by "LJ909" (lj909)

by "LJ909" (lj909)

Published 11/06/2017 at 20:12

by "LJ909" (lj909)

by "LJ909" (lj909)

Published 11/06/2017 at 20:12

No Tags

STARS: 0

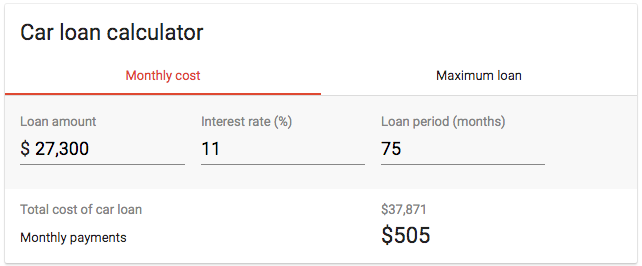

Here we have a 66 year old man. gets just over $4200 a month in income from both Social Security and his retirement. Has a 2015 Chevy Malibu like the one pictured above, not even LTZ trim mind you. Financed it with GM Financial for $27,300 for 75 months at $507 a month. For a Malibu. Last we ran of his credit the middle of last year shows hes paid it down however to just under $21 grand. And thats with shitty late payments pretty much every 2-3 months.

"E90M3" (e90m3)

"E90M3" (e90m3)

11/06/2017 at 20:19, STARS: 1

So you’re telling me he has an 11% rate on a car loan.

"ranwhenparked" (ranwhenparked)

"ranwhenparked" (ranwhenparked)

11/06/2017 at 20:21, STARS: 0

Wait, he’s going to pay over $38,000 for THAT! How does that even happen?

"LJ909" (lj909)

"LJ909" (lj909)

11/06/2017 at 20:22, STARS: 0

Well considering that we had to sue and get a judgement against him for not paying us back, its lack of financial savvy.

"itschrome" (itschrome)

"itschrome" (itschrome)

11/06/2017 at 20:27, STARS: 0

Must have taken car buying advise from my fiancee..

"wafflesnfalafel" (wafflesnfalafel1)

"wafflesnfalafel" (wafflesnfalafel1)

11/06/2017 at 20:39, STARS: 1

terrible deal with poor financing... buyer beware...

"LJ909" (lj909)

"LJ909" (lj909)

11/06/2017 at 20:40, STARS: 0

Did she buy a Malibu at a shitty rate too?

"Chariotoflove" (chariotoflove)

"Chariotoflove" (chariotoflove)

11/06/2017 at 20:42, STARS: 0

Feeling a sudden desperate urge to pay down my car loan, even though it’s only 2.99.

"LJ909" (lj909)

"LJ909" (lj909)

11/06/2017 at 20:45, STARS: 1

2.9 is low enough though for you to be in a good place if you dont pay it down, and an even better place if you do.

"Chariotoflove" (chariotoflove)

"Chariotoflove" (chariotoflove)

11/06/2017 at 20:51, STARS: 1

Yeah. You just reminded me that I hate paying interest because it increases the cost of my car. I’ve become used to 0% financing.

"boxrocket" (boxrocket)

"boxrocket" (boxrocket)

11/06/2017 at 21:01, STARS: 0

...Wow. My words have left me. I know that this sort of thing isn’t unusual, and is getting worse - higher payments for crummy cars like malibus and longer loans chasing a monthly payment - but that’s just appalling.

"LJ909" (lj909)

"LJ909" (lj909)

11/06/2017 at 21:15, STARS: 1

I used to feel bad for these people and the financial situations they put themselves in. But then when I get to look at a bigger picture of their finances and how their credit is, its a situation of their own doing, I start to care less or get mad because a lot of this still is unavoidable.

"Land_Yacht_225" (nadenator)

"Land_Yacht_225" (nadenator)

11/06/2017 at 21:15, STARS: 1

And I got tossed a service client today who is $18,000 burried in a 2016 Buick Encore, which she despises, driving 25,000 miles a year.

Needless to say, sales could do nothing for her. And I wish I knew how she came to be in that situation.

"LJ909" (lj909)

"LJ909" (lj909)

11/06/2017 at 21:16, STARS: 0

What the...$18 grand on a ‘16 Encore? I’m really curious about that and why should thought she could get out of that.

"Dr. Zoidberg - RIP Oppo" (thetomselleck)

"Dr. Zoidberg - RIP Oppo" (thetomselleck)

11/06/2017 at 21:23, STARS: 0

Seems like a predatory loan...

"LJ909" (lj909)

"LJ909" (lj909)

11/06/2017 at 21:27, STARS: 0

I would be surprised since its with GM Financial, which means he likely was at a Chevy or GM dealer, but at the same time I wouldnt be considering Chevy’s own build and price site defaults to 72 months when you do a payment estimator. The auto companies are in on the shitty financing deals as well.

"shop-teacher" (shop-teacher)

"shop-teacher" (shop-teacher)

11/06/2017 at 21:48, STARS: 1

I used to have a friend who had a credit score in the 300’s. Entirely of his own doing. Just one horrible decision after another. He’s invest in businesses, and they’d tank. He kept moving cross country chasing “opportunities.” He bought vehicles he shouldn’t buy. Took on pets when he couldn’t pay his own bills as it was. On and on and on. I genuinely don’t think he ever lied to anyone at the time he made a commitment, but inevitably after a few months he’d be doing something else entirely. Bottom line, his word didn’t mean anything

I say I used to have a friend, because as soon as it affected my family, I cut that loser out of my life. Which was easy to do because he turned tail and moved back to Florida for like the forth or fifth time.

"Land_Yacht_225" (nadenator)

"Land_Yacht_225" (nadenator)

11/06/2017 at 23:03, STARS: 1

I wish I knew how it happened because it doesn’t seem possible but somebody bought $30,000 financed on a $25,000 Encore and then depreciation hit it like a ton of bricks and she drove it too much.

She was welded to that thing.

"itschrome" (itschrome)

"itschrome" (itschrome)

11/07/2017 at 07:37, STARS: 1

she bought a new 2012 and was paying 350 a month since. and she just leased a new 2017 Malibu for 320 a month... ugh

"AMGtech - now with more recalls!" (amgtech)

"AMGtech - now with more recalls!" (amgtech)

11/07/2017 at 19:28, STARS: 1

Costs inflate more and faster than incomes do unfortunately.

"Party-vi" (party-vi)

"Party-vi" (party-vi)

11/08/2017 at 13:51, STARS: 1

Is that take-home for SS and retirement? Shiiiiiit that’s more than I make right now. Dude’s pulling in the equivalent of $79K a year it looks like.

"LJ909" (lj909)

"LJ909" (lj909)

11/08/2017 at 13:57, STARS: 0

Yep combined. Man gets $2417.56 for retirement every 1st of the month and another $1837.90 the 4th Wednesday of every month in Social Security.