"Krieger (@FSKrieger22)" (Krieger22)

"Krieger (@FSKrieger22)" (Krieger22)

07/07/2015 at 13:15 • Filed to: None

2

2

8

8

"Krieger (@FSKrieger22)" (Krieger22)

"Krieger (@FSKrieger22)" (Krieger22)

07/07/2015 at 13:15 • Filed to: None |  2 2

|  8 8 |

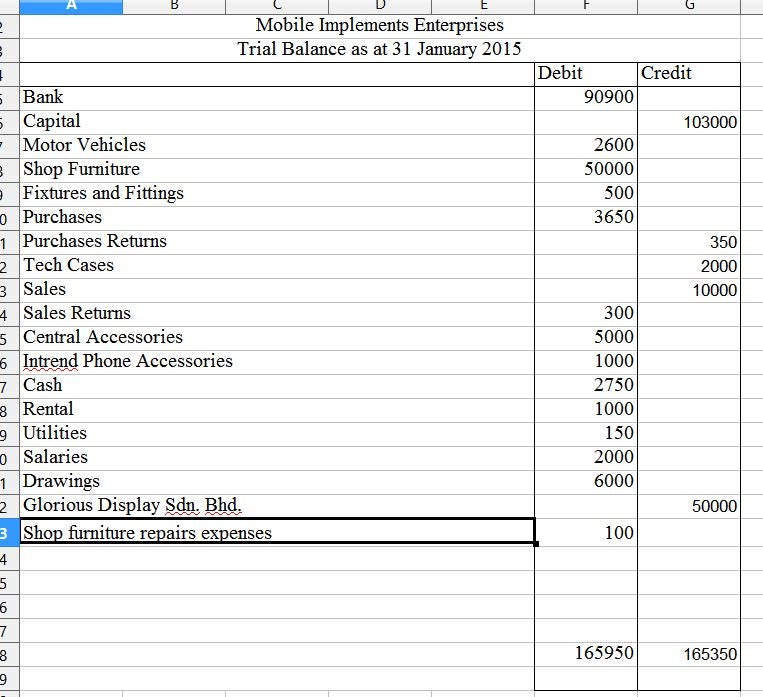

I need an auditor.

!!!error: Indecipherable SUB-paragraph formatting!!!

. Any help is greatly appreciated.

NoneOfYourBiz

> Krieger (@FSKrieger22)

NoneOfYourBiz

> Krieger (@FSKrieger22)

07/07/2015 at 13:37 |

|

I used to do the accounting for a small business. I have no idea what’s going on here. Did you start with $600 more than you’re showing? Seems like there’s a data entry error. Formula is correct.

Mr. Ontop, No Strokes, No Smokes...Goes Fast.

> Krieger (@FSKrieger22)

Mr. Ontop, No Strokes, No Smokes...Goes Fast.

> Krieger (@FSKrieger22)

07/07/2015 at 13:49 |

|

check for transpositions.

The Dummy Gummy

> Krieger (@FSKrieger22)

The Dummy Gummy

> Krieger (@FSKrieger22)

07/07/2015 at 14:10 |

|

ETA Readded bank balance. Nevermined

NoneOfYourBiz

> Krieger (@FSKrieger22)

NoneOfYourBiz

> Krieger (@FSKrieger22)

07/07/2015 at 14:12 |

|

There’s your problem. “Sales returns” should be under “credits.” That’ll make the sides balance. (-$300 from the left, +$300 on the right)

RockThrillz89

> NoneOfYourBiz

RockThrillz89

> NoneOfYourBiz

07/07/2015 at 14:26 |

|

A return of a sold item would be a Dr to sales (in this case, Dr to sales returns since that account is being used as a contra-revenue account) and a Cr either cash or A/P. Unless I’m missing what “sales returns” is being defined as.

RockThrillz89

> Krieger (@FSKrieger22)

RockThrillz89

> Krieger (@FSKrieger22)

07/07/2015 at 14:47 |

|

You put debited sales returns and you debited sales. That Dr to sales returns should go to inventory and cost of goods sold as a Cr. The Dr to sales is correct.

I found it thanks to CJ pointing out the Dr to sales returns, then looking at the sales account.

NoneOfYourBiz

> RockThrillz89

NoneOfYourBiz

> RockThrillz89

07/07/2015 at 16:58 |

|

Ah, was looking at it the other way - as if the entity holding the balance sheet had returned something and received a credit, not as if a customer of theirs had made a return. I think the OP needs to clarify but that’s all I got.

EDIT - Ah, there we go! RockThrillz89 found it. :)

RockThrillz89

> NoneOfYourBiz

RockThrillz89

> NoneOfYourBiz

07/07/2015 at 17:07 |

|

To be fair, the transactions are really poorly worded. There is another transaction that happened in the month where the company returned “goods” (I read goods to mean inventory).

I also think that Krieger needs to combine the Bank and Cash accounts, as well as add A/R and A/P accounts for all those credit sales and purchases. I did some quick t-charts and had outstanding A/R and A/P at the end of the month. I’m not sure how deep you went into it, but did you get non-zero balances too?