by "OpposResidentLexusGuy - USE20, XF20, XU30 and Press Cars" (jakeauern)

by "OpposResidentLexusGuy - USE20, XF20, XU30 and Press Cars" (jakeauern)

Published 03/08/2017 at 14:22

by "OpposResidentLexusGuy - USE20, XF20, XU30 and Press Cars" (jakeauern)

by "OpposResidentLexusGuy - USE20, XF20, XU30 and Press Cars" (jakeauern)

Published 03/08/2017 at 14:22

No Tags

STARS: 2

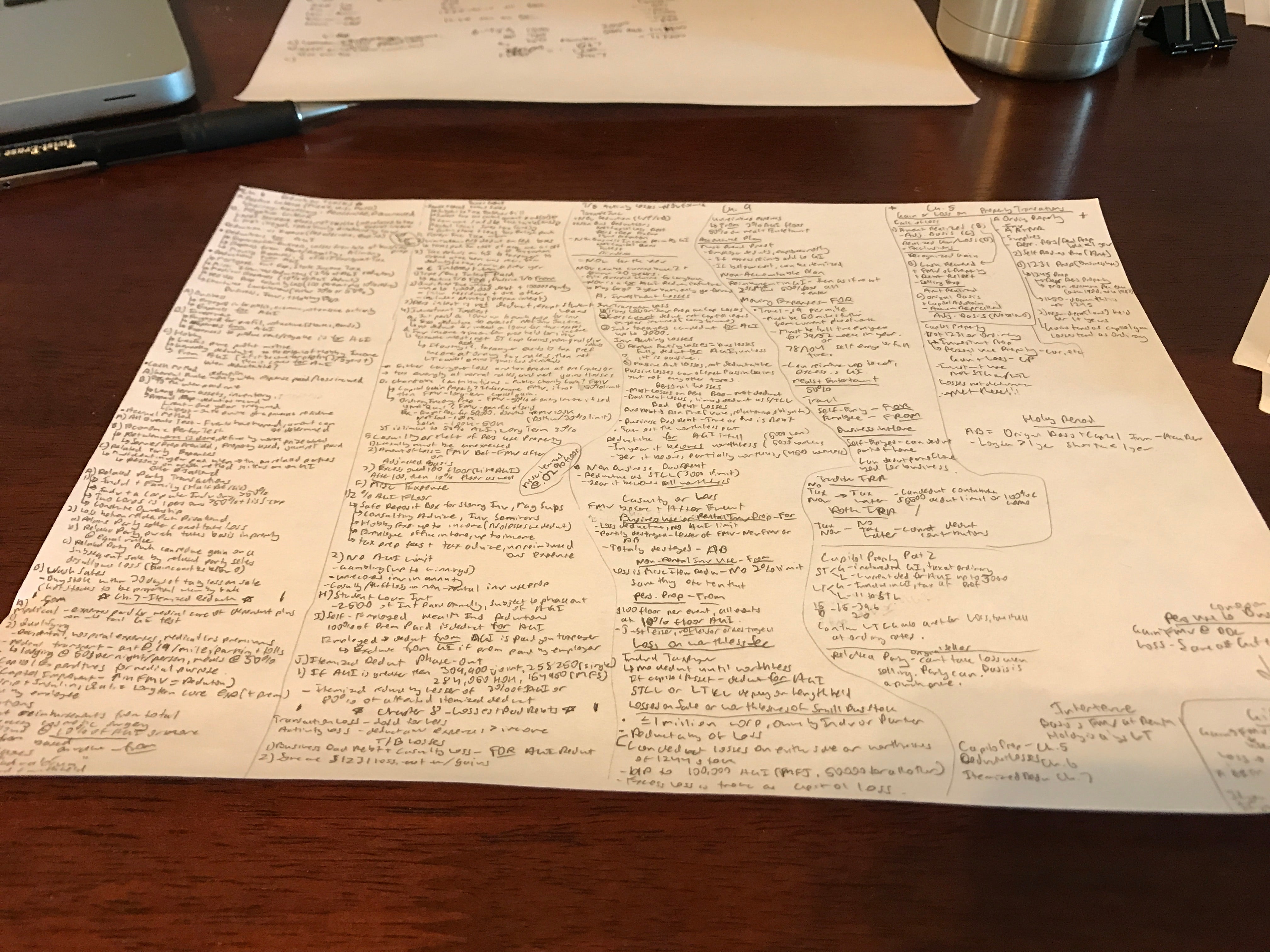

It is very difficult to learn how to give as little money to the government as possible. Like building a house without Zoidberg finding anything youíve messed up on difficult. Help.

"Ash78, voting early and often" (ash78)

"Ash78, voting early and often" (ash78)

03/08/2017 at 14:25, STARS: 0

My latest mistake: Buying a bunch of stuff for my home office because everyone was like ďYou can deduct it on your taxes!!Ē only to find out it was subject to the 2% floor. DAMMIT.

"Honeybunchesofgoats" (honeybunche0fgoats)

"Honeybunchesofgoats" (honeybunche0fgoats)

03/08/2017 at 14:26, STARS: 0

Iíve long just gone with Steve Martinís advice on how to be a millionaire and never pay taxes.

!!! UNKNOWN CONTENT TYPE !!!

"Rico" (ricorich)

"Rico" (ricorich)

03/08/2017 at 14:29, STARS: 0

Whoís administering it? Trump?

"OpposResidentLexusGuy - USE20, XF20, XU30 and Press Cars" (jakeauern)

"OpposResidentLexusGuy - USE20, XF20, XU30 and Press Cars" (jakeauern)

03/08/2017 at 14:30, STARS: 0

Thatís literally on one of these chapters. If youíre self-employed you can deduct the office space square footage from your mortgage as an expense. Also a chunk of your utilities.

"OpposResidentLexusGuy - USE20, XF20, XU30 and Press Cars" (jakeauern)

"OpposResidentLexusGuy - USE20, XF20, XU30 and Press Cars" (jakeauern)

03/08/2017 at 14:31, STARS: 1

I wish. It would be easier. His tax plan would make my life in this class much easier from what Iíve read.

"Rico" (ricorich)

"Rico" (ricorich)

03/08/2017 at 14:33, STARS: 1

Lol heís an expert in not paying any taxes because heís ďsmartĒ.

"OpposResidentLexusGuy - USE20, XF20, XU30 and Press Cars" (jakeauern)

"OpposResidentLexusGuy - USE20, XF20, XU30 and Press Cars" (jakeauern)

03/08/2017 at 14:34, STARS: 1

Well the preferential rates are amazing. Warren Buffet pays 20% tax rate all day because they are capital gains.

"Biggus Dickus (RevsBro)" (NKlein)

"Biggus Dickus (RevsBro)" (NKlein)

03/08/2017 at 14:38, STARS: 0

Is it open book? I was an accounting major and my only tax class was open book and open code.

"OpposResidentLexusGuy - USE20, XF20, XU30 and Press Cars" (jakeauern)

"OpposResidentLexusGuy - USE20, XF20, XU30 and Press Cars" (jakeauern)

03/08/2017 at 14:40, STARS: 0

One page cheat sheet. Stil filling in the blanks.

"Ash78, voting early and often" (ash78)

"Ash78, voting early and often" (ash78)

03/08/2017 at 14:50, STARS: 0

Yep, you can use actual incurred expenses or a simple portion of your homeís square footage (including a nice chunk of depreciation for your house!). But none of that matters until those expenses have hit 2% of your AGI, so for most average Americans, youíre not seeing much, if anything. And even if you do hit the amount, only the portion ABOVE 2% is deductible, so a fraction of the total. Kind of a bummer.

"OpposResidentLexusGuy - USE20, XF20, XU30 and Press Cars" (jakeauern)

"OpposResidentLexusGuy - USE20, XF20, XU30 and Press Cars" (jakeauern)

03/08/2017 at 14:53, STARS: 1

It really depends on your AGI. If you AGI is 100,000 you can still get everything past $2,000 which is nice. The kicker is Medical and Casualty which are both freaking 10% AGI Floor!

"Ash78, voting early and often" (ash78)

"Ash78, voting early and often" (ash78)

03/08/2017 at 15:03, STARS: 1

True, but achieving $2,000 in utilities, property tax, and depreciation expenses while using just ~10% of your home (average room) is a pretty tough exercise in reality. But I didnít realize medical and casualty were so bad...last I checked they were 7.5%, which was still pretty bad.

"Roundbadge" (Roundbadge)

"Roundbadge" (Roundbadge)

03/08/2017 at 15:25, STARS: 1

Not to mention that deducting for your home office is like waving an ďAUDIT ME!Ē flag...so Iíve heard.

"V12 Jake- Hittin' Switches" (jbv12)

"V12 Jake- Hittin' Switches" (jbv12)

03/08/2017 at 15:28, STARS: 0

Are you going for your CPA or CMA? Taking the CMA test is probably one of the best financial decisions Iíve ever made.

"OpposResidentLexusGuy - USE20, XF20, XU30 and Press Cars" (jakeauern)

"OpposResidentLexusGuy - USE20, XF20, XU30 and Press Cars" (jakeauern)

03/08/2017 at 15:38, STARS: 0

Neither haha. I was going CPA. But changed my mind in the last couple months. Iím going full time in June and then working towards my CISA with a MBA to come. I think I found a firm that pays pretty well. One more interview and I could be an IT Auditor in the Nashville market.

"Ash78, voting early and often" (ash78)

"Ash78, voting early and often" (ash78)

03/08/2017 at 15:45, STARS: 1

Yep, itís one of the most common audit flags, but in most cases people with half-decent recordkeeping have their audits dismissed via phone call and a couple emails (before the audit actually happens). Itís just one of those where itís easy to game the system because the IRS doesnít know what your house is like.

"V12 Jake- Hittin' Switches" (jbv12)

"V12 Jake- Hittin' Switches" (jbv12)

03/08/2017 at 16:09, STARS: 0

That works too.

"OpposResidentLexusGuy - USE20, XF20, XU30 and Press Cars" (jakeauern)

"OpposResidentLexusGuy - USE20, XF20, XU30 and Press Cars" (jakeauern)

03/08/2017 at 16:14, STARS: 0

Between the wife(in 3 months) and I we could be hitting a solid hundo before evil taxes right off the bat. Sadly weíve already determined everything we can is going straight into a down payment savings so now fun cars for me now. Just keep the LS400 and the RX350 alive.