"Ad Astra" (ad-astra)

"Ad Astra" (ad-astra)

10/17/2013 at 11:08 • Filed to: Oregon, Gas Tax

0

0

9

9

"Ad Astra" (ad-astra)

"Ad Astra" (ad-astra)

10/17/2013 at 11:08 • Filed to: Oregon, Gas Tax |  0 0

|  9 9 |

The

Economist's

Democracy in America blog published an

!!!error: Indecipherable SUB-paragraph formatting!!!

yesterday that discusses Oregon's proposed vehicle-miles-travelled (VMT) tax, which is intended to enter a trial phase in 2015. It is an interesting concept, and I was curious how it compares to the current model.

The current gas tax (30 cents/gallon) is added to the price of gas at the pump. The more gas you buy, the more tax you pay. The blog post's author explains that the increasing fuel efficiency of cars has decreased gas tax revenues. This shortfall is bad for drivers because it lowers the amount of funding available for infrastructure maintenance.

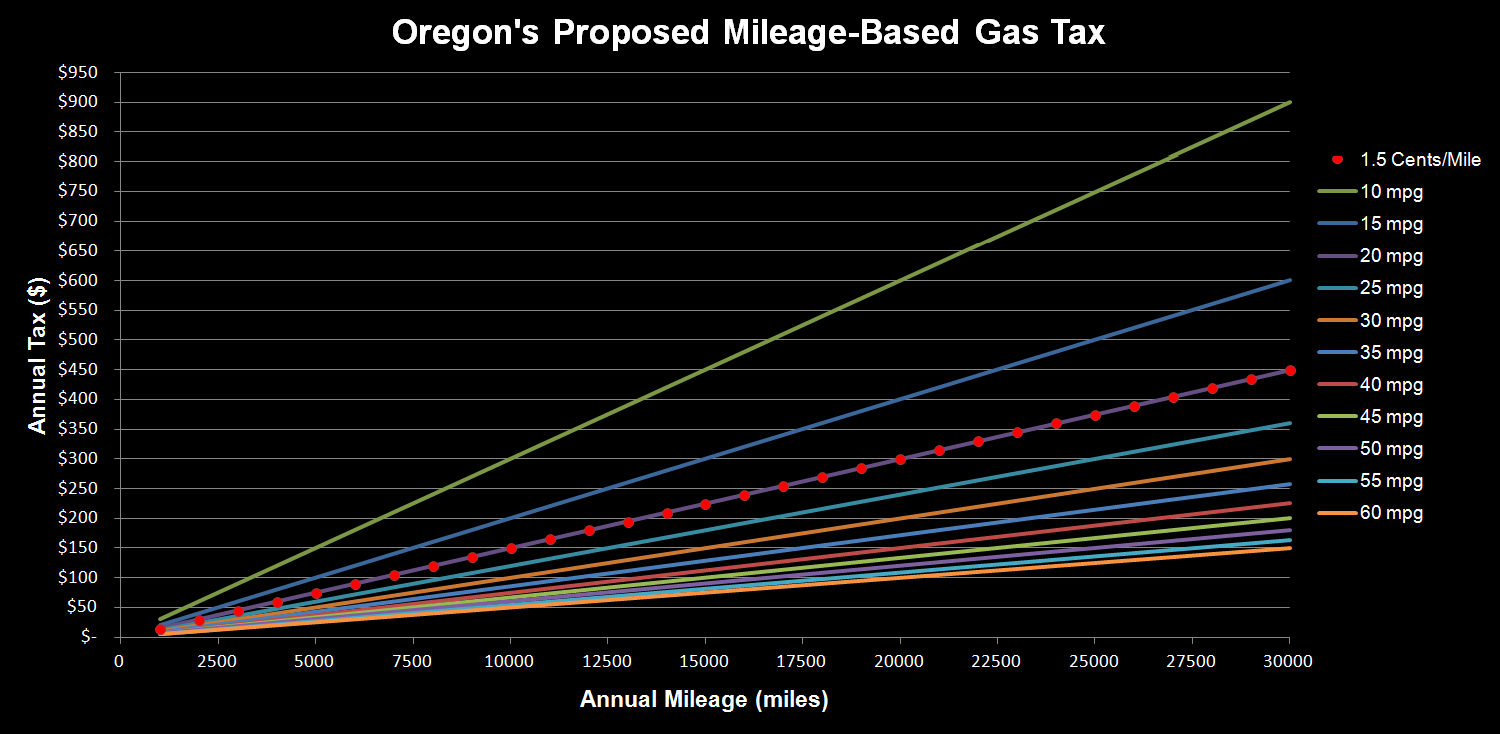

Oregon is considering boosting revenues by switching to a VMT tax scheme. Rather than adding thirty cents to the price of a gallon of gas, drivers would pay 1.5 cents per mile driven. The above chart compares the annual gas taxes paid under the VMT model with the taxes paid when filling up cars that get between ten and sixty mpg. Using the VMT model, drivers will pay gas taxes roughly equivalent to those who currently drive cars that get twenty mpg.

I don't live in Oregon and am not familiar with the politics surrounding the proposed VMT plan. In my opinion, it seems like a fair way to recoup tax revenues lost to more efficient vehicles. Efficient cars cause infrastructure wear and tear at roughly the same rate as inefficient ones (although, heavier vehicles do wear roads at a faster rate than lighter ones). I'm not sure how the plan intends to deal with electric vehicles. The blog post does note that the plan has faced controversy over the way that mileage might be monitored (GPS tracking).

Casper

> Ad Astra

Casper

> Ad Astra

10/17/2013 at 11:15 |

|

The problem they are having is that it's a theoretical system and no one knows how to implement it. For instance, GPS would instantly cause privacy concerns and generally be illegal according to precedent. On top of that, the GPS system has to be very accurate and complex because it can't charge for mileage conducted out of state or on federally maintained roads. If you don't use GPS, you have the same problem as latter, but also significant cost increases to running the system as you now need to check odometers. Doesn't really generate new revenue if all the revenue plus some is consumed in implementing the bureaucracy.

The other huge problem they face is that the politicians don't want to give up money, so they don't want a clause that eliminates the gas tax currently in place. The wording of the laws allows for it to remain and this to be done additionally... then they may remove the gas tax in the future. That would never happen, so no one is happy with it.

Slave2anMG

> Ad Astra

Slave2anMG

> Ad Astra

10/17/2013 at 11:16 |

|

What about out of state vehicles?

And frankly there is no way on this God's green earth I'm letting the state put a GPS device on my car. Never. If I lived in Oregon I'd move.

Ad Astra

> Casper

Ad Astra

> Casper

10/17/2013 at 11:19 |

|

I hadn't considered the cost of implementing the monitoring. It definitely won't be trivial.

Tekamul

> Ad Astra

Tekamul

> Ad Astra

10/17/2013 at 11:19 |

|

Woooo Hooooo!

My taxes are going down, AGAIN!

I love this country!

Ad Astra

> Slave2anMG

Ad Astra

> Slave2anMG

10/17/2013 at 11:22 |

|

This plan wouldn't generate revenue from out of state vehicles. As for the privacy issues, the plan allows you to opt out of GPS monitoring and pay to have your odometer read or pay a flat rate. I'm not sure how the state intends to verify the latter two methods.

Casper

> Ad Astra

Casper

> Ad Astra

10/17/2013 at 11:28 |

|

Which is another problem. Currently out of state trucks running the freeway are among the most damaging to the surfaces. As of now, they pay tax when they fill up on their way through. This tax would suddenly lose access to all that money and drain the local economies (which are already over taxed and under funded).

It's typical stupidity. While the counties in Oregon are looking at going bankrupt because they killed the industries with environmental regulation, they are now looking to give up funding externally in order to tax their residents more.

J. Walter Weatherman

> Ad Astra

J. Walter Weatherman

> Ad Astra

10/17/2013 at 11:44 |

|

I'm going to go out on a limb and say that there is approximately 0% chance that Oregon will actually implement that tax.

If gas taxes aren't raising enough revenue to cover road maintenance costs because cars are becoming more efficient, why not just raise the amount of the current gas tax? At a minimum, it should be indexed to inflation.

As the owner of one horrendously inefficient car, and one very efficient car, I don't mind paying more taxes when I drive the inefficient one, even if it is not directly proportionate to the increased wear that it does on the roads. No taxation system is ever going to perfectly charge people for exactly the amount of wear they cause, and the system we have does a decent enough job, and is relatively easy to administer.

Ad Astra

> J. Walter Weatherman

Ad Astra

> J. Walter Weatherman

10/17/2013 at 11:53 |

|

Yeah, it's not clear to me why the state can't just increase the gas tax. The article mentions the fact that tax increases require a supermajority vote, but adopting VMT doesn't seem to get around that.

Slave2anMG

> Ad Astra

Slave2anMG

> Ad Astra

10/17/2013 at 12:44 |

|

Well the failure to tax out of state vehicles is absurd. As Casper notes the trucks beat the stuffing out of the roadways. In a perverse way this actually makes a good case for toll roads...use it, pay for it. And makes a good case for those states that want to impose higher license plate/registration fees on fuel efficient cars, a method I find much more palatable than a road use tax.