by "LJ909" (lj909)

by "LJ909" (lj909)

Published 10/12/2017 at 12:01

by "LJ909" (lj909)

by "LJ909" (lj909)

Published 10/12/2017 at 12:01

No Tags

STARS: 2

With the line of work that I do with loans and finance, I like to point out the bad deals that people get into so it can be a learning experience. So people can know not to just sign on the dotted light and to fully understand what they are getting themselves into financially. But I myself may be one of the very people Iíve posted about on here.

Flashback about 3 years or so ago now. I was still in college and a young dad working pretty much full time at Panera Bread. Californiaís minimum wage hadnít gone up yet, and I had been working there already over 2 years. I was making just under $10 bucks an hour. But I was working crazy long hours at a place that wasnít supposed to be a full time job. I was both a trainer and over inventory. So I had the opportunity to save for a car down payment.

I lived a little over 5 miles from work. I even walked there once. But I took the bus since there was a bus stop 3 minutes walking time from my house. It was a long bus ride. I had no problem taking the bus. Im in favor of public transit and I donít look down on those who do. But I NEEDED a car. It wasnt a matter of want.

I ended up buying the S Type R that Im sure most of you are aware was a shit show. After that I realized I needed something more practical and reliable. Thats how I wound up at Hertz Car sales signing the papers on a 2013 Chevy Sonic hatch with 51 thousand miles for the on sale price of $9800 (down from almost 12 grand at the time).

I thought, and still think I got an ok deal monthly wise. I pay $200. But Iím probably in bed with the other deals Iíve posted here. My credit was nothing special at the time. So I put $2500 down and got financed for 72 months at the above mentioned $200 a month. But my APR is about 16 or 18%.

Fast forward to today, and with my car payment coming due, Iíve paid it down right under 6 grand. I estimate Iím underwater anywhere from $3-$4 grand. Not too bad I think but could be way way worse. But I just thought Iíd share that with you guys and see what youíre opinions are on my auto loan. Ask anything or comment anything youíd like.

"random001" (random001)

"random001" (random001)

10/12/2017 at 12:08, STARS: 3

Thatís a pretty rough interest rate. If youíve been good, and your credit has improved, maybe look at refinancing? I mean, Iím not one to judge. Youíre all good there. But Iíve had to go through the refinance dance, and it usually works out.

"Monkey B" (monkeyb)

"Monkey B" (monkeyb)

10/12/2017 at 12:09, STARS: 0

refinance for a better rate? I think you are better off than you think...unless the miles are extremely high itís still a $8-10k car if itís in good order. Trade you may be a little backwards, but Iíd think no more than $2k tops.

"LJ909" (lj909)

"LJ909" (lj909)

10/12/2017 at 12:11, STARS: 0

Yea I thought about doing that. Ive even had some offers from different lenders saying they could get me a lower rate. But the rates they have arenít that much lower, 1 or 2 % and Im not trying to keep the car much longer unless I have to you know?

"and 100 more" (nth256)

"and 100 more" (nth256)

10/12/2017 at 12:14, STARS: 1

Iím currently shopping around. Iíve done some research, and I think i can pull about a 10% apr with my credit rating. Iím trying to keep my payments under $200/mo. I will not accept an term longer than 60 months, not on a used car.

That puts my max price at about $10-11k.

So its seems your loan was on-par, considering your APR is higher and you accepted a 72-month term.

"random001" (random001)

"random001" (random001)

10/12/2017 at 12:17, STARS: 2

Huh. Check credit unions if you have one near you like. Rates are closer to like 4-5%, at least from my experience.

"BrianGriffin thinks ďreliableĒ is just a state of mind" (briangriffinsprius)

"BrianGriffin thinks ďreliableĒ is just a state of mind" (briangriffinsprius)

10/12/2017 at 12:18, STARS: 4

As others have said, why in holy hell have you not refinanced? Most CUs have auto loans for 2-3 percent and I think their only qualifications for the loan is that you have an account and a pulse.

"E92M3" (E46M3)

"E92M3" (E46M3)

10/12/2017 at 12:18, STARS: 2

I would look into Lendimg Club or Prosper. You may be able to get a loan for under 10% to payoff the loan you currently have.

"Chariotoflove" (chariotoflove)

"Chariotoflove" (chariotoflove)

10/12/2017 at 12:19, STARS: 4

As the others said, refinancing may be a good option for you, assuming your credit rating is now better. But, how about just paying the thing off early?

"Wrong Wheel Drive (41%)" (rduncan5678)

"Wrong Wheel Drive (41%)" (rduncan5678)

10/12/2017 at 12:21, STARS: 1

Holy crap 16-18%? That is higher than my credit cards! I never pay interest on those because of the 10-15% rates seeming ridiculous to me. But I have them just to earn points or better manage finances over the course of a month. And for emergencies.

My student loan interest seems like a lot to me and those range from 3% to 8% depending on the loan. Id definitely want an auto loan to be lower than that! But I guess credit scores matter and ive been building my 700+ trying to get perfect credit, but im just not old enough yet to have credit history get long enough.

"LJ909" (lj909)

"LJ909" (lj909)

10/12/2017 at 12:22, STARS: 0

Like I mentioned to someone else, Ive looked into it but the rates Ive gotten arent much better, and Ill only do that if I cant trade the car which Im trying to do soon. The downside is that I drive a lot. Its a commuter. So Im over 130 thousand miles now. But other than that the car is in perfect working condition other than the thermostat housing assembly that I posted about the other day. I ve never had any problems with the car.

"RutRut" (RDR)

"RutRut" (RDR)

10/12/2017 at 12:23, STARS: 0

Does California have really high interest rates or is that just a situational thing? Iím at 2.68% on a 2013MY truck I bought this past Jan.

"Wrong Wheel Drive (41%)" (rduncan5678)

"Wrong Wheel Drive (41%)" (rduncan5678)

10/12/2017 at 12:23, STARS: 2

Yeah definitely dont refinance if it extends your payment time! Just try to get a lower rate with the same payment window. Should certainly be able to get sub 10%

"LJ909" (lj909)

"LJ909" (lj909)

10/12/2017 at 12:24, STARS: 1

10 at 60 isnt too bad. But yea They tried to push 80+ but I wasnt having it. Those not in the know will be enticed by the sub 200 payment, I saw through the bullshit though and did 72 because that kept the payments within reason of what I could and was willing to pay. I dont normally do more than 60 either but this was an exception.

"MylesD" (mylesd)

"MylesD" (mylesd)

10/12/2017 at 12:24, STARS: 2

You can absolutely refi with a significantly lower rate, even with less than stellar credit. Credit unions ftw.

Similarly, maybe consider a personal loan through Lending Club or something similar. You could get a $6k personal loan, pay off the auto loan, and then pay the Lending Club loan down w/ a much lower interest rate.

"LJ909" (lj909)

"LJ909" (lj909)

10/12/2017 at 12:25, STARS: 0

I would look into Lending Club. But Prosper isnt good from what Ive seen.

"LJ909" (lj909)

"LJ909" (lj909)

10/12/2017 at 12:26, STARS: 0

Well Im not a CU member, even though Wells Fargo and their shit has been making me think about switching. But I have looked into refinancing and the rates were just 1-2% lower than what I have now. But this was awhile ago now.

"LJ909" (lj909)

"LJ909" (lj909)

10/12/2017 at 12:27, STARS: 1

Well If I cant trade it off, because I need something bigger now, Im just either going to pay it off early, or pay it down a huge chunk.

"LJ909" (lj909)

"LJ909" (lj909)

10/12/2017 at 12:28, STARS: 0

Nah its a situational thing. That could point to a lot of people here having shitty credit, which almost seems to be the case from what I can see.

"Bytemite" (bytemite)

"Bytemite" (bytemite)

10/12/2017 at 12:28, STARS: 2

That is a terrible deal and I would get out of it. Refinance if you qualify for better rates now or pay that thing off asap.

"Nothing" (nothingatalluseful)

"Nothing" (nothingatalluseful)

10/12/2017 at 12:31, STARS: 1

It all depends where your credit is now. Good to Excellent, you should be able to refi a 2013 model year car to closer to a 4.5-5% rate. Even fair should cut your current rate at least in half. A refi out of that rate would save $1300 or so over the remaining life of the loan.

Throwing more at it monthly with that interest rate wonít save a ton over the life of the loan.

Bad loans can happen to good people. For your next purchase, do yourself a huge favor and get qualified at a reputable bank, first. One thing that saves is the stupid 4 square game at a dealership. If it doesnít work out at one, try another. Pulling credit for a singular purpose multiple times wonít ding your score that bad.

"LJ909" (lj909)

"LJ909" (lj909)

10/12/2017 at 12:33, STARS: 0

Thats a good idea. Thanks.

"Chuckles" (chucklesw37)

"Chuckles" (chucklesw37)

10/12/2017 at 12:33, STARS: 0

Have you looked into a personal (unsecured) loan? If your credit is good you can probably get a much better rate. During the course of moving, I racked up about 4k in credit card debt at 18%. I went to my bank, got a personal loan at 7%, and immediately paid off the cards. Itís unsecured, so itís got nothing to do with your car but it can help with debt consolidation.

"LJ909" (lj909)

"LJ909" (lj909)

10/12/2017 at 12:35, STARS: 0

Good points. But this: Similarly, maybe consider a personal loan through Lending Club or something similar. You could get a $6k personal loan, pay off the auto loan, and then pay the Lending Club loan down w/ a much lower interest rate.† Even though I could probably get a lower rate, I never recommend paying off a loan with another loan, even if you get a lower rate than the original .

"Bytemite" (bytemite)

"Bytemite" (bytemite)

10/12/2017 at 12:35, STARS: 4

A car loan should not be anywhere close to 10% APR...if that is all you qualify for then you should not be buying a car with those terms. Stick to around 1-4% new, at most 5% used. Why would you shop by a monthly payment budget instead of looking at the numbers that really matter. Worry about the deal you get vs the value of the car, and if you get a loan, the APR. And reject any BS dealer add-ons (extended warranties, gap insurance, maintenance plans, etc).

With those rates and a 10k loan, you would be giving away $2.7k to the bank. That is a 27% return for them and a terrible deal for you. Again, if you are someone who can only qualify for a 10% auto loan, you should not be buying a car until you get that credit score up. Or better yet live within your means and buy a car with cash.

"BrianGriffin thinks ďreliableĒ is just a state of mind" (briangriffinsprius)

"BrianGriffin thinks ďreliableĒ is just a state of mind" (briangriffinsprius)

10/12/2017 at 12:35, STARS: 2

You NEED to be a credit union member and NEED to get away from WFB. Especially if you ever have your sights on buying a house, a credit union will be your best friend.

"Nibbles" (nibbles)

"Nibbles" (nibbles)

10/12/2017 at 12:35, STARS: 1

I was in that position once. Purchased a 2007 Focus with 52k on it for 11 grand at 16%. 3 years later traded it in on a 2010 S40 with 56k for 21 grand at 10.9. 3 years later traded that in on a brand new Ram 1500 for 48k (8 grand wrapped in because fuck depreciation hit that Volvo like a ton of bricks), 84 mos at 3.9.

Yeah itís a long note. We fully expect to have this truck for that length or longer, and should have it paid off within 5 years anyway. The lower initial payment allows us to have the truck on my salary alone until my wife has her degree. Then her entire salary goes to paying it (and student loans) off because itís all gravy anyway.

"BrianGriffin thinks ďreliableĒ is just a state of mind" (briangriffinsprius)

"BrianGriffin thinks ďreliableĒ is just a state of mind" (briangriffinsprius)

10/12/2017 at 12:37, STARS: 1

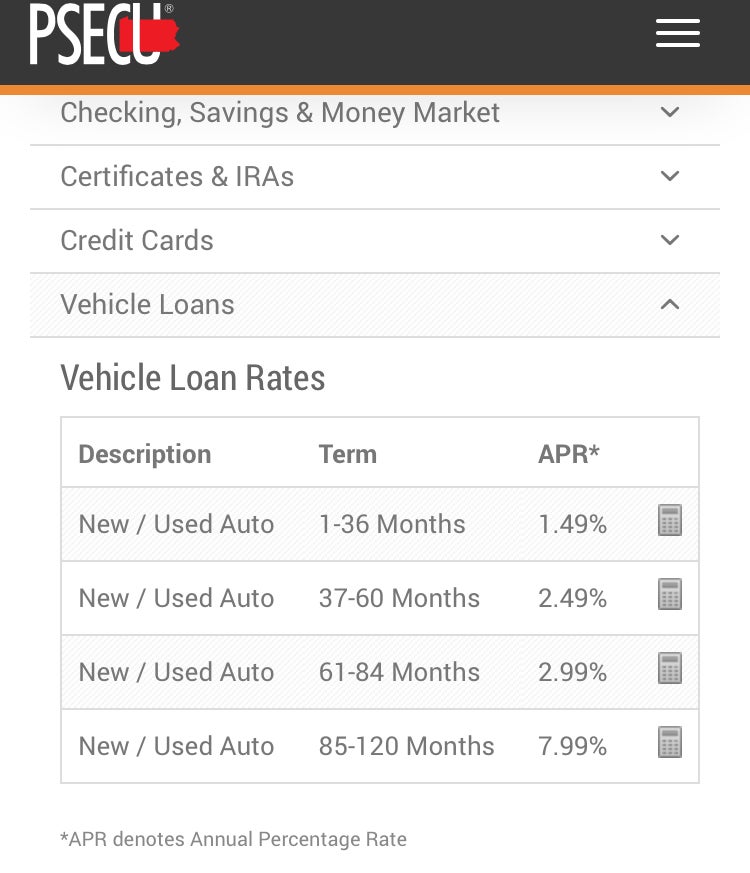

Just in case you donít believe me:

"Eric @ opposite-lock.com" (theyrerolling)

"Eric @ opposite-lock.com" (theyrerolling)

10/12/2017 at 12:37, STARS: 4

His only option would be a personal loan at this point. Since the car has so little value, refinancing probably isnít even on the table. This is why I tell people to get a decent loan up front if they must take a loan to get a car - these high-interest loans cost so much that itís almost impossible to get ahead enough to get out of them and theyíre usually such long periods that theyíre perpetually underwater until the car is only worth a few grand.

"Textured Soy Protein" (texturedsoyprotein)

"Textured Soy Protein" (texturedsoyprotein)

10/12/2017 at 12:38, STARS: 6

Except, paying off a loan with another loan is exactly what refinancing is. If you do it the right way, you will save money.

"Eric @ opposite-lock.com" (theyrerolling)

"Eric @ opposite-lock.com" (theyrerolling)

10/12/2017 at 12:38, STARS: 0

Even Wells Fargo probably would have given you a far better deal on a loan than you received. This is why you shop for a loan before you shop for a car if you must have a loan and donít have stellar credit.

"Milky" (jordanmielke)

"Milky" (jordanmielke)

10/12/2017 at 12:39, STARS: 0

Agreed on Credit unions. I just did my first solo loan on my Miata and the rate is 3.25.

"Monkey B" (monkeyb)

"Monkey B" (monkeyb)

10/12/2017 at 12:40, STARS: 0

I think you are in sell outright territory. At 130k I still think itís a $6-7k car.

"LJ909" (lj909)

"LJ909" (lj909)

10/12/2017 at 12:40, STARS: 0

Yea my next car Iíll try to go through a CU. And the loan I have right now is with Chase. But I always tell people that that inquires for a singular purpose, like you mentioned, isnt as bad as some people and dealers like to make you think. I hate when dealers point out inquires.

"LJ909" (lj909)

"LJ909" (lj909)

10/12/2017 at 12:42, STARS: 0

Nah i never considered that. With the line of work that I do now, I never recommend paying off one loan with another. Even with a good rate its not a good idea. Debt consolidation doesnt really work well for most people outside of a company that specializes in it. And even then its still not great.

"LJ909" (lj909)

"LJ909" (lj909)

10/12/2017 at 12:45, STARS: 1

See if you can make it work financially, then more power to you. But do be careful because something happens financially god forbid, you loose your job or something, thatís going to get bad, fast. Especially at 84 months. But it works out since you actually plan to keep the truck.

"LJ909" (lj909)

"LJ909" (lj909)

10/12/2017 at 12:47, STARS: 0

It is and isnt though. Refinancing is one thing. Taking out a separate loan to pay down another loan is another. It still couldnt hurt to look into.

"LJ909" (lj909)

"LJ909" (lj909)

10/12/2017 at 12:48, STARS: 0

This loan is with Chase Auto. And being in the situation I was in, I had no time nor the inclination at the time to shop around for a loan. It was out of necessity sadly.

"diplodicus" (diplodicus)

"diplodicus" (diplodicus)

10/12/2017 at 12:48, STARS: 1

Iím absolutely terrified of loans. I test drove a Fiesta ST about 2yrs ago and ford offered me 0% @72mos and I couldnít do it. Just the thought of being contractually obligated to do something for 6yrs is too much for me.

"LJ909" (lj909)

"LJ909" (lj909)

10/12/2017 at 12:48, STARS: 0

Last time I tried to trade it, the beginning of this year, the dealer offered $2500 for it. I think Blue Book on it is about 5? Maybe a little under.

"MylesD" (mylesd)

"MylesD" (mylesd)

10/12/2017 at 12:50, STARS: 2

I hear ya, I just view refi as the same thing. Also, Lending Club is a pretty no hassle process. While they probably donít want you using their money for that (can just say itís for CC debt or something), you wouldnít have to deal with getting the paperwork for car updated with the new lien holder. Youíd pay the car off, get it in your name, and now have a physical asset.

"Chuckles" (chucklesw37)

"Chuckles" (chucklesw37)

10/12/2017 at 12:51, STARS: 0

It can work if youíre disciplined. In my case, I had accrued credit card debt but was no longer using those cards. I took out a loan at a lower rate, paid off the cards in full immediately, and paid back the remainder of the loan. So my total debt didnít change by a dime, but now the interest rate is much more friendly (7% vs 18%). Itís not a problem at all as long as I continue to not use the credit cards.

With your experience, is there any reason why the situation I just described is a bad idea? Admittedly, my debt consolidation was pretty small in the grand scheme of things, but I didnít see any need to use a specialized company.

"LJ909" (lj909)

"LJ909" (lj909)

10/12/2017 at 12:51, STARS: 1

Like I mentioned before, the auto companies and their finance subs are complacent in a lot of the subprime loans out there. Theyíve slowly raised loan terms these last few years. Industry standard used to be 60. Now its 72, with even the default on some cars on Fords site being 84. Thatís how theyíve been posting record sales and profits. Look at Chrysler Financial. They finance anyone.

"Eric @ opposite-lock.com" (theyrerolling)

"Eric @ opposite-lock.com" (theyrerolling)

10/12/2017 at 12:54, STARS: 0

Good luck on hitting ďperfectĒ. I am around 815 and just canít get it to budge. My wife is just slightly lower. I have no clue how to push it any higher, but it was more than good enough to get the best rates on car loans and a mortgage, so I guess it doesnít matter beyond that.

"Textured Soy Protein" (texturedsoyprotein)

"Textured Soy Protein" (texturedsoyprotein)

10/12/2017 at 12:56, STARS: 3

When you refinance a loan, you apply for a new loan with whatever bank is doing the refi, they pay off your old loan, and you have a new loan with the new bank. It is quite literally using a new loan to pay off an old loan.

The only difference between that and the personal loan suggestion above, is that when you have a large auto, home or school loan, generally you refinance with a loan of the same type. But with a 4-figure auto loan balance with a high interest rate, itís entirely possible youíll be able to pay off the auto loan and get a better rate, with one of several different loan types.

Sometimes a personal loan might even be better. If you take out a personal loan to refi an auto loan, your car is no longer collateral and the bank canít repo the car if you donít pay. It still screws up your credit, but at least you still have the car.

"diplodicus" (diplodicus)

"diplodicus" (diplodicus)

10/12/2017 at 12:56, STARS: 0

Ya I was looking at a local chrysler dealerships used inventory and noticed that the monthly payments advertised were on an 84mo loan for a used car. What kind of crazy person does that.

"LJ909" (lj909)

"LJ909" (lj909)

10/12/2017 at 12:57, STARS: 0

Its just from what Iíve seen in my line of work and people coming to us trying to consolidate not always working out or being a good idea thatís all. Some people that are financially savvy, like yourself, can make it work. But for the most part I look at it like this: most people want to consolidate because they cant make the payments on the debt they have. If you couldnít make the payments on the debt you have, what makes you or the company giving you the money think that youíll be able to make the one or two payments on whatever loan you get to consolidate debt?

A person wanting to consolidate, say $6 grand in credit card debt from a total of 5 cards with total monthly of 2-300 bucks is probably going to have trouble paying off a loan of 7 grand with a monthly thats close to or a little more than those very cars they are trying to pay off. But again, thats just the average that I see. Everyoneís situation is different of course.

"LJ909" (lj909)

"LJ909" (lj909)

10/12/2017 at 12:58, STARS: 0

A lot of crazy people. There are a ton†of Charges and Challengers I see driving around here in SoCal. And I would bet $100 bucks that most of the people that are in them cant afford the payments, or are struggling to make them.

"Rico" (ricorich)

"Rico" (ricorich)

10/12/2017 at 12:59, STARS: 0

Howís your credit score?

"LJ909" (lj909)

"LJ909" (lj909)

10/12/2017 at 13:00, STARS: 0

Yea I wouldnít be willing to take that kind of ding on my credit. Though I have seen it.

"LJ909" (lj909)

"LJ909" (lj909)

10/12/2017 at 13:02, STARS: 0

Thats a good question. I havent checked it in a month or so. I used to use Credit Karma but its so far off its inaccurate. Its in the 6's though.

"Rico" (ricorich)

"Rico" (ricorich)

10/12/2017 at 13:03, STARS: 3

Definitely work on getting your credit score above 700 - it will only help you in the future.

"LJ909" (lj909)

"LJ909" (lj909)

10/12/2017 at 13:04, STARS: 0

Oh yea of course.

"Chuckles" (chucklesw37)

"Chuckles" (chucklesw37)

10/12/2017 at 13:05, STARS: 1

In my case, it wasnít because I couldnít make the monthly payments. It was because I wanted a lower rate. I was paying well over the minimum, but it was still going to take a little while at 18%. And the beauty of a personal loan is that they donít really care what you use it for, so you donít have to justify it with them. The credit card was with capital one, and the loan is with my bank, PNC. They were happy to lend me the money because Iíve been banking there a long time and my credit is good, and they werenít making money off of my credit card debt.

Itís true that it might not be a good idea for everyone, but it might be good for you.

"Textured Soy Protein" (texturedsoyprotein)

"Textured Soy Protein" (texturedsoyprotein)

10/12/2017 at 13:08, STARS: 3

Right, Iím not saying most people would refi an auto loan with a personal loan so they can go into default and keep the car. What I mean is that if someone were looking to refi an auto loan, and both personal and auto loans were available with roughly similar rates, it might be better to go for the personal loan, just in case. All else being equal, not having to put up collateral is better.

"Nibbles" (nibbles)

"Nibbles" (nibbles)

10/12/2017 at 13:23, STARS: 1

Thankfully Iíve cemented my place in this fortune 200 company. I have one of those titles that is near impenetrable unless I do something unabashedly stupid like embezzle or maliciously destroy the infrastructure.

Itís all about how you treat the high-risk loan. If you use it as a stepping stone to something better, always assessing your options and moving around, youíll find your creditworthiness increases quickly.

I was a 520 when we bought the focus. 2 years later I was 590 and bought a house. I was 649 when we bought the Volvo and now sit nicely around 730.

"Chariotoflove" (chariotoflove)

"Chariotoflove" (chariotoflove)

10/12/2017 at 13:34, STARS: 1

Now that you mention it, I see that youíre right.

"Wrong Wheel Drive (41%)" (rduncan5678)

"Wrong Wheel Drive (41%)" (rduncan5678)

10/12/2017 at 13:35, STARS: 0

Well yeah getting it over 800 would be nice. Its just ridiculous that its a negative impact to have less than 8 years of average credit history. Like what the hell I wont get there until im over 30 probably!

"Chariotoflove" (chariotoflove)

"Chariotoflove" (chariotoflove)

10/12/2017 at 13:35, STARS: 1

Yep. Canít fix the past, but you can mitigate the damage from now on.

"rillweid - Now with more TRD and less TDI" (rillweid)

"rillweid - Now with more TRD and less TDI" (rillweid)

10/12/2017 at 13:59, STARS: 0

If you use Mint to track expenses they tell you your credit score for free.

"LJ909" (lj909)

"LJ909" (lj909)

10/12/2017 at 14:13, STARS: 0

Yea I started using Mint after I noticed how far off Credit Karma was.

"Matt Nichelson" (whoismatt)

"Matt Nichelson" (whoismatt)

10/12/2017 at 14:23, STARS: 1

I feel ya. I see a lot of people at the credit union I work at who are upside down on their vehicle, have no clue what interest rate they first financed their vehicle at, and I are shocked when I tell them that in order to refinance they would need $3k-$6k because we can only do a certain amount. Those are not fun conversations to have, but I also try to treat it as a learning experience, especially with younger people.

"Bytemite" (bytemite)

"Bytemite" (bytemite)

10/12/2017 at 14:36, STARS: 0

Wait a minute. Wells Fargo is one of the biggest players in the mortgage industry right now undercutting everyone in pricing. I doubt a CU is offering a better rate than WF. Service and ability to close is a different matter...

"BrianGriffin thinks ďreliableĒ is just a state of mind" (briangriffinsprius)

"BrianGriffin thinks ďreliableĒ is just a state of mind" (briangriffinsprius)

10/12/2017 at 14:53, STARS: 0

My CU is at 3.875 for a 30 year fixed. Idk what WFB is at, but I canít imagine theyíre a whole lot less than they based on other rates Iíve been watching.

Edit: just checked, WFB is 4%. CU still wins.

"and 100 more" (nth256)

"and 100 more" (nth256)

10/12/2017 at 14:57, STARS: 0

Iím basing my affordability on my projected monthly payments because I know what I can afford to fit into my monthly budget.

This is not a situation where Iím looking for a car I want. This will be my primary vehicle. The one I had, that I had paid off a few years ago, took a shit unexpectedly (and expensively), and had lost more or less all but its scrap value - it would cost more to fix than what anyone was willing to pay for it. I now find myself in a worse financial/credit situation that I was when I bought it six years ago, because life happens, so after shopping around for different loans, I kinda have a good view of the field. Trust me, Iíve been at this. Iíll likely be approved at a lower rate, but it wonít be much below 8%.

And you say I shouldnít be buying a car. How then should I get to my job 35 miles from the house I bought last year? Iím borrowing a car from a friend now, but its not in much better condition that the car I sold off for junk.

You are looking at this from the perspective of someone with choice. Iím not currently in that situation. I understand youíre trying to offer sound advice, and I do appreciate it. But I also know better what my situation is than you do.

"and 100 more" (nth256)

"and 100 more" (nth256)

10/12/2017 at 15:00, STARS: 0

Yeah, I just canít see being underwater on a sub-$10k used car for six years, especially if itís already three or four years old.

"Bytemite" (bytemite)

"Bytemite" (bytemite)

10/12/2017 at 15:14, STARS: 0

Iím going to assume that theyíre both advertising par. But even then, you have differing closing costs which affect the APR. Window stickers should not be relied on for your personal case because even though theyíll both be using Fannieís pricing adjustments for credit score and LTV and all that, there are differences in closing costs and concessions you can get from your lender. Congrats on starting the hunt if you are house shopping and hope you get good rates and service.

"Bytemite" (bytemite)

"Bytemite" (bytemite)

10/12/2017 at 15:33, STARS: 1

You are right and you would know your situation better. What Iím trying to get at is making the right choices now to prepare you for when life inevitably happens again.

You can continue driving that junk car while saving up a few grand in 3 months to buy yourself a much better commuter car. After your transportation needs are taken care of, you can start your path to recovery and build a bit of savings so if your car does go to crap again, you are prepared for it.

You donít find yourself in a worse financial situation, you make the choices that lead to it. This wasnít thrust upon you, you chose and risked it. Donít make the same mistake twice?

Also this may come off as impersonal and cold so just know that I am only writing this as helpful advice for you if you care to give it just a bit of consideration. Life ainít black and white and your well-being is far more important than

†

some textbook financial advice. Just try to incorporate a bit of that advice into your life while taking care of the far more important things money canít buy. Not because they are good advice to build wealth, but because some of these things will prepare and prevent the situations that cause you to lose your well-being.

"jonny11quest" (jonny11quest)

"jonny11quest" (jonny11quest)

10/12/2017 at 15:47, STARS: 1

If it was me, Iíve got two options:

1 - Pay it off as soon as freaking possible, like eat ramen, donít buy clothes, forget friendships and relationships kind of fast. Pay for food, water, shelter with everything else going towards the car. Then keep it, do your own maintenance, pull repair parts from junkyards, and stay out of a loan until youíre in a long-term career type job.

2 - If you absolutely hate the car and canít stand it, do the above until youíre at private party bluebook, and put it on craigslist. Good pictures and solid honest write-up make for a quick sale in the land of Cameros. Then youíre back to no car, no loan. Ride a bike/take the bus/bum rides until you save up for whatever cheap car on craigslist peaks your interest (there a tons of sweet $1k beaters if you have basic repair/maintenance skills).

"LJ909" (lj909)

"LJ909" (lj909)

10/12/2017 at 15:57, STARS: 0

Cant do any of that because I have a kid to support. Which is why the need of another car comes into play. Growing family=need a bigger car. If I were single with no kids, then yea I could probably pull that off. But no dice.

"jonny11quest" (jonny11quest)

"jonny11quest" (jonny11quest)

10/12/2017 at 16:07, STARS: 1

Thatís fair. I would still argue that there are still ways to save (not as extreme as ramen 3x a day) and pay off the car and keep it. It seats 5 and has a hatchback. Growing family = want a bigger car.

I also understand most people donít want to live like that, and thereís nothing wrong with that. We only live once and itís nice to have a comfortable life, just as long as you understand the tradeoff with the debt and stress that goes with nice things. EDIT: I do honestly wish you the best. It sounds like a tough situation with no good answer.

"LJ909" (lj909)

"LJ909" (lj909)

10/12/2017 at 16:24, STARS: 1

Its just gotten to small thats all. But thanks. Its not as bad as you would think. I mean Iímm not hurting financially or anything like that. Its just that out of the necessity of the situation at the time, I got into this. But from what I see, it could be way way worse.

"Eric @ opposite-lock.com" (theyrerolling)

"Eric @ opposite-lock.com" (theyrerolling)

10/12/2017 at 22:10, STARS: 1

My wife was hovering around 800 when she was 23 (due to the methods that I taught her, although she was in the high-700s when I met her), then bumped up to very close to mine after we got married and I added her as an AU on my accounts.

I donít have anywhere near 8 years of average history, either. Mine was all self-made as I have never been an AU on anyone elseís account. My trick is to control what I can, which I have with precision for many years. Itís so much easier today with all these credit tracking sites that spell out how to do it than it was when I was younger...

"Wrong Wheel Drive (41%)" (rduncan5678)

"Wrong Wheel Drive (41%)" (rduncan5678)

10/13/2017 at 08:20, STARS: 0

Hmm, I wonder how much my student loans actually impact my score? I mean ive had like 780 for the longest time, Ive just wanted to get it over 800 to feel accomplished. And I guess it goes up and down depending on hard inquiries. I wish that apartments wouldnt need to do crap like hard checks!