by "Wobbles the Mind" (wobblesthemind)

by "Wobbles the Mind" (wobblesthemind)

Published 09/05/2017 at 13:43

by "Wobbles the Mind" (wobblesthemind)

by "Wobbles the Mind" (wobblesthemind)

Published 09/05/2017 at 13:43

Tags: Credit

STARS: 1

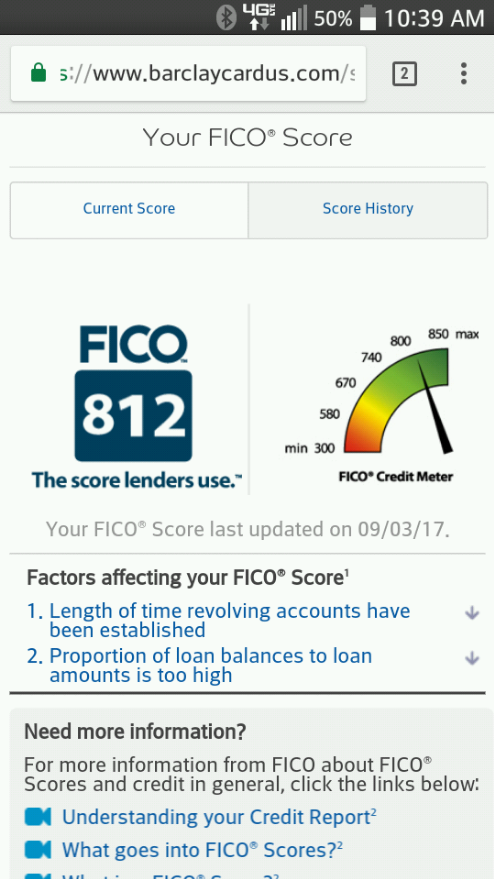

The goal is still to knock out these debts including the cars before I go for a house. Ive been noticing that over the last few years the amount needed to qualify for the top rates at my credit union other lenders have climbed up. When I was looking at the Jeep just two years ago you needed a 760 to qualify for the top rates at my CU. When I looked again for the XF you needed a 780 to qualify for the top rates.

Im getting the feeling that as more and more people are monitoring and learning how to work with the scoring systems within this credit dominated future of ours, the qualification thresholds will keep being raised.

By the time I start looking for a house who even knows whether or not the fact that the neighborhood’s average credit score is an 826 while some other home Im looking at is in a neighborhood where the credit score average is 760. All of a sudden that lower score area gives you better rates because they want you there to bump up the neighborhood score. The credit score of your neighbors begins to (if it doesnt already) impact the resale value of your property because people always want to live in the “good” neighborhood. Zillow adds in a “Show Homes in 820+ Neighborhoods” feature and then you have neighborhood “advisors” asking you why you havent bought a brand new car or done any high dollar remodel projects. Youre killing their property values you debt-free jerk! We dont want you here. Get a loan and we can get along!!

Sorry, I run paranoid in general, dont mind me. But if you’ve ever talked to “finance enthusiasts” then I bet you can imagine waking up to see “667" spray painted on your payed off Toyota while it’s sitting in the driveway. It will be an old meme in 2023.

Yes, I do read a lot of dystopian short stories.

"Captain of the Enterprise" (justanotherdayinparadise)

"Captain of the Enterprise" (justanotherdayinparadise)

09/05/2017 at 13:46, STARS: 0

Mines in GT500 territory at around 650

"PartyPooper2012" (PartyPooper2012)

"PartyPooper2012" (PartyPooper2012)

09/05/2017 at 13:52, STARS: 0

Someone remind me how many points I get for writing my name?

"Demon-Xanth knows how to operate a street." (demon-xanth)

"Demon-Xanth knows how to operate a street." (demon-xanth)

09/05/2017 at 13:56, STARS: 0

For some reason mine dropped from 826 to 801, I might’ve carried a few hundred dollars worth of balance.

"Nick Has an Exocet" (nickallain)

"Nick Has an Exocet" (nickallain)

09/05/2017 at 14:07, STARS: 0

My brother, who I would personally consider an insane risk, has a credit score of 720+. I consider anything that I lend him a gift. The rating system is suck.

"Wobbles the Mind" (wobblesthemind)

"Wobbles the Mind" (wobblesthemind)

09/05/2017 at 14:14, STARS: 0

All of them since a signature is always required.

"rb1971 ARGQF+CayenneTurbo+E9+328GTS+R90S" (rb1971)

"rb1971 ARGQF+CayenneTurbo+E9+328GTS+R90S" (rb1971)

09/05/2017 at 14:25, STARS: 0

The best thing about this is that right when you buy a house your credit score jumps down. Mine did that earlier this year. So weird.

"haveacarortwoorthree2" (haveacarortwoorthree2)

"haveacarortwoorthree2" (haveacarortwoorthree2)

09/05/2017 at 14:30, STARS: 1

I always love the credit score game. I get downgraded because my house is paid for and my last two cars were purchased with cash. For years I only had one credit card (albeit with a high limit) that I used for personal and business expenses, so I was told get another card so that your utilization numbers drop/your available credit increases. So I went ahead and did that, only to have my score drop by 15 points (oh sure, it will go back up at some point but that puts me right back where I was in the first place).

"PartyPooper2012" (PartyPooper2012)

"PartyPooper2012" (PartyPooper2012)

09/05/2017 at 15:08, STARS: 1

in that case, my credit score must consist of all the points.

Gazillion million!

"BeaterGT" (beatergt)

"BeaterGT" (beatergt)

09/05/2017 at 16:14, STARS: 0

I try to stay in Demon territory but it’s hard if you want to churn credit cards. I figure by the time I want to buy a house, they’ll have come up with some other insane metric.