by "Wobbles the Mind" (wobblesthemind)

by "Wobbles the Mind" (wobblesthemind)

Published 05/15/2017 at 22:57

by "Wobbles the Mind" (wobblesthemind)

by "Wobbles the Mind" (wobblesthemind)

Published 05/15/2017 at 22:57

Tags: Debt

STARS: 0

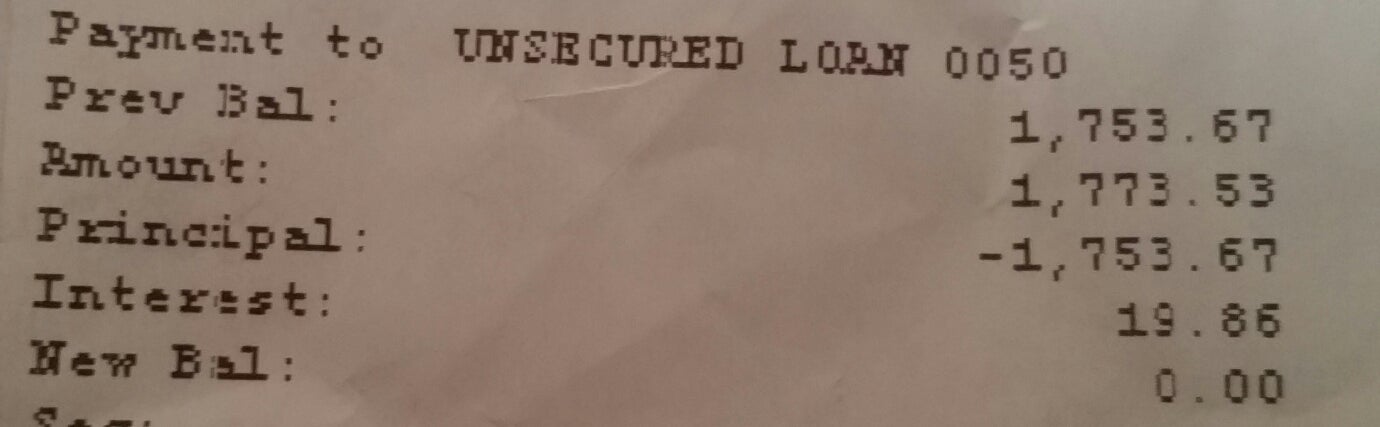

Operation Tetelestai †is still in full effect. Today I paid back the†loan request which was used to pay off my credit cards. After attempting to pay the cards off for months and months†I realized I was always going to put money back on them. Two years ago I decided to print off the current statements of every credit card I had, hand†them to my Credit Union, and applied for a loan which paid off all those credit card balances precisely.

My Credit Union paid each†card off right then and there so I was never tempted by having money in my account. This all turned out to be the perfect strategy for me since it got those cards paid off and†increased my credit score from what I believe was a 670 at the time to a 750 the following month. These payoffs have been so much planning effort that I think Iím going for a cash only lifestyle, including buying a house.

"DC3 LS, will be perpetually replacing cars until the end of time" (dc3ls-)

"DC3 LS, will be perpetually replacing cars until the end of time" (dc3ls-)

05/15/2017 at 23:05, STARS: 4

But if you buy everything in cash (talking cars and houses here,) thereís no point in having a high credit score.

"barnie" (tlanarch)

"barnie" (tlanarch)

05/15/2017 at 23:18, STARS: 3

Cut up my last credit card in Ď83. Been cash only since save for a business AmEx from a firm I worked for (never saw the statements). I own a >$200k boat, a couple cars and have a decent savings account. And I use a credit union, too; screw banks! Iím retired now with enough (learn what that is young and ya got it made...). Work at a big box as low level employee for a little extra pocket and a schedule. Life is good!

"DipodomysDeserti" (dipodomysdeserti)

"DipodomysDeserti" (dipodomysdeserti)

05/15/2017 at 23:21, STARS: 2

Buying everything cash will eventually ensure you donít have a high credit score.

"Wobbles the Mind" (wobblesthemind)

"Wobbles the Mind" (wobblesthemind)

05/15/2017 at 23:22, STARS: 2

Precisely, Im sick of celebrating†a†number that says how great I am at owing money.

"DC3 LS, will be perpetually replacing cars until the end of time" (dc3ls-)

"DC3 LS, will be perpetually replacing cars until the end of time" (dc3ls-)

05/15/2017 at 23:39, STARS: 1

But itíd be insanely hard to buy a house in cash.

"atfsgeoff" (atfsgeoff)

"atfsgeoff" (atfsgeoff)

05/15/2017 at 23:54, STARS: 0

I was in the same trap about 12 years ago and closed off my one credit card back then. I just recently (early last year) got a couple more credit cards to boost my score, and have been in the habit of using them instead of my debit card and then paying every statement in full. Because theyíre cash rewards cards, Iím essentially getting paid to use them.

"Dr. Zoidberg - RIP Oppo" (thetomselleck)

"Dr. Zoidberg - RIP Oppo" (thetomselleck)

05/16/2017 at 01:09, STARS: 1

Credit scores are a fickle mistress. You can spend years building it but mere months knocking it below 700.

"barnie" (tlanarch)

"barnie" (tlanarch)

05/16/2017 at 02:01, STARS: 0

I tried to get my credit reports from the 3 companies in 2001. Had so much trouble trying to convince 2 of them that Iím me that I gave up. Havenít bothered with them since. They canít be too bad though, cause I rented an apartment a couple years ago and got all the utilities in my name.

"Eric @ opposite-lock.com" (theyrerolling)

"Eric @ opposite-lock.com" (theyrerolling)

05/16/2017 at 02:24, STARS: 1

Some of us only ďoweĒ because thatís how they account for it. I spend money I donít have that I pay back immediately with money I do, meaning I never pay interest.

The only ostensible loan I have is my car payment, which comes out of a savings account with the money I would have spent to buy it outright had they not offered me a 0% loan and incentives beating the cash incentives.

The trick is self control and not getting into debt on them. I know plenty of people that send far more than they can pay off, then they end up making minimum payments and paying interest for decades on those charges. A total waste of money... Every time I find someone in that situation, I try to help them learn how to get out of it.

"ArmadaExpress drives a turbo outback" (armadaexpress)

"ArmadaExpress drives a turbo outback" (armadaexpress)

05/16/2017 at 09:40, STARS: 0

Cash only lifestyle is the best way to go. The only debt we have is our mortgage, and Iím okay with that. You can always pay a little extra towards the mortgage principal every month, and save a ton of money on interest in the long run.

"merged-5876237249235911857-hrw8uc" (merged-5876237249235911857-hrw8uc)

"merged-5876237249235911857-hrw8uc" (merged-5876237249235911857-hrw8uc)

05/16/2017 at 09:48, STARS: 1

The key is to use the credit card the same way you would a debit card, or cash, donít spend what you canít pay off at the end of the month. Then you can earn rewards on the credit card and also keep yourself relatively safe from fraud. Credit cards only legally can collect $50 to recoup fraudulent charges. Whereas if someone got ahold of your debit, they can drain your account and youíre hosed. The key is to use the cards to your advantage, and donít carry a balance from month to month.