investments take a hit on the stock market because the price goes down, but you only really lose money if you sell those stocks at the reduced price. Until then, the loss is virtual.

Iím having trouble getting what your sister doesnít get about upside down, which isnít the point of your post, I know.†

LJ909

> Nothing

LJ909

> Nothing

08/29/2017 at 14:19 |

|

Oh yea of course. All those things you mentnioned are just bad financial decisons. But getting a shitty trade offer can make you seem more underwater than you are. At least to me.

What happens with valuation after that moment is irrelevant to the lender.

If this were really the case dont you think that being underwater wouldnt be a thing?

punkgoose17

> LJ909

punkgoose17

> LJ909

08/29/2017 at 14:22 |

|

I think 2009 is a bad year to compare stats to since it was the middle of the recession. I would say it is a bad idea to pay for something you are no longer extracting value from.

Nothing

> LJ909

Nothing

> LJ909

08/29/2017 at 14:44 |

|

How would underwater not be a thing? A person entered a contract with a lender with an agreed upon purchase price and a finance charge. If that person honors that agreement, the lender doesnít give a ratís ass if you owe more than the car is worth during the life of the loan. They already KNOW it. They want their contracted financial agreement to be fulfilled. Thatís why credit is risk. They base that agreed upon financial charge on the likelihood of that contract being honored. If youíre risky, the higher interest rate will cover the potential depreciation hit the bank will take when they repo your car. All of that is done up front, not during or after.

Aaron M - MasoFiST

> LJ909

Aaron M - MasoFiST

> LJ909

08/29/2017 at 15:01 |

|

There is generally a pretty solid table that a lender has regarding what percentage of a carís value theyíre willing to lend. If you have a 780 credit score, they may be willing to lend you 125% of the carís value, while with a 650 only 80%. However much youíre underwater on the deal goes directly into that number. It creates two sets of incentives...for the dealer, theyíre incented to work with you on the deal, at least to the point where it meets the lenderís requirements (and note the lender has their residual value of the car already calculated, and itís not how much youíre paying necessarily). It also could create an incentive for you to buy a car with more residual value so that the lender is taking on less *relative* risk.

Yowen - not necessarily not spaghetti and meatballs

> LJ909

Yowen - not necessarily not spaghetti and meatballs

> LJ909

08/29/2017 at 15:12 |

|

subjective: ďbased on or influenced by personal feelings, tastes, or opinions.Ē

As for being underwater? The vehicle is underwater in all those cases. So thereís no question in YOUR example. Itís unanimous.

Now if you have 5k left on a loan and one dealer offers 4900 while the other offers 5100, then YES, itís subjective.

LJ909

> Chariotoflove

LJ909

> Chariotoflove

08/29/2017 at 15:32 |

|

She doesnt get the virtual loss, or mainly why the loss is tied to the loan. Shes viewing the loan and the car value as 2 different things.

LJ909

> Yowen - not necessarily not spaghetti and meatballs

LJ909

> Yowen - not necessarily not spaghetti and meatballs

08/29/2017 at 15:36 |

|

Now if you have 5k left on a loan and one dealer offers 4900 while the other offers 5100, then YES, itís subjective.

This is my point because this usually always happens.

Yowen - not necessarily not spaghetti and meatballs

> LJ909

Yowen - not necessarily not spaghetti and meatballs

> LJ909

08/29/2017 at 15:50 |

|

I guess whatís the point of this post? Dealers offer slightly different amounts on trade-ins. For some people that means theyíll be slightly over or under water. In most of those cases though, the numbers probably arenít hugely consequential.

Being underwater is a problem for people that are so by thousands of dollars without the means to get out of the situation.

jonny11quest

> LJ909

jonny11quest

> LJ909

08/29/2017 at 16:28 |

|

Hereís my take: being upside-down on a loan and being upside-down in a transaction are two different things. During the loan repayment period, upside-down is how much you owe compared to market value (how much you COULD get for it). In a transaction, I think the determination is based on how much you ACTUALLY got for it. Say market value is 12k, you owe 10k, you sell it to a homeless guy for $3.52... you are upside-down on that transaction.

Basically, upside-down is just describing a situation of owing more than its worth or sold for, whichever is less.

EDIT: Keep in mind being upside-down is necessarily a bad thing. I bought a brand new car and put almost nothing down because it was 0% interest. I was upside-down the entire time I owned the vehicle on purpose. I had the difference available at all times in case of a total loss, but my money was accruing interest in my own accounts instead of wasting it paying off a 0% loan balance. This is a rare case only with really low interest loans though.

Chariotoflove

> LJ909

Chariotoflove

> LJ909

08/29/2017 at 16:36 |

|

I think I might go with her own example like this. So you still owe her $150 of the original $300. She wants her $300 back, right (leave out interest for now)? I mean, thatís the meaning of a loan, otherwise itís a gift and who does that to their brother? So, you want more money to buy a new Apple Watch. You give her the old watch as a trade in, but she can only sell it for $100 on eBay, which means she would still be $50 down from what she gave you. So she says, sure sheíll give you the money for the new watch, but you will owe her that amount plus $50 because she still wants her money from the earlier loan.

Now, thatís when she is the lender for both the first watch and the second. Say your mom loaned you the money for the first watch and she actually owns the watch until you pay it off, but she letís you wear it (which is what happens when you have a car loan). You canít give your sister the old watch to sell on eBay because itís not yours, unless your sister pays off the loan to your mom first. Then, the trade in watch is hers to do what she wants, but she had to pay your mom $50 to get it. She doesnít want to eat your old loan because it cuts into what she can get from selling your old watch on eBay, and thatís not advantageous for her; so, she charges you that $50 as part of your new loan.

Does this work? I realize you may not be interested in having this discussion with your sister, but itís helpful for me to work the scenario because I may be covering this with my daughter one day.

jonny11quest

> jonny11quest

jonny11quest

> jonny11quest

08/29/2017 at 16:45 |

|

*not necessarily a bad thing...

Manwich - now Keto-Friendly

> LJ909

Manwich - now Keto-Friendly

> LJ909

08/29/2017 at 18:24 |

|

ďSay youíre wanting to buy an Apple watch,Ē

Watches are not cars. They donít have the same depreciation curves. So the comparison is not exactly relevant. But anyway...

ďSo I give you $300 bucks or whatever to be able to buy the watch.Ē

Then I owe you $300.

ďI come telling you that instead of the $150 that you had left that you owe me, because of the first model you bought is worth about 100 bucks now you owe me more than what the watch is worth.Ē

No. Thatís not how it works. False logic. Non sequitur. THIS is where her reasoning goes off the rails.

In reality, for the analogy to be *accurate*, I would be trading in my old watch for a new watch. The old watch is worth $100. The money owed is $150. So after I hand in the old watch and she sells it for $100, there is still $50 in debt that has to be paid... that needs to be paid by me. So I have to pay that remaining $50 in debt, plus the cost of the new watch... which is another $300. Which means I will have $350 owing.

ďI told her shes weird for using that example but I kind of got her point.Ē

More accurately, itís non sequitur... her logic does not follow... even if she believes it does. And she also leaves out the interest rate and the monthly payment amounts.

And she does seem to understand the difference between depreciation on an asset and amortization schedule of a loan.

She might think the value of the watch or vehicle is tied to the loan, but she is completely wrong about that because, and I say this with confidence, she has absolutely no idea what she talking about and it would be a excellent idea for her to take some finance and/or accounting courses... like I did.

Hyperpred

> LJ909

Hyperpred

> LJ909

08/29/2017 at 23:24 |

|

Something is only worth what someone will pay. Your lender doesnít care about what someone will pay. They loaned you x and expect you to pay x plus interest. If your only offers are lower than the remainder of x you are underwater and the bank expects you to make up the difference.

As to specific amount, sure thatís subjective based on what someone offers... But underwater is underwater until you can find someone to pay more than you owe. Not subjective at all.

Now_looking_for_a_cheap_car

> LJ909

Now_looking_for_a_cheap_car

> LJ909

08/30/2017 at 10:17 |

|

If you try to explain this via a total loss incident, it may become easier to understand. That scenario can be just as possible as trading your car in 5 years later

LJ909

> Chariotoflove

LJ909

> Chariotoflove

09/02/2017 at 16:52 |

|

Sorry for the late reply but yea this worked and she sort of gets it now. This whole thing came about about because she was wanting to buy a Camaro before she gets deployed in the Navy. And I mentioned to her why the hell would you buy a car thats just going to be sitting and thats how we got into depreciation.

Chariotoflove

> LJ909

Chariotoflove

> LJ909

09/02/2017 at 17:43 |

|

Thanks for getting back to me. Yeah, glad you had that conversation and that you straightened her out a bit.